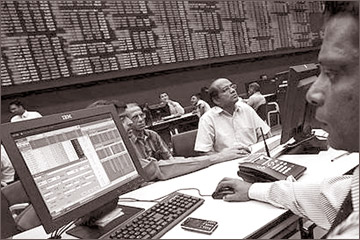

Market gains

The week saw the both market indices gaining with the ASPI up 197.41

points - an increase of 3.10 percent, and the MPI up by 150.96 or 2.21

percent week on week. The oil palms sector indices gained 8410.18 points

or increase of 9.2 percent week on week while Investment Trusts and

Services sector indices moved by 4.2 percent.

The upward thrust of the indices were backed by all other sectors

apart from Construction Engineering which was the only sector that moved

down by 50.24 points against last week. Value of turnover decreased by

37 percent against last week’s Rs. 11.36 billion to close the week at Rs.

7.10 billion with a 14 percent decline in volumes traded against last

week. Market capitalization recorded at Rs. 2.1 billion with 25 P/E

Ratio and PBV multiples of 3.

|

Stock Market |

The week’s highest turnover value was generated by the diversified

sector at Rs. 2.6 billion accounting for 36.7 percent of the total

turnover value, with a volume of 19.17 million shares or 8 percent of

Turnover volume. JKH and Aitken Spence were the main contributors to

this sector.

Highest turnover in terms of volume was from the Banking and Finance

sector which accounted for 51.56 percent of total turnover volumes this

week. Janashakthi and SMB Leasing were the main contributors to the Bank

and Finance sector turnover volume. Manufacturing sector generated a

Turnover volume of 37 million or 15.47 percent buoyed by activity in

Piramal Glass and Grain Elevators.

JKH accounted for the highest contribution to the market turnover

with Rs. 2.1 billion, accounting for 30 percent of total value of market

turnover. JKH closed at Rs. 302.50. Bairaha Farms witnessed a turnover

of Rs. 574 million with the scrip closing at Rs. 267.

Commercial Bank and Grain Elevators represented 5.22 percent and 5

percent of market turnover this week. S M B Leasing (voting) placed

highest scrip traded during the week representing 21 percent of

aggregate market volume. Piramal Glass and S M B Leasing (Non Voting)

were active stocks in the market with 15.3 million and 8.3 million

shares changing hands respectively.

The week saw several counters such as Bukit Darah and Carsons

capitalization of reserves. Foreign activity levels were high this week

with both buying and selling seeing improvements week on week.

With JKH being one of the counters which attracted their interest,

foreigners remained net sellers once again, with total sales amounting

to Rs. 1.77 billion as against the Rs. 1.53 billion recorded last week,

an increase by 15 percent week on week. foreign buying was Rs. 1.15

billion this week as against last week’s Rs. 502 million, an increase of

122 percent from that recorded last week.

Confifi Hotel emerged as the week’s top gainer recording a increase

of 26.9 percent on the scrip price which closed at Rs. 279.20. Coco

Lanka (Non Voting) and Bairaha Farms reflected a northward momentum

closing at Rs. 50.90 and Rs. 267.00 respectively. Colombo Investment

Trust was the top loser of the week with a dip of 16.5 percent on the

share price to close at Rs. 176 as against last week’s Rs. 210.80.

Finlays Colombo and Tea Services were other losers, with the scrips

closing at Rs. 175 and Rs. 700.10 respectively.

Point of view

The bourse’s trading volumes will continue to be relatively static

next week although retail investors looking to pick up bargains in blue

chips stocks will be seen active in the market. |