Exploring FDI atmospherics in corporate strategies

Dr Dharma De Silva

Foreign Direct Investment (FDI) is a driving force of globalization

and an important engine of economic growth. The relationship between

corporate strategies for the green world and host country aspiration is

receiving increased attention in the light of globalization and its

implications for sustained economic growth. Foreign Direct Investment (FDI) is a driving force of globalization

and an important engine of economic growth. The relationship between

corporate strategies for the green world and host country aspiration is

receiving increased attention in the light of globalization and its

implications for sustained economic growth.

Historically, developed countries pioneered by transnational (TNC) or

multinational corporations (MNC) benefited immensely by FDI and

developing countries via public policy measures increasingly began to

seek and attract FDI due to its many advantages for economic

development.

Foreign direct investment has played a critical and growing role in

the global economy assisted by accompanying improving absorptive

capacities in host countries. To a host country, FDI promises a source

of new resources and new technologies that could spur national economic

growth and development of various sectors.

Evidence of FDI influence on economic growth figures prominently both

in theoretical and empirical studies focusing on a large number of

developing nations among them cited in the paper are strong growth in

regional FDI inflows in South, East and S-E Asia, e.g., China, India,

Malaysia and Sri Lanka.

|

|

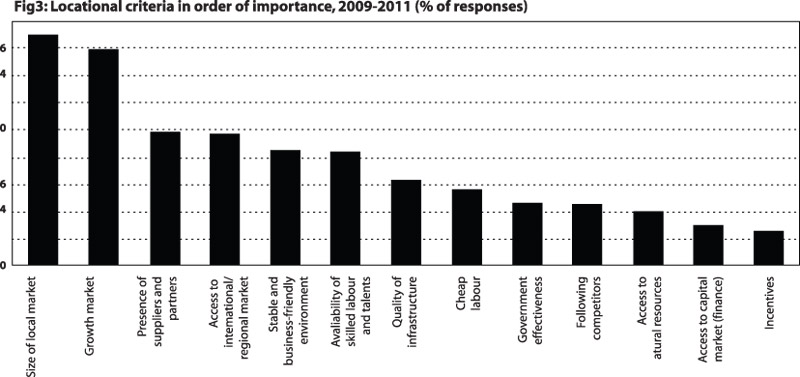

To a home country TNC or MNC, FDI offers the promise of new markets,

a mode-of-entry beyond exporting and less expensive export-led

production facilities. This current paper draws on reports, findings,

reviews and relies on the existing FDI statistical systems, reported by

UNCTAD World Investment Report 2010, World Investment Prospects Surveys

2009 and 2010, EIU, among others cited, to examine the various issues

related to FDI definitions, trends, perspectives, policies and

significant operations during the past two decades, decline during

global economic crisis (2007-2009), and prospects for 2010-2014. Of

significance is the trend of FDI in a low-carbon economy, and the

Strategies of Transnational Corporations (WIR 2010). Low-carbon FDI in

areas such as renewable, recycling and low-carbon technology

manufacturing is already large (some $90 billion in 2009), but its

potential is huge concludes UNCTAD’s 2010 World Investment Report.

Around 40 percent of low-carbon emission FDI projects by value during

2003-2009 were in developing countries.

Yet there is potential for much more “green” FDI to flow into

developing economies and the role of the private sector will be critical

in tackling climate change by expanding its presence in those countries.

Recipient countries will need to do more by adopting market-creating

policies that can foster demand for new low-carbon products and

services.

The World Investment Report 2010 draws attention to investing in a

low-carbon economy. The report illustrates global and regional trends in

Foreign Direct Investment followed by recent policy developments. Global

FDI witnessed a modest, but uneven recovery in the first half of 2010.

This sparks some cautious optimism for FDI prospects in the short run

and for a full recovery in the future. Developing and transitional

economies attracted half of global FDI inflows, and invested one quarter

of global DFI outflows.

Overcoming barriers remains a key challenge to attract FDI for small,

vulnerable and weak economies. The chapter on leveraging foreign

investment for a low carbon economy describes characteristics and scope

of low-carbon foreign investment; its drivers and determinants;

strategies and policy options; and sums up with global partnership to

further low-carbon investment for sustainable development. (WIR 2010).

This paper draws on data from a number of international organizations

to explore the changing relationship between FDI and sustained growth,

especially for emerging economies and emphasizes the importance of

absorptive capacity and policies in the host country’s ability to

benefit fully from FDI and encourage MNC and TNC corporate strategies.

It is presented against the backdrop of the deepest global economic

slow down since the great depression of the 1930’s and the modest

recovery of 2010. It is presented against the backdrop of the deepest global economic

slow down since the great depression of the 1930’s and the modest

recovery of 2010.

