|

REPORTS

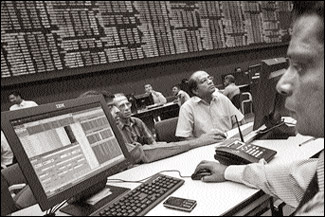

Stock indices bearish

Both indices recorded an overall contraction of .27 percent of the

ASPI and .06 percent of the MPI. The ASPI shed 20 points to close at

7459.58 while the MPI shed 4.45 points, closing at 6875.54.

The weekly turnover recorded Rs 15.39 billion with a daily average of

Rs 3.07 billion, an increase of 12 percent from last week’s Rs 2.74

billion daily average turnover. The volume of turnover last week was

696.45 million shares averaging 139.29 million shares daily, whilst last

week’s volume was 140.43 million shares per day. The volume of turnover

contracted marginally week on week.

|

Colombo Stock Exchange |

Banking, Finance and Insurance sector continued to represent the

largest contribution to the weekly market turnover both in value and in

volume as it accounted for 21.9 percent of overall turnover in value and

32.4 percent of turnover in volume, driven by interests in Nation Lanka,

Central Finance, Commercial Bank and Janashakthi. The other major

contributors to total market turnover in value were Land and Property

sector representing 12.8 percent of the weekly turnover followed by the

Diversified sector with 10 percent of total turnover. Second on the list

of total turnover in volume was the Land and Property Sector with 8.9

percent whilst Diversified sector was third with 6.3 percent

contribution.

JKH was the major contributor of the aggregate market turnover,

accounting for Rs 1.14 billion or 7.4 percent of aggregate market

turnover of the week. Nation Lanka denoted 5.4 percent of aggregate

market turnover accounting for Rs 833 million.

Central Finance, Dunamis Capital and Touchwood were highlighted as

other major counters in the top turnover list, reporting total turnover

of Rs 813.1 million, Rs 605.8 million and Rs 597.9 million respectively.

CDIC recorded as the major price gainer for the week witnessing an

increase of 88 percent increase in share price as against previous

week’s price of Rs 215.00. The share closed at Rs 404.20. Dunamis

Capital reported a gain of 80.4 percent in comparison with previous

week’s price of Rs 13.80 closing at Rs 24.90. Serendib Land, Colombo

Land and CFT were other major price gainers of the week closing prices

at Rs 1,700.00, Rs 35.70 and Rs 11.2 respectively.

Swarnamahal Finance was the top loser of the week with a decrease in

price of 55 percent against last week price of Rs 100.00, to close at Rs

45.00. Eastern Merchant reported a decline of 32.2 percent in price to

close at Rs 1525, compared with previous week price of Rs 2250.00.

Bogala Graphite, Autodrome and Alufab were other major losers of the

week, as the shares closed at Rs 65.30, Rs 910.10 and Rs 107.10

respectively.

Foreigners remained net sellers this week with Rs 105.21 million

outflow as against last week’s outflow of Rs 291.79 million. Total

Foreign buying this week was Rs 1.23 billion, recording a daily average

of Rs 246.71 million as against last week’s daily average buying of Rs

365.98 million. Therefore total buying recorded a decline by 32 percent

week on week. Additionally, Foreign sales experienced a sharp

contraction of 42 percent with the total sales for the week at Rs 1.33

billion, averaging at Rs 267.7 million daily compared with last week’s

total sales of Rs 1.38 billion averaging at Rs 463.25 million daily.

Colombo Land was placed first in the top volume list with 77.44

million shares changing hands during the week. The counter represented

11.12 percent of aggregate market volume. S M B Leasing (Non-Voting)

traded 56.2 million shares contributing 8.12 percent to aggregate

turnover in volume. S M B Leasing (Voting), Pan Asian Power, Nation

Lanka recorded volumes at 53.3 million, 52.9 million and 33.2 million

respectively.

Point of view

The indices reflected mixed investor sentiments at the bourse as it

continued to be dominated by retail activities and the absence of major

institutional investments.

With regard to corporate profits, 88 percent of the counters that

have released their quarterly earnings upto now have recorded profits

with the Banking, Finance and Insurance sector recording the largest

contribution of the total attributable earnings.

We anticipate that the present momentum of activities will be

maintained during the week ahead.

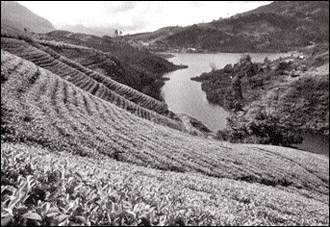

John Keells Tea Market Report:

Monsoon likely to affect crops

The South West monsoon appears to have started to develop over the

Island, which will lead to heavy and incessant rain. From May to

September the South West monsoon will sweep across the Western central

highlands unloading heavy rains on the mountain slopes and emerge as dry

winds on the Eastern slope of the central hills heralding the start of

the Uva quality season which is famous for its distinctive flavour.

It’s a period when the tea bushes undergo severe stress conditions on

account of the harsh weather and consequently, crop intakes from both

sectors will show a substantial drop.

