Export proceeds and foreign exchange leakage - Part 5

Nihal Sri Amerasekere Former Chairman PERC

(Continued from yesterday)

Need for pragmatic management of export proceeds

What is the cogent pragmatic reason and rationale, as to why Sri

Lanka should not have been and not be monitoring and enforcing the

‘repatriation’ of exports proceeds, whilst other IMF Article VIII Status

countries do monitor the same, and ironically very countries from whom,

Sri Lanka borrows in foreign exchange and expects foreign exchange

investments? Could Sri Lanka have afforded not to have done so, and not

to do so?

To enforce such requirements now, those affected and ‘miscreant’

parties, purport that it would be sending ‘wrong signals’! This is mere

‘perception’, and to whom are the ‘wrong signals’, in any case, being

sent? Is it not to the very perpetrators of such ‘economic crime’ of

‘siphoning out of valuable foreign exchange from the country’,

regardless of the national and public interests of the country?

Given the foregoing facts, how could one baselessly espouse that

‘wrong signals’ would be sent in enforcing export proceeds

‘repatriation’ requirements, whereas this is not a matter of sending

‘wrong signals’, perhaps to ‘robber barons’, but a grave matter of

national and public importance of acting to ‘protect’ the interests of

the broad spectrum of poverty stricken masses, whose rightful resources

have been mismanaged, even permitted to be ‘pillaged and plundered’! export proceeds

‘repatriation’ requirements, whereas this is not a matter of sending

‘wrong signals’, perhaps to ‘robber barons’, but a grave matter of

national and public importance of acting to ‘protect’ the interests of

the broad spectrum of poverty stricken masses, whose rightful resources

have been mismanaged, even permitted to be ‘pillaged and plundered’!

On the contrary, ought not ‘correct signals’ be sent to these very

masses, ‘who are the real stakeholders’, who vote governments into

power, and action be taken to protect their very interests and future?

If not, why?

On the contrary, what of the ‘dismal result’, with erosion of the

economy, and impoverishment of the people, who voted governments into

power to ensure ‘good governance’? Are they not ‘key stakeholders’ and

to them, in taking action to enforce the due and proper ‘repatriation’

of export proceeds, would it not be more than a mere ‘good signal’, but

‘pragmatic action’, taken in their own interest and their future, and

the future generations of the country?

There are those, who endeavour to ‘mislead’ by citing that countries,

such as India and China, are now phasing out export proceeds

‘repatriation’ and export proceeds ‘surrender’ requirements. This is not

so.

These countries during 2004 have even enforced export proceeds

‘surrender’ requirements, partially, by permitting only certain

percentage of export proceeds to be retained in ‘supervised’ foreign

currency bank accounts, whilst enforcing fully, export proceeds

‘repatriation’ requirements.

Sri Lanka did not even, ‘phase out’, but intriguingly did away with

such ‘good governance’ practice ‘abruptly’!

Nevertheless, the cogent issue is how did these countries manage

their exports proceeds since 1993, and on the other hand, how did Sri

Lanka not enforce exports proceeds ‘repatriation’ and export proceeds

‘surrender’ requirements since 1993?

Who takes responsibility and who is accountable? Prior to 1993, the

Controller of Exchange did ‘permit’ exporters up to a maximum of around

5% on the incremental value of exports to be expended overseas, in

relation to justifiable promotional costs of the exporters.

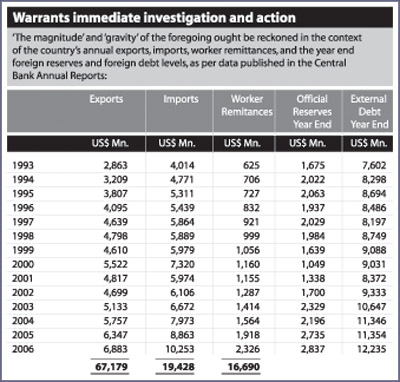

Also to be reckoned would be the total of US $ 16,690 mn., remitted

since 1993 by poor Sri Lankan ‘migrant labour’ working particularly in

the Middle East, undergoing untold hardship and trauma, which would have

made a cognisable ‘contribution’ towards the foreign exchange

requirements of the country, whereas the aforesaid export proceeds

‘leakage’ would have had a cognisable ‘negative’ impact thereon. Is this

reasonable, equitable and justifiable?