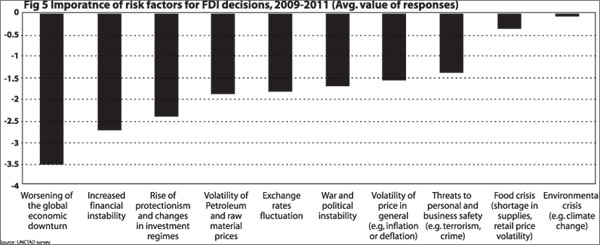

What began as a financial crisis in a handful of industrialized

economies continued to spill over into the global economy, engendering

massive contractions in consumer demand, rising unemployment, and

growing protectionist pressures worldwide.

A large number of developing countries have not been spared from its

fallout; many are now faced slumping demand for their export products

along with fluctuating commodity prices, significant reductions in

foreign direct investment and remittances, and a more general liquidity

shortage.

The strong interdependence among the world’s economies make this a

truly global economic crisis, affecting a sharp decline in FDI and

economic growth slow down. As we slowly emerge from the global economic

slowdown, and as the economic balance of power gradually shifts towards

emerging economies led by the Bricks, this paper highlights the

importance of FDI to economic growth and development, as well as the

changing nature of the relationship between emerging economies and FDI

related to the potential of FDI in corporate strategies for the green

world.

The annual UNCTAD World Investment Reports and a fund of literature,

both theoretical and empirical available, many cited in this paper

enable the analysis of FDI rise during two decades, recent fall and

policy implications of the global slowdown and crisis from late 2007

going into 2008-2009; and look at prospects for 2010-2014.

These findings are also in line with those of other sources, such as

GCR and WEF. EIU, the IFO Global Business Index and OCO Global

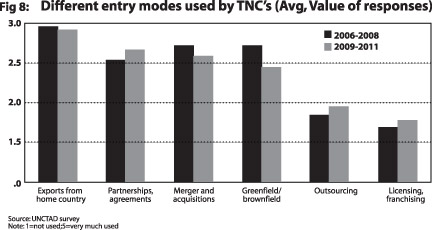

2008-2009, 12th Annual CEO Survey. Over the past twenty years, FDI

inflows have expanded substantially.

Specifically, global foreign direct investment flows fell moderately

in 2008 following a five-year period of uninterrupted growth, in large

part as a result of the global economic and financial crisis.

While developed economies were initially those most affected, the

decline has now spread to developing countries, with inward investment

in most countries falling in 2009 too. The decline poses challenges for

many developing countries, as FDI has become their largest source of

external financing. Greater involvement by TNCs (MNCs) not only lead to

greater productivity in manufacturing, in agriculture, rural development

essential to economic growth but also to the alleviation of poverty and

hunger.

Although the 2008-09 major economic crisis began in the advanced

economics, it rapidly spilled over to the developing world through the

contagion mechanisms of reductions in trade, foreign direct investment,

remittances, and other types of financing. Although GDP growth rates in

emerging markets did not fall as much as they have in advanced

economies, the notion that the developing world would be only marginally

affected by the crisis, having decoupled from the business cycle of

industrialized economies, has not held true.

However, it is important to note that the crisis has not affected

developing countries in a homogenous way - some economies are showing a

higher resilience and even managing to enhance their competitiveness in

the midst of the global downturn. However, it is important to note that the crisis has not affected

developing countries in a homogenous way - some economies are showing a

higher resilience and even managing to enhance their competitiveness in

the midst of the global downturn.

According to IMF Update global economy is beginning to pull out of a

recession unprecedented in the post-World War II era, but stabilization

is uneven and the recovery is expected to be sluggish. Financial

conditions have improved more than expected, owing mainly to public

intervention, and recent data suggest that the rate of decline in

economic activity is moderating, although to varying degrees among

regions.

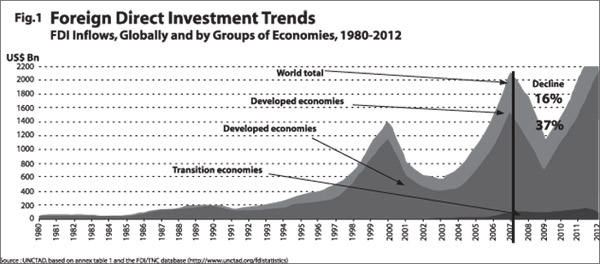

Cross border mergers and acquisitions (M&As) are the principal

drivers of this growth, as they are the main form of FDI in the

developed world and an increasingly important one in emerging markets.

