|

CSE transaction cost to be reduced:

SEC to improve CSE structure

Encouraging decision for investors:

The Securities and Exchange Commission (SEC) will improve market

microstructure of the Colombo Stock Exchange (CSE). Securities and

Exchange Commission (SEC) Director General, Channa de Silva told Daily

News Business that this was an encouraging decision for the investors

and fundamental changes like this were required.

|

Director General, Channa de Silva |

The crossing threshold will be increased from Rs 10 million to Rs 20

million. The tick size on transactions will be reduced to 10 cents

across the board.

The threshold for negotiable brokerage will be reduced from Rs 100

million to Rs 50 million. The minimum brokerage floor will be 0.15

percent.

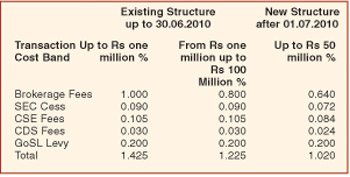

The SEC Cess, CSE fees, Central Depository System (CDS) fees and

Government levy are to remain unchanged as per the existing structure

for negotiable trades.

De Silva said that the two band fee structure which exists at present

will be removed.

There will be one band for transactions up to Rs 50 million. Once the

change is effective the total transaction cost up to Rs 50 million will

be 1.02 percent.

The Director General said the biggest beneficiaries of this reduction

would be investors transacting less than Rs one million as at present

whose effective reduction is

28 percent, whilst the reduction for transactions over Rs one million

at present is over 16 percent. 28 percent, whilst the reduction for transactions over Rs one million

at present is over 16 percent.

It was further decided to revisit and review the changes towards the

end of the year.

The changes to the market microstructure of the CSE including

transaction costs will be active with effect from July 1 this year, he

said.

The reduction of the high transaction costs was a combined effort of

the Securities and Exchange Commission (SEC), the Colombo Stock Exchange

(CSE) and the Central Depository System (CDS), de Silva said.

The Director General said that the reduction of the transaction costs

will show a rapid increase in the trading and it will also make the CSE

more attractive.

Reduction of the transaction cost was the first step and the SEC

would like to move further towards a low cost structure.

This regulatory reform was very meaningful as the capital market is

performing outstandingly and the country’s economy is stabilizing in a

faster manner.

With the reduced transaction cost the SEC expects an increase in the

number of local and foreign investor participation in the CSE and these

developments in the capital market will affect the country’ economy very

favourably, he said.

SEC with the CSE and market stakeholders decided the above changes at

its 257th Commission Meeting held on April 23 this year.

CdeS |