In the national economic interest, a requisite ‘pragmatic procedure’,

examining practices prevalent in other countries, ought be put in place

to ensure the ‘good governance’ of ‘foreign exchange management’, as per

the specific current urgent particular needs of the country; even if it

means, to take ‘courageous’ and bold decisions!

Given the seriousness and gravity of the ‘ground realities’, it would

be pertinent and necessary to Gazette forthwith, in the least, export

proceeds ‘repatriation’ requirement, if not export proceeds ‘surrender’

requirement, and for documentation of exports to be channelled through

the banking system, with immediate effect.

The aforesaid estimated foreign exchange ‘leakage’ reckoned during

the years 1993 to 2006 to be in the region of US $ 6,718 mn. to US $

13,436 mn., plus interest thereon, is several times more than the

foreign exchange reserves today, and ought to be compared with the

Foreign Debt Level of US $ 12,235 mn, as at December 31, 2006!

If the due and proper ‘repatriation’ of export proceeds had been in

force, would not the Central Bank then have progressively purchased the

foreign exchange ‘repatriations’ to increase the foreign exchange

reserves, whilst at the same time stabilising the foreign exchange

rates; whereas recently ironically did not the Central Bank ‘off-load’

over US $ 400 Mn., from the Government reserves, with the ‘puerile

attempt’ to bring down the rising foreign exchange rates?

The US Dollar rate in 1992 was Rs. 43/83, and today it is over Rs.

113/- ! What ‘economic mismanagement’ of the country; the first Asian

country to usher in a ‘free and open’ economy?

‘Enforcement’ of export proceeds ‘repatriation’ requirement

Serious consideration ought to be given, in the least, to enforce

export proceeds ‘repatriation’ requirement, if not also the exports

proceeds ‘surrender’ requirement, at least partially, inasmuch as such

‘surrender’ requirement is enforced on ‘small time Sri Lankan

entrepreneurs’, who are ‘indirect exporters’ supplying to the ‘direct

exporters’; thereby raising the cogent question, as to why not on the

‘direct exporters’ ?

The Controller of Exchange could be empowered to do so, by the

Minister of Finance publishing a Gazette Notification on the lines of

the following, recommended by a former respected Controller of Exchange,

subject, however, to being checked and confirmed by the present

Controller of Exchange;

“Order made by the Minister of Finance by virtue of the powers vested

in him by Sub-sections (3) and (4) of Section 22 and Section 44 of the

Exchange Control Act No. 24 of 1953, as amended by the Exchange Control

(Amendment) Law No. 39 of 1973.

Order

1. Permission is hereby granted to export goods of any class or

description for the purpose of sale from Sri Lanka to any destination

outside Sri Lanka by a person in Sri Lanka, provided that the payment

for such goods is made in convertible foreign currencies, except where

payment is made in accordance with the provisions indicated in the

paragraph (2) below, and that such a payment is repatriated to Sri Lanka

within 120 days from the date of exportation, unless otherwise permitted

by the Central Bank.

2. The provisions of any trade and payment agreements entered into by

the Government of Sri Lanka with the Government, or any person of a

foreign country where payment to be made to a person resident in Sri

Lanka in Sri Lanka Rupees from

a) an account of a foreign bank maintained with an Authorised Dealer

in Sri Lanka, or

b) such an account of any other person resident in Sri Lanka as

approved by the Central Bank and is maintained with an Authorised

Dealer.

3. Goods not intended for the purpose of sale such as goods for

personal use, trade samples, repairs etc., shall be exported without

permission of the Central Bank subject to monitoring by the Sri Lanka

Customs.

4. The orders made on 18.3.1973, 23.10.1975, 25.3.1993 and 29.3.1994

under Sub-sections (3) and (4) of Section 22 of the Exchange Control Act

(Chapter 423) as amended by the Exchange Control (Amendment) Act No. 39

of 1973 and published in the Gazettes Extraordinary No. 81/9 of

19.10.1973, No. 187/2 of 27.10.1975, No. 759/15 of 26.3.1993 and No.

813/14 of 7.4.1994 respectively are hereby rescinded”

In addition, given the ‘overall impact’ on the national economy,

consideration ought to be given for all exporters to be required to

submit export documentations through the banking channels, so as to

enable the Controller of Exchange to effectively enforce exports

proceeds ‘repatriation’ requirements.