Global flows of foreign direct investment have halved in the last two

years, and in the process emerging markets have edged ahead of developed

markets as the major destination. As higher-growth economies, emerging

markets have proven better than developed markets at attracting FDI

during the global downturn-with the notable exception of Eastern Europe,

which continues to suffer.

Surveys underline that, for developed-market companies, FDI tends to

pay off handsomely in terms of higher economic growth. Global FDI flows

are forecast to grow again this year, with emerging Asia in the

vanguard, but the volume is unlikely to match 2007’s US$2 tn level until

2012 or 2014 according to UNCTAD and EIU respectively.

FDI, globalization and economic growth

The boom in worldwide FDI flows constitutes a major element of

globalization and economic growth. Foreign direct investment is probably

one of the most significant factors leading to the globalization of the

international economy. FDI inflows to the developing countries increased

remarkably in the 1990s and now accounts for about 40 percent of global

FDI. The globalization of world markets has been accompanied by the

rapid growth of FDI by small and medium-sized firms accompanied by an

increase in entrepreneurial enterprises.

However, the dominance of MNCs/TNCs point to the complementarity of

trade and foreign direct investment in the context of sustainable

economic growth, as seen by:

* Multinational and Transnational companies, traditional exporters

and investors, send substantial exports to their foreign facilities;

* About 1/3 of world trade is intra-firm trade among MNCs and their

affiliates established under FDI;

* Many of the exports from parent MNC/TNC to subsidiary would not

occur if overseas investment did not exist. In these cases, factor

movements stimulate trade rather than substituting for it;

* The globalization of world markets has been accompanied by the

rapid growth of FDI by small and medium sized firms and entrepreneurial

enterprises in addition to traditional MNCs;

* Globalization has advanced FDI as a strategic foreign market entry

mode aiding growth

* Globalization of the world economy has raised the vision of firms

to realize the entire world as their markets market;

* Beyond export-led growth, the key to sustainable economic growth is

investment, which comes from: savings, retained earnings,

gifts/grants/foreign aid, investments (FDI)

* Trends are evident of TNC and MNC incorporate corporate strategies

for the Green World consistent with host country policies, backed by

Kyoto protocol.

Annual FDI flows increased fifteen-fold from about $55bn in 1980 to

$1.4 billion in 2000 and increased to over $2 trillion in 2007. FDI

soared not only in absolute terms but also in relative terms. Overall

FDI flows accounted for about 3 percent of worldwide exports in

1980-1985. By 2000, the FDI and export ratio exceeded 15 percent.

In other words, while exports remain the dominant form of corporate

internationalization strategies, globalization through FDI has gained

significantly in relative importance.

However, FDI inflows fell 37 percent from 2008 to 2009 to $1.114

trillion. However, this amount still represents the 5th highest amount

of cross border investment flows since data began to be recorded. It

accounts for a whopping 11 percent of global GDP output and over 80

million jobs.

In addition early signs from the beginning of 2010 suggest there will

be modest and uneven recovery in trillion by 2014 depending on data

provided by WTO and UNCTAD, EIU and author’s calculations.

The rapid expansion of FDI is enlarging the role of international

production in the world economy, making it “the main force in

international economic integration” says WIR2010.

The World Investment Report 2009, published by the UNCTAD (United

Nations Conference on Trade and Development), states there is a total of

889,416 multinational companies (MNCs) around the world: 82,053 parent

corporations and 807,363 affiliates.

In 2008, the 100 largest MNC’s sales combined amounted to nearly $8.5

trillion.

They also increasingly shape trade patterns, accounting for about

two-thirds of all world trade. But both FDI and trade are concentrated

within regions and neighbouring regions, and within each region, trade

links are somewhat stronger than FDI links.

Structural shift in global FDI

The decline in global FDI flows in 2009 was accompanied by a distinct

shift in the pattern of FDI. Economic theory tells us that capital

should flow from capital-abundant rich countries to capital-scarce poor

countries.

In practice, that has not been the case as developed countries have

consistently attracted the bulk of global FDI flows.

High risk in many emerging markets, the benefits of advanced

institutions and infrastructure and a superior overall business

environment in developed countries have tended to outweigh the

attractions of greater market dynamism and lower costs in emerging

markets.

The share of emerging markets in global FDI has tended to rise during

recessions as slumps in M&A have hit the developed world

disproportionately. Despite the steadily increasing share in recent

years of emerging markets in cross-border M&A, this still remains mainly

a developed country phenomenon.In 2008 some 80 percent of cross-border

M&A sales were still in developed states. However, the influence of the

M&A factor has been reinforced by other developments which pushed the

share of emerging markets in global FDI inflows to a record level in

2009.

