MBSL includes 13 new firms for 2013

In a pioneering move, MBSL constructed a Stock market Index: the

“MBSL Midcap Index,” which measures the aggregate price level and price

movements of medium size companies listed on the Colombo Stock Exchange

(CSE).

There was no index to measure the price movement of medium sized

companies listed on the CSE. The MBSL Midcap Index filled this vacuum.

The index which came into operation in 1999 is revised annually and

looks at the Middle Range Market Capitalization, Liquidity and the

Profitability of the firms to be included in the Midcap Index. The index which came into operation in 1999 is revised annually and

looks at the Middle Range Market Capitalization, Liquidity and the

Profitability of the firms to be included in the Midcap Index.

MBSL Midcap Index can be used as the benchmark index by individual

and institutional investors who prefer growth but are prepared to with

stand only conservative levels of volatility in their equity

investments.

The Midcap Index, together with the Milanka Price Index (MPI)

generate valuable signals for portfolio managers for switching between

larger-cap more sensitive stocks and the midcap less sensitive stocks

with more growth potential in response to changing capital market

conditions.

The Midcap Index focus in profitability helps to screen stocks with

better future prospects that will cross to higher market capitalization.

MBSL has included 13 new firms for 2013 composition by excluding 13

existing firms from the index.

The new inclusions are, Central Finance Company PLC, LB Finance PLC,

Lanka Orix Finance PLC, Nations Trust Bank PLC, People’s Leasing Company

PLC, Access Engineering PLC, Softlogic Holdings PLC, Vallibel One PLC,

Asiri Hospital Holdings PLC, Browns Beach Hotels PLC, John Keels Hotels

PLC, Primal Glass Ceylon PLC and Textured Jersey Lanka PLC.

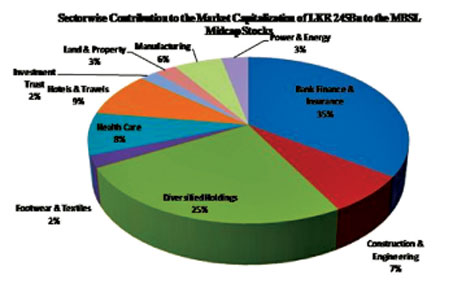

Stocks are diversified over ten sectors. The MBSL Midcap Index has

the base as 1,000 as at December 31, 1998 (which is the same base year

for Milanka Index).

The range for market capitalization for the Year 2012 was Rs 1bn – Rs

15 bn. With the stock market activity, this range is adjusted for the

change in the ASPI annually. Accordingly the range of market

capitalization for t 2013 is Rs 1.9 bn – Rs 19.9 bn MBSL has excluded

firms Asian Alliance Insurance PLC, Singer Finance ( Lanka) PLC, Union

Bank of Colombo PLC, HVA Foods PLC, Renuka Agri Foods PLC, Hemas

Holdings PLC, Browns Investments PLC, Nawaloka Hosptial PLC, PC House

PLC, Overseas Realty PLC, Royal Ceramic Lanka PLC, Vallibel Power

Erathna PLC and Brown & Company PLC from the MidCap index composition of

2012.

Selection criteria

The criteria for selecting the twenty-five stocks of the index

remained unchanged for last 14 years and are: Middle Range Market

Capitalization, Liquidity and Profitability.

The Colombo Stock Exchange (CSE) performed exceptionally well in the

two years following the end of the war: the benchmark All Share Price

Index (ASPI) surged 96 % to become Asia’s best - Midcap Index also

surged 125.4 % in the Year 2009 and 70.4 % in the Year 2010. Although

the indexes are declined for Year 2011 & Year 2012 by 17.1 % & 29.4 %

respectively.

In absolute terms, market indices have declined year to date,

reflecting the weak global outlook for equities and rising domestic

interest rates. The Sri Lankan economy is not immune to global

conditions and faces its own challenges in the near term. Larger than

expected trade deficits, depleting foreign reserves, rising interest

rates and weaker than expected FDIs are primary concerns.

Strong policy measures were adopted by the Central Bank and the

Government in the early part of the year to limit excessive credit

growth and contain the high import demand thereby arresting the

imbalances that were emerging in the economy since the latter part of

2011.

Policy makers have allowed the currency to depreciate and interest

rates to rise in order to address structural imbalances in the economy

in the short to medium term. Inflation, as measured by the y-o-y change

in the Colombo Consumers’ Price Index (CCPI), increased to 9.5 % in

November 2012 from 8.9 % in the previous month.

Inflation has remained near 9 % in the second half of the year as a

result of the increases to administered prices and recent tariff

adjustments while adverse weather conditions towards the third quarter

caused prices, particularly of fresh food items, to remain high.

However, as per current projections, inflation is expected to

moderate towards the second quarter of 2013 and stabilize thereafter

benefiting from the strong demand management policies introduced at the

beginning of this year.

At the same time, to induce a downward adjustment in market interest

rates, the Monetary Board decided to reduce the policy rates of the

Central Bank by 25 basis points each while allowing the ceiling on rupee

credit extended by banks to expire at end 2012. The Monetary Board was

also of the view that the credit ceiling imposed for 2012 has served its

purpose and such a policy measure may not be required in the near

future. On a positive side, we have observed net foreign inflow in to

the market over Rs 37 bn; this sluggish market trend is an opportunity

to the investors to collect value stocks since most share prices trading

below its intrinsic value, and there is an opportunity prevailing in

investing Midcap Stocks, when market recovers the chances of Midcap

Stock price increase is high.

Conclusion

Mid-caps generally outperform because they are in the prime of growth

and seeing both cash flow and earnings per share accelerate, especially

compared to large-caps, and Mid-cap companies generally have much

greater growth potential than comparable large-caps, with more seasoned

management, liquidity, and operating histories than small-caps. As well

as the Milanka Price index (MPI) will be discontinued from January 1,

2013 following the launch of the S&P SL20 index earlier this year. The

S&P SL20 currently represents 54 % of the total market in contrast to

the MPI’s comparatively lesser representation of 22 % as at November 12,

2012.

The S&P SL20 Index includes the largest 20 stocks, by total market

capitalization, listed on the CSE that meet minimum size, liquidity and

financial viability thresholds. As a result there will be no longer

measure to track the performance of the midcap stocks in the market.

Therefore including mid-caps in an overall portfolio allocation is a

proven diversifier for increasing returns while enjoying a very

favorable risk/reward ratio, the MBSL Midcap index continuously fill the

vacuum of measures the aggregate price level and the price movement of

medium sized companies listed on the CSE.

|