European stocks down

European markets mostly fell on Friday as investors awaited news on a

bailout deal for Greece expected this weekend, while the euro gained and

bond markets eased at the end of a tumultuous week.

|

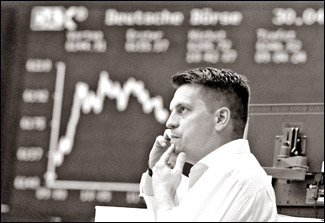

A stock broker works in front of the daily graph of the German

share index DAX at the stock exchange in the central German city

of Frankfurt am Main on April 30, 2010. The DAX opened for

business at 6155,57 points. (AFP Photo) |

The London stock market fell 1.15 percent, Paris slipped 0.62 percent

and Frankfurt edged down 0.15 percent.

Paris markets were down 3.4 percent compared to last Friday.

All three main markets had rallied Thursday on news that a Greek debt

bailout was near, with sentiment also lifted by positive company

results.

“Expectations of an announcement about a joint EU-IMF bailout of

Greece within days have helped soothe investor anxiety about an imminent

Greek default,” said CMC Markets analyst Michael Hewson.

“And (this) has seen the euro continuing to pull away from this

week’s 12-month lows,” he said.

The euro jumped to 1.3300 dollars during late trading in London, up

from 1.3229 dollars in New York late Thursday, and after striking a

one-year low of 1.3115 on Wednesday.

As pressure eased, Greek bond yields, indicating the price the

government would have to pay to raise new money on financial markets,

fell under nine percent.

The rate on 10-year paper came to 8.938 percent against 9.039 percent

on Thursday. The yield on Wednesday soared to a record 11.142 percent.

“Expectations are clearly running high that the Greek bailout deal

will be sealed in the near term and this is helping lift equities as we

move towards the long weekend,” said IG Index analyst Anthony Grech.

“Financial markets have been generally cheered by the prospect that

these large tranches of sovereign debt they are holding won’t go bad.”

AFP |