To avoid doing so, on the ‘pretext’ that bank charges are prohibitive

would be ‘nonsensical’! Where any exceptions are warranted due to

emergencies and/or bank holidays, separate procedures and guidelines

ought to be adapted.

Communication systems today afford instant ‘transmission’ of

documentation, unlike in the past era!

Documentations in respect of 30% of exports, as per Central Bank

sources, are not channelled through the banking system, and hence the

banking system cannot be expected to monitor the ‘repatriation’ of

export proceeds in cases of such exports!

To suggest that perishable exports, such as vegetables, fruits,

flowers, etc., in view of urgency, need to be exported, without the

documentations being channelled through the banking system, could not be

a plausible reason. If 30% of the country’s exports are from this

agricultural sector, would not then, such agricultural sector be

thriving and booming today? Is it really so?

To entertain the logic that there is ‘under invoicing’ of exports,

inasmuch as there is ‘over invoicing’ of imports, and that therefore it

is ‘futile’ to enforce export proceeds ‘repatriation’ requirement and

‘surrender’ requirement, is simply ‘illogical’, ‘nonsensical’ and

‘puerile’, and only a questionable attempt to ‘collude’ to ‘cover-up’;

in which case, one might as well ‘give up the very governance’ of the

economy of the country, due to admitted ‘incompetence’!

The ‘under invoicing’ of exports and ‘over invoicing’ of imports is

distinctly another issue, coming under the purview, supervision and

control of the ‘Customs Department’, which is expected to deal with such

‘under invoicing’ and ‘over invoicing’, in terms of the law.

Is it to be conceded that the Customs Department is totally inept and

incapable of dealing with such offences? Can that too be ‘complacently’

accepted, if one is to discharge the ‘good economic governance’ of the

country?

This whole ‘episode’ and continuance thereof, without ‘heeding’ the

‘findings’ reported by the Auditor General and COPE, warrants through

investigation forthwith to ascertain the extent and volume of ‘foreign

exchange leakage’, since the questionable gazetted Orders of 1993 and

1994, and ‘stringent’ corrective action taken in such regard.

The important question arises, as to why there has been no action,

whatsoever, taken on the Auditor General’s ‘findings’ and the COPE

Report of 2005, on a matter of ‘national economic proportion and

significance’, whereas, on the contrary, a huge ‘hue and cry’ is being

made of the COPE Reports of 2007, which deal with certain ‘individual

cases’ of alleged fraud and corruption, no doubt of significance?

Nevertheless, is not the foregoing of far greater national economic

and public significance, reported as far back as 2005 by the Auditor

General and COPE, as requiring the immediate attention of Parliament.

The COPE Report of 2005 to Parliament stated thus:

“The Committee was seriously concerned over the activities of the

CBSL (Central Bank of Sri Lanka) and wishes to report to the Parliament

on matters that need immediate attention of the house” (Emphasis added)

“The Auditor General and the Department of Public Enterprises have

highlighted the following in their reports ......”

* “Decline in the remittances of export earnings to the country as

the Bank did not monitor the remittances of such export proceeds to the

country and the foreign exchange loss to the country.”

“Your Committee in conclusion recommends the following:”

* “Carry out investigations on the nonrepatriation of export proceeds

to Sri Lanka and take corrective action appropriately to avoid drain of

foreign resources.”

To begin with, to examine this ‘malignant malady’of national economic

significance and proportion, ought not the top 100 exporters and ‘ghost

exporters’ be promptly ‘investigated’, and ‘stringent corrective action’

taken in such regard, particularly given the current perilous state of

the economy?

Given the current situation, vis-a-vis, the position of foreign

exchange reserves and the depreciation of the Sri Lanka Rupee against

foreign currencies, would not this matter, in the national economic

interest, need careful consideration.

Malaysia in the recent past, rebutting academic, economic and

theoretical opinions, took some bold pragmatic decisions to stabilise

its economy, vis-a-vis, ‘foreign exchange management’, resulting in the

current economic strength of Malaysia! Ironically, Sri Lanka is today

seeking ‘foreign investment flows’ from Malaysia!

(Concluded)

(The writer a management consultant could be

contacted on www.consultants21.com) |