Remarkable 2010 for Sri Lankan banking industry

Prasad Polwatte and Asanka Liyanage

As the effects of the financial crisis permeated into the Sri Lankan

economy, a noticeable indolence in the financial services sector was

evident throughout 2009.

|

The banking sector sustained its earnings via an increase in

investment income from government securities and equities |

This was further aggravated as repercussions of financial fall-outs

in the local industry were disclosed in the early part of 2009.

Domestic financial markers that were somewhat volatile at the

commencement of 2009 became more liquid and steady in the second half of

2009 and first half of 2010.

The Government’s post war economic development policies were lenient

on the monetary system and led to a declining inflationary pressures

situation in financial market. Resumption of capital inflows due to

reduced risk and improved investor sentiment has given a positive shock

to the banking industry.

This article compares and contrasts the performance of lincensed

Commercial Banks (LCBs) for 2009 and 2010. Both public and private LCBs

overall performance was comparatively higher in 2010 compared to the

2009.

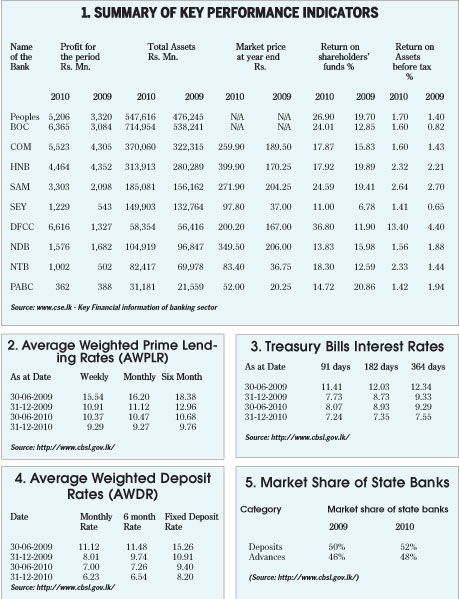

All of the key performance indicators showed positive growths in

2010. Summary of Key Performance Indicators of 2010 and 2009 of Leading

LCBs are presented in Table 1.

Financial markets were more stable with improved liquidity and

declines in interest rates from the beginning of 2010. The exchange

rates remained more stable. Equity prices have surged upwards during the

year.

The banking sector sustained its earnings via an increase in

investment income from government securities and equities.

Almost all banks moved to long-term investments rather than

short-term investments. On the other hand they encourage short-term

borrowings as it was less costly than the long-term borrowings.

Overall drop apart from DFCC bank can be seen in total revenue

compared to 2009 in 2010. The main reason was the average drop in

interest income by 10 percent to 15 percent in almost all LCBs.

In the case of DFCC bank the results of 2010 included profit relating

to the sale of Bank’s shareholding in Commercial Bank of Ceylon PLC (CBC).

Sale of Commercial Bank shares have contributed Rs 5,282 million to

DFCC Bank’s profit.

The main reason for the drop in interest income of all LCBs was the

drop in lending rates from 15 percent 18 percent to 9.29 percent - 9.76

percent range in 2010

Even though an increasing trend was visible in the growth in Advance

portfolio of the banks (Approximately 20 percent - 30 percent) but the

interest income had dropped mainly due to the decrease in Average

Weighted Prime Lending Rates (AWPLR).

On the other hand LCBs concentrated on Government securities

specially Treasury bills, of which interest rates were decreased by

considerable percentage. Details are as follows: A material decrease in

interest expense was shown in 2010 to 2009. (Averagely 20% to 30% drop

in all banks).

The decrease in the Average Weighted Deposit Rates (AWDR) was the

main factor for this interest cost reduction. It is clearly evident in

the following table.

The deposit growth in 2010 (nearly 10 percent- 20 percent) has not

proportionately increased the interest cost in LCBs due to the drop in

AWDR.

On the other hand banks were unable to attract more deposits since

short-term deposit interest rates were less attractive and customers

tend to switch for more attractive investments such as Capital/Money

markets.

2010 can be considered as a remarkable year to increase LCBs profits.

Apart from NDB and PABC all other banks have recorded an increase in

their profit after tax in 2010 compared to 2009 (Nearly 50 percent to

100 percent).

The same increase can also be notified in Net Asset Per Share, EPS,

ROE and ROA. Further, two State banks were able to sustain their market

share on deposits and advances with slight increase.

This year is also a blooming year for all banks since the government

has given several encouragements in its budget proposal. They are:

* Reduction of Corporate Tax from 35 percent to 28 percent and

reduction of Nation Building Tax (NBT) will improve profitability of

most listed companies

* Reduction of Financial Services VAT (FS VAT) from 20 percent to 12

percent. However such institutions are expected to create an investment

fund that can be utilized to grant attractive credit facilities

including long-term loans at a lower rate of interest.

* Removal of debit tax will also have a positive impact on LCBs

deposit growth.

The ban king sector is continuously seeking opportunities in the

North and East for market exposure. On the other hand the CBSL is of the

view that further decrease in interest rates in the future is possible

and the banking sector should take into account the amount of customer

deposits that can be overlooked due to further decrease in the interest

rates. LCBS will face great challenges in 2011 to sustain it level of

performance of 2010. |