Sri Lanka's natural rubber productivity still lagging behind

Dr. N. Yogaratnam, Consultant/National Institute of

Plantation Management

The centenary of Research on Rubber in Sri Lanka (not the Rubber

Research Institute of Sri Lanka) is expected to be celebrated next year.

Yet, it is disappointing that the rubber industry is still lagging

behind in terms of crop productivity by global standards. The centenary of Research on Rubber in Sri Lanka (not the Rubber

Research Institute of Sri Lanka) is expected to be celebrated next year.

Yet, it is disappointing that the rubber industry is still lagging

behind in terms of crop productivity by global standards.

Research has made many significant contributions. Crop productivity

has been increased by about 10 fold from about 450 kg/ha/yr to the

present level of about 4500 kg/ha/yr although the plantation management

has not been able to keep pace with this trend.

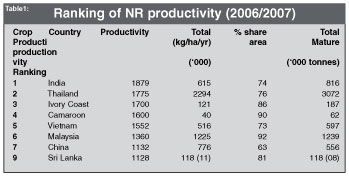

International Rubber Study Group's (IRSG) latest estimates (Box 1)

indicate that India recorded the highest productivity of 1879 kg/ha/yr

in recent years, with 89% share of area under rubber in smallholdings,

followed by Thailand with 17750 kg/ha, Ivory coast 1700, Cameroon with

1600, Vietnam 1552 kg/ha and so on.

Sri Lanka, although has been showing an increasing trend, yet it is

still ranked ninth with a crop productivity of about 1128 kg/ha/yr. Some

plantation companies have been able to achieve much higher levels of

productivity in the region of 1800 to 2000 kg/ha/yr in some fields,

demonstrating that potential exits for higher yield and has to be

exploited by the plantation management for the industry to continue to

enjoy the benefit of the current market boom.

Total Out put

Table 1, shows the recent trend in total output along with total area

in rubber and the percentage share of mature rubber in production for

comparison. Table 1, shows the recent trend in total output along with total area

in rubber and the percentage share of mature rubber in production for

comparison.

As can be seen, while Thailand is the current number one in terms of

total output Indonesia has a larger area under rubber with low level of

productivity, yet there is a possibility of overtaking Thailand in the

future in terms of total out-put. One can easily guess which countries

might be in the top five in the near future.

In Sri Lanka, although rubber planted areas are expected to increase

by about 40,000 hectares, unless the level of crop productivity is

increased, we will not be recognised as a significant contributor to

global Natural Rubber (NR) out-put.

Sri Lanka's total output of about 118,000 tonnes in 2007 places it at

the eighth position in the global scenario with crop productivity in the

ninth position and the total area under rubber in the eleventh position

with 118, 000 hectares, this is likely to go up by 40,000 to 158,000

hectares.

Global NR/ SR (Synthetic rubber)

The total world NR production was expected to reach about 9.8 million

tonnes in 2007, but its growth fell sharply from almost 10% to around 3%

at the end of 2007.

On the other hand, growth in SR production has been steady and has

even improved in recent months to 3.7% bringing it to 12.98 million

tonnes.

Global NR supply is supported by continued increase in production in

Indonesia while there have been a decline in Thailand, Malaysia and

India.

Impact of NR / SR prices

The sharp rise in NR prices that was seen again from the middle of

August continued through to end of the year. This was driven possibly

due to short term supply concerns and rampant oil prices and has had its

negative effects as well.

For example, India has been increasing particularly sharply in recent

years, the percentage of SR consumption in the tyre manufacturing

sector.

Rising NR prices, the basic raw material for making automobile tyres,

has been squeezing the margins of tyre manufacturers, forcing them to

increasingly look at SR as an alternative raw material.

The average ratio of NR : SR decreased from the year 2005 level of 79

: 21 to 74 : 26 in 2006.This had been a worrying factor to Indian rubber

growers.

Oil prices have been increasing, reaching a record high of almost U$

100 a barrel in November. This sharp rise, however, it has been

reported, has not been matched by SR and its feedstocks prices,

demonstrating that demand rather than cost push is the important factor

influencing the prices of the SR recently.

As SR prices have been relatively stable compared to NR, the gap

between the two prices is again widening to almost 40%.

Forecasts

IRSG has forecasted that the NR/ SR consumption growth would be

upward in the region of 4.9% in 2007, but downward to 2.2% in 2008,

before the growth is expected to pick up again in 2009 to show an annual

growth rate of 3.8 % during the 3 year period.

Weather related problems have always been crucial factors in rubber

production, and this has resulted in a downward trend of the growth in

global NR output to only 1.3% in 2007.

It is forecast that this trend would pick up in 2008 and 2009

bringing the annual growth rate of about 3.1%, although climatologists

are concerned over the changing weather patterns observed in the recent

years.

Global SR output is projected to increase by about 3.4% a year.

NR supply/demand balance

The forecasted global NR supply / demand balance indicates that the

trends of slower growth in supply and rising demand are expected to push

excess supply down sharply.

Sri Lankan scenario

The international economic environment appears to be deteriorating in

the recent months and is not expected to recover until mid-2009. Oil

fell more than U$ 1.00 to a one month low below U$ 89.00 per barrel in

mid- January with concerns that a recession in the US could drag down

other economies, as well.

Weather related problems due to unpredictable changes in weather

pattern are also matter for worry. The fluctuations in rubber market

that have now become a regular phenomena, would therefore continue more

violently in the near future.

Sri Lanka still being a small player in global rubber business should

continue to up crop productivity and output. The rapid improvement of

crop productivity depends upon the application of long term and short /

medium term approaches in rubber crop husbandry.

Long term approach

* Staff and worker development programmes, should be in place. RRI

and NIPM have the professional competence to provide such services, but

the industry's priorities appear to be different.

* Development of degraded soils in order to restore productivity,

increase productivity and to prevent deterioration of productivity

* Selection of new plantings, replanting land by adopting stringent

criteria and ensuring that the fields selected have the potential for

higher productivity.

* Improving the genetic character of holding using the right

combination of clones in the field. Clones RRISL 200 series as well as

the emerging RRISL 2000 which have a higher potential should be

considered.

* Using quality planting materials raised in their own nurseries by

adopting stringent procedures

Short/medium aspects

* Skilful manipulating of planting practices and balanced input of

fertilisers in the immature phase

* Adoption of stringent tapping standards and stimulation ( Ethephone)

of virgin as well as renewed panels ( BO - 1, BO - 2, B1 - 1, B1-2,

B2-1)

Productivity improvement is a macro level feature of importance in

rubber plantation scenario. Despite the lower extent under rubber,

target should be set to rise annually by about 05% in the medium term,

1240 kg/ha by 2010, 1364 kg/ha by 2012 with a projected national crop

productivity target of about 1800 kg/ha by year 2015.

The plantations companies with well established infrastructure and

access to unlimited capital should take the lead with their maximum

yields in the region of 2000 kg/ha, serving as a benchmark. Research's

efforts and achievements in crop productivity, processing and value

addition technologies will be nullified if due emphasis is also not

given by the industry to value addition.

In the ultimate analysis, the issue centers around the extent to

which the rubber industry and indeed, the country benefits from

corporate sector management of plantations.

Professionalism in management is known to be associated with

impossible looking goals, miraculous solutions unheard of triumphs etc.

We are in the era of professionalism in business management. Why not the

plantation management? |