FDI flows to emerging markets have held up better because their

overall economic performance has been much better than in the developed

world which has experienced its worst recession since the Second World

War.

Primarily this is due to the continued high growth of China and

India. However, even if China and India are taken out of the equation,

most emerging markets outperformed the developed world in 2009.

The notable exception is Eastern Europe which has suffered very badly

- its average output contracted by almost 6 percent in 2009.

Other factors are also apparent. Numerous studies have shown that

both “push” and “pull” factors determine FDI flows to emerging markets,

even during recessions. The trend of improving business environments in

many emerging markets in recent years has strengthened the “pull factor”

and has helped limit the recession-induced decline in FDI flows.

Globalization and increasing competitive pressure on companies have

increased the opportunity cost of not seizing opportunities in more

dynamic and lower-cost destinations.

The 2009 Economist Intelligence Unit global survey of 548 companies

provided evidence of a link between investing in emerging markets and

corporate financial success.

Among surveyed companies from developed countries that derive less

than 5 percent of their revenue from activities in emerging markets,

only 24 percent reported their financial performance as being better

than that of their peers.

By contrast, for developed country companies that derived more than 5

percent of their revenue from emerging markets, the share reporting

better performance than their peers was just under 40 percent.

Finally, the increased share of emerging markets in outward

investment is also increasing the share of emerging markets in inward

flows because a disproportionate share of outward investment by emerging

markets goes to other emerging markets. As a result of the various

factors that are expected to be at work, global FDI inflows as a

proportion of GDP are expected to decline from highs of about 3 percent

of global GDP to an average of 2.5 percent in 2010-14.

FDI inflows into emerging markets are projected to decline from

recent peaks of 4 percent of emerging markets’ GDP to an average of

about 3 percent of their GDP in 2010-2014 determination, FDI inflows are

dependent on a measure of the business environment, market size, real

GDP growth, unit labour costs, distance from markets, and the use of the

English language and natural resource endowments.

The model can be used to estimate the negative medium-term impact of

the effects of the 2009 crisis on FDI inflows.

Based on the model, global FDI inflows in 2010-14 will be some 25

percent lower compared with what they would have been if the average

business conditions and growth in 2004-08 had also pertained in 2010-14.

M&A’s have experienced a faster recovery, while Greenfield

investments have been more resilient during the crisis. FDI inflows

Global FDI witnessed a modest, but uneven, recovery in the first half of

2010. Developing and transition economies now absorb half of FDI.

Developing and transition economies attracted more Greenfield

investments than developed countries in 2007-2010. Although the majority

of cross-border M&A deals still take place in developed regions, the

relative share of such transactions in developing and transition

economies has been on the rise.

UNCTAD’s World Investment Prospects Survey 2010-2012 (WIPS) also

confirms that interest in developed countries as foreign investment

destinations compared to other regions had declined over the past few

years and is likely to continue to do so in the near future.

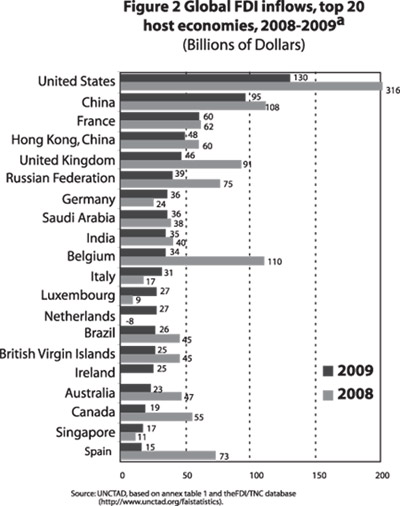

Global rankings of the largest FDI recipients confirm the emergence

of developing and transition economies: three developing and transition

economies ranked among the six largest foreign investment recipients in

the world in 2009, and China was the second most popular destination.

While the United States maintained its position as the largest host

country in 2009, a number of European countries saw their rankings

slide.

The determinants and drivers of FDI flows

The relationship between foreign direct investment (FDI) and economic

growth is a well-studied subject in the development economics

literature, both theoretically and empirically.

Recently, renewed interest in growth determinants and the

considerable research on externality-led growth, with the advent of

endogenous growth theories made it more plausible to include FDI as one

of the determinants of long run economic growth.

The interest in the subject has also grown out of the substantial

increase in FDI flow that started in the late 1990s, and led to a wave

of research regarding its determinants.

With the development of globalization, foreign direct investment is

increasingly being recognized as an important factor in the economic

development of countries.

Although FDI began a century ago, the biggest growth has occurred in

recent years.

This growth resulted from several drivers and factors, particularly

the more receptive attitude of governments to investment flows, the

process of privatization and the growing interdependence of the world

economy. |