Depending on the severity of the monsoon these rains can bring gale

force winds and lashing rain in the South Western quarter.

Sri Lanka Tea Crop for the month of April 2011 at 28.4 mkgs is 5.6

percent below the corresponding month of 2010. Although High Growns have

once again recorded a gain during the month Medium and Low Growns have

both recorded shortfalls.

As at end April, Sri Lanka production at 106.3 mkgs reflects a gain

of 2.1 mkgs over last year which in fact was a record year.

Last week’s large volume of 1.8 mkgs. of Ex Estate teas commenced at

firm levels and appreciated as the sale progressed by Rs 10 to Rs 15 for

most invoices.

However prices were not sustained and once again tended lower towards

the latter part of the sale.

A fair weight of Low Grown, High and Medium CTC PF1s remained unsold

on account of little or no interest. Russia was selective, whilst the

Tea Bag sector lent only fair support. UK, Japan and Continental buyers

too were very selective.

The 3.9 mkg of Low Growns that came under the hammer last week, met

with better demand. In the Leafy category, although prices of Main

Grades commenced on a lower note, gained as the sale progressed, but

dipped again towards the latter part.

In the Small Leaf category, the well made teas appreciated in value,

whilst at the bottom end prices declined further. With the large volume

on offer, it is clearly evident that most markets are looking at well

made teas with the poorer sorts been neglected.

Western Teas

Select Best BOPs were firm to Rs 5 dearer, other good invoices gained

Rs 5, Below Best and Plainer varieties were firm to dearer. Select Best

BOPFs declined Rs 5 to Rs 10, other good invoices were irregularly

dearer, Below Best sorts which were Rs 10 dearer eased as the sale

progressed, plainer varieties too followed a similar trend. Medium BOPs

shed Rs 5 to Rs 10, whilst the BOPFs declined by a similar margin and

substantially more for the poor leaf sorts.

Nuwara Eliya Teas

Brighter BOPs declined Rs 10 to Rs 15 and more, others were firm to

Rs 5 dearer. Brighter BOPFs declined substantially whilst the others

were firm to marginally dearer.

Uva Teas

BOPs declined Rs 5 to Rs 10, whilst the BOPFs were firm to irregular.

Uda Pussellawa BOPs advanced Rs 5 to Rs 10 whilst the BOPFs were

irregular.

CTC Teas

Low Grown CTC PF1s declined Rs 5 to Rs 10 with a large volume

remaining unsold. BP1s declined Rs 20. High and Medium PF1s shed Rs 10

and more as the sale progressed with a large volume remaining unsold.

BP1s advanced Rs 5 to Rs 10 on average.

Low Growns

Lower demand. Select Best OP1s were firm to dearer by Rs 5 to Rs 10

whilst the balance were irregularly lower Rs 5 to Rs 10 and more at

times.

A few Select Best and Best BOP1s were firm to Rs 5 to Rs 10 dearer,

however the Below Best and poor sorts tended lower by Rs 5 to Rs 10.

Select Best along with the Best OP/OPAs eased Rs 5 to Rs 10, the balance

too declined by a similar margin and declined further as the sale

progressed.

Select Best and Best Pekoe/Pekoe1s were firm to Rs 3 to Rs 5 dearer

at times, however the balance shed Rs 10 to Rs 15, flaky types were

firm. Improved demand was witnessed for Tippy/Small Leaf category.

Select Best BOPs advanced Rs 5 to Rs 10, Best types maintained last

levels, Below Best types gained Rs 5 to Rs 8, poorer types gained Rs 5.

Select Best BOP. SPs were firm, Best types gained Rs 5 to Rs 10, Below

Best sorts were firm, poorer sorts were easier by Rs 5.

A few Select Best FBOPs advanced Rs 5 to Rs 10, others maintained

last levels.

Best types moved up Rs 5 to Rs 8, Below Best types were irregular,

poorer sorts were irregularly lower to last. Select Best and Best FF1s

moved up Rs 5 to Rs 10, Below Best and poorer sorts too moved by Rs 5 to

Rs 8.

Select Best tippy varieties met with improved demand and gained above

last, Best types too gained Rs 10 to Rs 20, Below Best and poorer sorts

were irregular.

Off Grades

Select Best liquoring Fngs1s appreciated by Rs 10 to Rs 15, whilst

the Below Best and poorer sorts advanced Rs 10. Select Best and Best BMs

appreciated by Rs 5 to Rs 10, whilst the poorer sorts were dearer by Rs

10 to Rs 15. All BPs sold at firm levels. All Low Grown Fngs were lower

by Rs 10 Select Best BOP1As along with the Best appreciated Rs 5 to Rs

10 and more at times whilst Below Best and poorer sorts were firm to

dearer by Rs 10 to Rs 15 from last levels.

Dust

Select Best Dust1s were firm. Improved teas in the Best and Below

Best category appreciated Rs 5 to Rs 10 whilst the balance were firm.

Poorer sorts declined Rs 10 to Rs 15. Clean secondaries were firm whilst

the balance gained Rs 5 to Rs 10. Best Low Grown Dust/Dust1s were firm

whilst the balance gained Rs 10 to Rs 15. |