|

Amidst heavy activity on banks

Market steady

The market opened on a high note on Monday but however settled into a

narrow trading range as the week progressed. Nevertheless the activity

levels continued to remain strong with high interest seen on banking

sector stocks. Comparing Week on Week (WoW) the ASPI (All Share Price

Index) rose by 16.6 points or 0.5 percent to close at 3131.9 points,

while the MPI (Milanka Price Index) improved by a higher 42.7 points or

1.2 percent to close at 3546.9 points.

A 7.3 million quantity of banking sector counter, HNB, traded during

the week with larger chunks being traded during the early part of the

week, which were reportedly sold by Browns' Group. On Monday the counter

managed to contribute Rs.866.0 million, towards the day's turnover with

a total of 5.0 million shares trading on the back of renewed foreign

interest. During the week, the counter was seen trading between a range

of Rs.169.75 and Rs.175.00 per share to close at Rs.170.00 per share on

Friday while contributing Rs.1.3 billion towards weekly turnover which

led the counter becoming the highest contributor towards this week.

Market heavyweight counter JKH also managed to contribute notably

towards weekly turnover this week, even though the volumes traded

remained slightly lower compared to last week.

The most part of the volumes were traded on Thursday, which saw 1.4

million of 2.6 million shares traded for the week. During the week JKH

traded within a price range of Rs.153.00 and Rs.155.00 per share. The

contribution towards weekly turnover amounted to Rs.400.9 million,

however the share closed 0.5 percent lower compared to last week at

Rs.170.00 per share.

Attention was drawn towards banking counters this week, as trades in

HNB, Commercial Bank (COMB), DFCC, Seylan Bank (Non Voting), Pan Asia

and Nations Trust managed to come within the top 10 contributors for the

week.

The week saw 2.0 million COMB shares trading, with the contribution

towards turnover amounting to Rs.358.7 million while WoW the share

closed 5.6 percent higher at Rs.190.25 per share. DFCC, which became the

fifth largest contributor, injected Rs.344.8 million while trading a

total of 2.2 million shares. Similarly, DFCC share too showed an

improvement this week, which closed 7.4 percent higher WoW at Rs.164.25

per share on Friday.

Among the other counters which saw interest during the week were

Browns amidst the speculation over the sale of HNB shares held by the

company. During the week 2.2 million Browns shares traded with its share

price showing an 8.4 percent increase WoW to close at Rs.84.00 per

share. Contribution towards weekly turnover from the counter amounted to

Rs.347.7 million. Activity levels remained high during the week, with

total turnover amounting to Rs.6.4 billion, higher than the Rs.5.6

billion posted last week. The average daily turnover stood at Rs.1.3

billion, showing a growth of 15.6 percent WoW. Foreign participation too

was slightly higher at 26.0 percent of total activity, as trades on the

highest contributed stock HNB went through as foreign trades. Foreign

purchases totaled to Rs.2.2 billion and foreign sales amounted to Rs.1.3

billion, resulting in strong net foreign inflows of Rs.1.1 billion.

Amongst the heavily traded stocks this week were, Tess Agro, Seylan

Bank (Non Voting), Piramal Glass, Sierra Cable and Dialog.

Point of View

Stick to fundamentals

As we expected the market witnessed high activity throughout the

week, backed by strong investor sentiments. The ASPI however gained only

16.6 points Week-on-Week while the more liquid MPI climbed 42.7 points.

We do not expect any sharp change in investor sentiments over the

coming week, thus the market would hold steady backed by healthy

activity levels. The third quarter corporate earnings season has now

begun. While the overall expectations on third quarter earnings remain

mild, any weaker or better than expected company earnings could affect

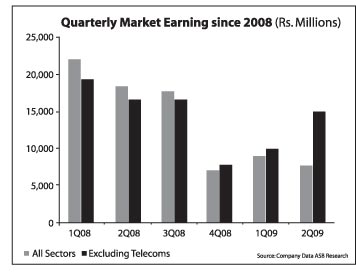

short term market direction. Earnings in the 2Q of 2009 witnessed a

drop, largely on the back of poor earnings reported by Telcos (Refer

graph below).

According to our analysis corporate earnings excluding the Telecom

sector witnessed a 49.9 percent improvement Quarter on Quarter (QoQ).

While, third quarter earnings are likely to witness an YoY drop, we

believe QoQ earnings would show a notable improvement.

While economic, political developments and participation of

foreigners in the market are likely to be key factors driving the

market, short term fluctuations would also trace corporate earnings

announcements for the third quarter. In our view the real recovery of

earnings would be seen during the final quarter and as such we advise

the investors to focus on the medium term and stick to fundamentally

sound counters.

The information contained herein has been compiled from sources that

Acuity Stockbrokers (Private) Limited (ASB) believes to be true and

reliable but we do not hold ourselves responsible for its completeness

or accuracy. No matter published herein create any liability of any kind

on ASB.

All opinions, views, findings and conclusions included in this report

constitute ASB's judgment of this date and are subject to change without

notice. ASB has the sole copyright for this report and the information

and views contained cannot be reproduced or quoted in part or whole in

any form whatsoever without the written permission from ASB. |