Restoration of GSP+ needed

Sent by Hiran Bandaranayake, Secretary General, Sri

Lanka Garment Buying Offices Association

The European Union withdrew the GSP+ tariff concession granted to Sri

Lanka under special privileges to economically vulnerable developing

countries since 2005, on August 15, 2010 in relation to what was

regarded as shortcomings in Sri Lanka on the implementation of

International Conventions which is an integral part of the trade

benefit.

EU Ambassador in Colombo Bernard Savage has stated recently that the

Government and the EU are not involved in fresh talks to revive the GSP

plus trade benefits for the country.

He has stated that the Government had not made any approach to resume

negotiations on the issue and so the matter was now closed.

During the recent past, one of the most crucial trade concessions Sri

Lanka received was the granting of GSP+ status in the EU market,

following the ‘Tsunami’ of December 26, 2004.

This provided duty-free access for 7,200 items and the most

beneficiary of the concession is the Apparel sector.

Few countries provide such an attractive Import Duty concession

except under a Free- Trade-Agreement (FTA).

Garments has been promoted as an engine of development in Sri Lanka.

It certainly brings in dollars.

This provision of duty-free access to EU Market is regarded as having

facilitated substantial growth in the country’s exports and especially

apparel, in the region since its implementation in year 2005.

Major impact

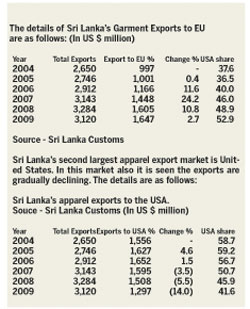

Apparel exports alone to the EU, climbed from US $ 997 million in

2004- the year before Sri Lanka was granted GSP+ benefits- to US $ 1,647

million in 2009 an increase of 65.2 percent and thus EU became the top

market for Sri Lanka’s apparels in 2008 replacing United States who has

been the top market since inception of the apparel industry in early

1980’s.

Its export share which was 37.6 percent in 2004 also climbed to 52.9

percent in 2009. It is widely accepted that the withdrawal of GSP+ will

have a major impact on the apparel industry.

The fear is that the growing number of European buyers will find Sri

Lanka’s apparels increasingly uncompetitive and shift their sourcing to

rival producers.

The table also indicates that due to the EU- GSP+ concession, total

apparel exports also gradually increased year after year, except for

year 2009, where the entire global apparel industry was affected due to

a world-wide economic recession.

During 2009-with Sri Lanka while enjoying EU-GSP+ concessions, was

the eight Leading exporter to EU Market. China topped with US $ 38,057

million, followed by Turkey-US $ 9,967 million, Bangladesh-US $ 7,126

million, India-US $ 6,316 million, Tunisia-US $ 3,185 million,

Morocco-US $ 2,813 million, Vietnam- US $ 1,752 million and Sri Lanka-US

$ 1,687 million and closely followed by Indonesia US $ 1,603 million and

Pakistan US $ 1,568 million. Now with Sri Lanka not enjoying the GSP+

concession with effect from August 15, 2010, Sri Lanka obviously will be

at a disadvantage.

Pakistan which was behind Sri Lanka will probably receive the GSP+ in

2011 to 2013, will also be a threat to Sri Lanka. The above countries

are the main competitors of Sri Lanka in the global apparel market.

Source - World Trade Organization (WTO)

The country thus stands to lose millions of dollars worth of apparel

exports to the 27-nations EU market and the livelihood of thousands of

apparel sector workers are at stake, as the withdrawal of the privileges

is expected to affect large nu0mber of factories.

According to Industrialists, the loss of the GSP+ benefit will exert

tight pressure of profit margin, for when the benefits are lost, sellers

will have to bear the cost of additional tariff. Under the GSP+

concessions Sri Lankan goods entering the EU need to pay no duty, but

now the privilege is lost and the standard GSP kicked in and thus Sri

Lankan apparel became subject to concession of only 2-2.4 percent duty

which is 20 percent of standard tariff averaging 10-12 percent as

against zero duty which enjoyed prior to withdrawal of GSP+ in August

15, 2010.

Meanwhile, despite Sri Lanka enjoying the GSP+ privileges in the EU,

Sri Lanka’s Apparel exports to EU market contracted by 8.4 percent

during the first eight months of current year from the year ago level.

