Colombo Stock Market

A brief introduction :

What is a “Stock Market”?

A Stock Market is a place where stocks, bonds, or other securities

are bought and sold. The centre at which all these activities take place

is known as a stock exchange.

The stock market is a vital part of the market economy. A stock

exchange is a corporation or mutual organization which provides trading

facilities for stock brokers and traders, to trade shares and other

securities.

What is the Colombo Stock Exchange (CSE)?

|

The Colombo Stock Exchange |

The CSE is the organization responsible for the operation of the

stock market. The CSE is a company limited by guarantee established

under the Companies Act and licensed by the Securities and Exchange

Commission of Sri Lanka (SEC) to operate as a stock exchange in Sri

Lanka and a Not-for-Profit organization. The CSE currently has 15 member

firms and six trading members. The Stockbroker firms act as market

intermediaries performing a number of services to investors and

companies. All member firms are institutions and are subject to the

regulations of the SEC, and are required to obtain a license annually.

The CSE has other stakeholders associated with the Secondary Market

as stated below:

* Investors

* Listed Companies

* Commercial banks offering custody services

* Fund Managers

* SEC

* Government

What is a Share?

A share represents your ownership in a company. As a part owner you

are investing in the future growth of the company. Here is an example of

how buying shares work.

If a company releases 100,000 shares to the market and an investor

purchases 1,000 shares, then we can say that the Investor owns 1 percent

of that said company.

If you are an Investor in a certain company, then you have the right

to receive the annual report of the company you have invested in, as

well as other benefits offered to shareholders such as dividends (if

declared by the company) for profits the company has made and

participation in Annual General Meetings.

What is a “Listed Company”?

A listed company is a public company which has listed its shares or

debentures for trading on CSE. Listing is open to a corporate body,

incorporated in Sri Lanka under the Companies Act No. 7 of 2007. There

are currently 232 companies listed on he CSE, across 20 business

sectors.

What does a company gain by Listing

on the Stock Exchange?

A listing on a Stock Exchange offers several benefits for companies.

* Raising capital - The Stock Exchange provides access to a global

pool of institutional and individual investors. A listing on the

exchange allows a company to raise capital and use it to fund investment

and growth. Even after a company is listed, it can raise capital from

the market, through a Rights issues or through the issue of other

securities.

* Price Discovery - A listing enables companies to discover a price

for their shares.

* Low cost capital - The chief advantage of raising capital from the

market is that it avoids some of the intermediation costs evident in the

alternative forms of capital raising. Hence, the market provides

companies with capital at a lower cost.

* Value addition - A listing on a stock exchange can add value to a

company. A listing can enhance a company’s corporate stature and could

advance brand awareness of company products.

Furthermore, the enhanced profile, coupled with the greater

transparency, could enhance the company’s ability to borrow from

traditional sources of capital. A listing can also be expected to add

value to a company’s Employee Share Ownership Scheme.

How do you purchase shares?

A market can be split into two main sections: the primary and

secondary market.

- the primary market is where new issues are first offered

- any subsequent trading goes on in the secondary market

The Primary Market:

The primary market is the market for new share or debenture issues

and deals with the issuance of new securities.

|

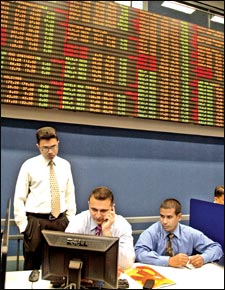

Stock Market officials in action. Pictures by Sumanachandra

Ariyawansa |

Companies, governments or public sector institutions can obtain

funding through a new share issue. The issue is an initial public

offering (IPO). In the primary market, the security is purchased

directly from the issuer (company).

In a primary issue, the company offering the share/debenture

publishes a prospectus, which is an invitation to the general public to

buy shares or debentures of that company and includes the details of the

offer, the business activities of the company, its financial standing

and future plans, its directors and management and for what purpose the

company is raising this capital.

If you decide that a particular issue is a promising investment, you

need to fill up the application form for the purchase of shares or

debentures.

You can send this form directly to the company concerned or to a

stockbroker with payment for the amount due. However, you should read

the prospectus carefully to see whether the investment will give the

returns you desire.

If necessary, consult an expert for advice. It is advisable to

request that the shares be directly deposited into your account in the

Central Depository Systems (CDS) of the CSE. You may do so by filling

your CDS account number on the application form.

This will save you time and worry when you want to dispose of your

shares and will be the best and safest way to keep custody of the shares

or debentures you purchase. No fee is charged for opening a CDS account.

The Secondary Market:

A market in which an investor could trade (either buy or sell) shares

or debentures of a Company with another investor, subsequent to the

original issuance in the primary market, is known as the secondary

market. The Colombo Stock Exchange (CSE) facilitates the function of the

secondary market in Sri Lanka.

A newly issued IPO will be considered a primary market trade when the

shares are first purchased by investors directly from the issue; any

shares traded subsequently will be on the secondary market, between

investors themselves.

In the primary market prices are often set beforehand, whereas in the

secondary market only forces of supply and demand determine the price of

the security.

How do I buy Shares on the Secondary Market ?

You must instruct your Stockbroker to buy shares for you. You must

clearly provide him with the following particulars.

a) The names of the company you want to invest in

b) The amount of shares you desire to purchase

c) The price you are prepared to pay

When you give these instructions to your Stockbroker, he will take

the necessary action to buy you those shares. Afterwards, the shares

will be credited into your account in the Central Depository Systems

(CDS).

How do I open a CDS account?

You must complete an account opening form of the CDS through a

Stockbroker. All Stockbrokers have this form readily available.

The completed form will be forwarded to the CDS by the Stockbroker

and an account will be opened in your name.

Joint accounts can also be operated. There is no payment involved to

open a CDS account. To open the account you will have to give the broker

a photocopy of your National Identity Card (NIC) and a utility bill and

make your NIC as well as your bill, available for inspection.

The passport is also an acceptable document of identification.

Trading on the stock market takes place from Monday to Friday from 9.30

a.m. to 2.30 p.m. except on Public holidays.

You could place your orders by visiting any one of the stockbroker

offices or the CSE public galleries located in Colombo and other branch

offices in Kandy, Kurunegala, Negombo and Matara. Alternatively, you

could trade via the Internet through stockbroking firms that offer the

Internet Trading facility. To use such facilities and to trade on the

CSE, you should be over 18 years of age.

Courtesy: CSE |