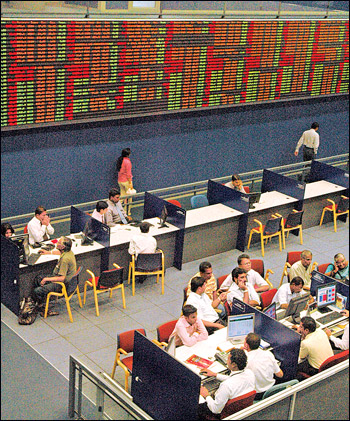

Indices continue to post decent gains

Stocks continued to rally on anticipated strong earnings with ASPI

closing up substantially compared to last week. The ASPI (All Share

Price Index) closed the week at 4188.9 points up by 67.2 points or 1.6

percent compared to last week, while the MPI (Milanka Price Index)

picked up by 16.6 points or 0.4 percent to close at 4712.9 points on

Friday.

KHZ

placed highest in terms of activity levels for the week helped by few

crossings on the counter. The high cap conglomerate added over Rs. 1.0

billion to the week’s turnover, with a trading a volume of 5.5 million

shares. JKH saw its share price close unchanged Week on Week (WoW) at Rs.

185.25 per share on Friday. KHZ

placed highest in terms of activity levels for the week helped by few

crossings on the counter. The high cap conglomerate added over Rs. 1.0

billion to the week’s turnover, with a trading a volume of 5.5 million

shares. JKH saw its share price close unchanged Week on Week (WoW) at Rs.

185.25 per share on Friday.

Raigam Wayamba Salterns (RWSL) initial public offer of 80 million

shares at Rs. 2.50 a share which was oversubscribed on the opening day

of March 23, came into listing on April 29 the counter gained

substantial interest on its opening day on Thursday which generated a

contribution of Rs. 268.9 million for the week.

The share price witnessed an increase of 72.0 percent to close at Rs.

4.30 per share, becoming the week’s second largest price gainer. The

property firm Overseas Realty (OSEA) contributed Rs. 432.7 million

towards the turnover, with the bulk of this amounting to Rs. 389.1

million coming on Thursday. During the week 25.7 million OSEA shares

traded at a highest price of Rs. 18.00 and a lowest price of Rs. 15.75

before closing the week at Rs. 17.50, up 9.4 percent on Friday.

Activity remained moderate this week in spite of the reduced number

of trading days this week, with JKH’s trades boosting turnover levels.

Total turnover for the week amounted to Rs. 6.8 billion this week whilst

the average daily turnover this week stood at Rs. 1.9 billion, showing a

3 percent decline in turnover comparing last week’s average daily

turnover of Rs. 2.0 billion.

Foreign investors were net sellers this week amounting to Rs. 1.3

billion. Foreign purchases showed a 27.6 percent decline to stand at Rs.

842.4 million, while foreign sales witnessed a similar 27.4 percent

decline to amount to Rs. 2.1 billion. Foreign participation stood at

21.8 percent of total activity.

Volume-wise highest traded stocks this week were, Raigam Salterns,

Nawaloka, Overseas Realty, Janashakthi Insurance and Colombo Land.

Expectations of improved earnings to

push market up

The week ended 30.04.10, saw the ASPI move 67.2 points, and the MPI

16.6 points.

Our prediction of the ASPI reaching 4200 during this week fell short

by 10 points, due to a holiday dragged week. However, we predict the

ASPI to move beyond the 4200 mark with the March earnings season round

the corner. With the expectation of improved corporate earnings; we

expect the bourse to be in “Green” for the next couple of weeks, with

occasional “profit taking”.

The information contained herein has been compiled from sources that

Acuity Stockbrokers (Private) Limited (ASB) believes to be true and

reliable but we do not hold ourselves responsible for its completeness

or accuracy. No matter published herein create any liability of any kind

on ASB. All opinions, views, findings and conclusions included in this

report constitute ASB’s judgment of this date and are subject to change

without notice.

ASB has the sole copyright for this report and the information and

views contained cannot be reproduced or quoted in part or whole in any

form whatsoever without the written permission from ASB. |