Decline in exports

The apparel exports to EU during January to August, 2010 was US $ 986

million as against US $ 1,077 million during same period 2009.

The European Commission (EC) announcement of February 15, 2010 of its

intention to suspend the GSP+ concession granted to Sri Lanka with

effect from August 15, 2010 would have also have affected for above

decline in exports.

Joint Apparel Association Forum Chairman Sukumaran has said recently

that it is most likely that the apparel exports, which is Sri Lanka’s

key industrial exports, would come down by 10 to 15 percent this year,

reaching US $ 2.7 to 2.8 billion, as compared to last year. (Source -

Fibre2Fashion News Desk - India)

According to Joint Apparel Association Forum Secretary General Rohan

Masakorale around 250 factories may get affected due to this withdrawal.

It is seen from the above table the apparel exports to USA has

declined by from US $ 1,556 million in 2004 to US $ 1,297 million in

2009, which is a drop of 16.6 percent.

The share also has dropped to 41.6 percent in 2009 from 58.7 percent

in 2004.

The apparel exports to USA during the first eight months of 2010

declined by 4.6 percent over the same period year ago. The exports

during the period January to August, 2010 was US $ 833 million as

against US $ 873 million during January to August, 2009.

The major global market for apparel imports right throughout are EU

and USA. In 2009, EU (US $ 160 billion) and USA (US $ 72 billion)

totalling US $ 232 billion and these two markets accounted for 73

percent of global total apparel imports.

Similarly Sri Lanka’s two major apparel export markets are EU (US $

1,65 billion) and USA (US $ 1.3 billion) and both these markets

accounted for 94.5 percent of total apparel exports in 2009.

Cheaper sources

In today’s market place, it has become a norm to source clothing from

countries with low costs. Furthermore the buyers are being forced to

look for cheaper sources in order to satisfy consumers who are

increasingly demanding, while competition in the retail level continue

to get tougher.

However, there is still a gap in the market for manufacturers based

in Western Europe and the United States who produce goods in their own

country for sale in the domestic market and for export.

Of course, production costs are usually much higher in developed

countries. Indeed labour costs alone in Western Europe can be over many

times as high as those in Asian countries, Nonetheless, manufacturing in

developed countries bring in number of benefits.

One benefit is flexibility in being able to offer smaller production

runs and short delivery times. While distant suppliers may be cheaper,

buyers often demand minimum quantities which can be economically not

possible.

The buyers are looking increasingly to source from factories which

adhere to Corporate Social Responsibility - CSR programs in general-and

fair labour practices in particular. Our ‘Garments Without Guilt’ is

well-known both locally and internationally as superior garments.

On the employment side-media reports quoted that the future looks

bleak and fears of retrenchment are worrying the workers, but the

figures can rise with the withdrawal.

Thus causing loss of job opportunities in the apparel industry it

will also no doubt affect the inflow of foreign currency from export

earnings.

Sri Lanka has gained a reputation of exporting top brands to leading

buyers in the world but will soon lose that status if we don’t regain

the GSP+.

International Textile Manufacturing Federation-ITMF, at its annual

meeting in Brazil expressed concern about the soaring cotton prices and

their negative implications for the international cotton textile value

chain from fibre to retail.

The ITMF stated that the textile industry all over the world is not

in a position to absorb any longer cotton price increases of

unprecedented dimensions recorded during the past months without risking

its own existence.

Further in addition to above stated facts, increases in prices of

cotton, freight cost, currency fluctuation and competition from other

countries with GSP+ with all this taking place in the global apparel

industry and with an additional payment of 9.6 percent to 12 percent

duty on Sri Lankan products makes Sri Lanka extremely expensive compared

to our competitors.

Any decline in apparel exports will also affect the local textile

industry as obviously requirements from apparel industry will be

gradually reduced.

EU Ambassador Bernard Savage’s recent statement that the Government

and the European Union (EU) are not involved in fresh talks to revive

the GSP plus trade benefits for the country, comes as a fresh blow to a

dying industry intensifying the shock.

Therefore taking above facts into consideration, if the GSP+ status

is not restored in the near future, Sri Lanka’s apparel industry which

is the major foreign exchange earner of the country for many decades may

have to face bad times with decline in exports and employment

opportunities.

The outcome will not be good for the economy of the country and thus

the Government and the EU should pursue its dialogue without further

delay and both must arrive at a win-win situation and ensure the

restoration of the GSP+ at the earliest. |