Developing countries and debt sustainability

The global financial crisis which erupted in 2008 has raised the

spectre of external debt difficulties for a larger group of countries.

Reduced export earnings have diminished the resources available to

service existing debt while balance - payments difficulties have

required a number of developing countries to increase their external

borrowing.

These developments point to the need for a broader multilateral

framework if the international community is to deliver fully on its

commitment in the Millennium Declaration to “deal comprehensively with

the debt problems of developing countries.”

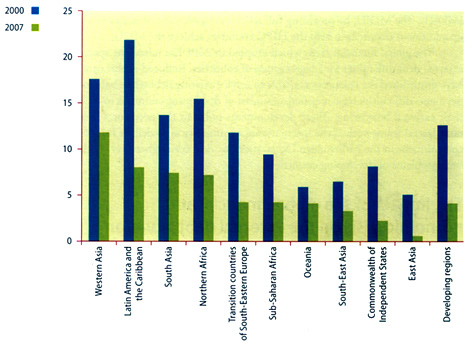

Export revenues of developing economies nearly doubled between 2003

and 2007, giving countries more resources with which to service their

external debt. For the average developing country, the burden of

servicing external debt fell from almost 13 percent of export earnings

in 2000 to four percent in 2007. The ratio declined in every region but

remained above 10 percent in Western Asia in 2007 and was between five

and 10 percent in Latin

|

Ratio of the

external debt-service to export revenues, by region, 2000 and

2007 (percentage)

|

America and the Caribbean, and South Asia, in that same year. In all

other regions, it had fallen below five percent by 2007. In the last

quarter of 2008, however, export revenues of developing countries began

to fall because of the global economic crisis. Although consistent

up-to-date data are not available at the time of writing, the ratio of

debt-service payments to export revenue for developing countries is

expected to have reversed its downward trend in 2008.

The global economic showdown has affected the external debt situation

of developing countries through a variety of channels which mostly

originate in the decline in export earnings that has afflicted the

majority of developing countries. The situation has been particularly

severe for the commodity-exporting countries because of the decline in

both the quantities and the prices of commodity exports after mid-2008.

The fall in foreign earnings encountered by most developing countries

increased the burden of existing debt-servicing obligations in relation

to exports.

The collapse in export receipts has been accompanied by higher costs

for imported food and fuel, resulting in overall balance-of-payments

difficulties for many developing countries. Some developing countries

had built up their foreign-exchange reserves when export revenues were

growing rapidly and have been able to use such reserves to finance

shortfalls over the short-term. In some countries (such as Brazil,

Kenya, South Africa and Thailand), strains on the balance of payments,

coupled with the turmoil in world financial markets, have resulted in

depreciation of national currencies.

The weakened external payments position has been accompanied by a

deterioration in many developing-country fiscal positions. Depreciations

have increased the domestic cost of servicing external debt and have

raised the ratio of debt to gross national product (GNP). At the same

time, the fall in export earnings has reduced foreign-currency earnings

from taxes on such exports as minerals and, to the extent that imports

have been curtailed, from import duties and value added tax (VAT). On

the other hand, devaluations will have boosted government revenues from

these trade taxes in the national currency.

Where a country’s external debt was large initially, the increased

cost of servicing debt is likely to outweigh the revenue benefits of

currency depreciation. Countries with large foreign-exchange reserves or

fiscal stabilization funds may be able to cushion the effects of a

decline in public revenues. In other countries, a weakened fiscal

position and the need to meet debt-service obligations may put public

expenditures on development activities in jeopardy unless additional

resources are forthcoming.

Many developing countries that lack domestic resources require

additional external resources to help counteract the impact of the

crisis, but borrowing could pose serious risks for countries that

already have a high debt burden.

The IMF has identified 28 countries with debt in excess of 60 percent

of gross domestic product and its simulations suggest that the debt

ratios of another three countries could exceed this level if they

undertook additional borrowing to cover the shortfalls in their external

financing.

Some post-completion point HIPC countries that already have elevated

levels of debt distress may be among those that face difficulties. On

the other hand, HIPCs that have not yet reached their completion point

should be able to achieve debt sustainability with the potential debt

relief available to them under the HIPC and MDRI initiatives. Overall,

however, the crisis is aggravating the external debt situation of

countries that have not received debt relief in the recent past and is

compromising the progress made under these two initiatives.

Apart from the increased difficulties of servicing debt and borrowing

funds to finance larger balance-of-payments deficits, many developing

countries - even those that do not have debt-servicing problems - have

faced problems in rolling over their increasingly large stock of

existing private sector external debt, particularly corporate borrowing,

since the global availability of credit in this regard has declined

precipitously as a result of the financial crisis. Where available,

interest rates for such credit have risen.

At their meeting in April 2009, the leaders of the Group of Twenty

(G-20) reached agreement on a number of arrangements to increase the

external financing available to developing countries. They announced as

$ 1.1 trillion package both to help affected countries meet the

immediate financial needs that have arisen from the crisis and to boost

economic activity worldwide. Of this amount, the IMF was expected to

triple its resources from $250 billion to $ 750 billion. At its meeting

on April 26, 2009, the World Bank/IMF Development Committee underlined

the need to translate these commitments into action and urged all

concerned to provide the additional resources.

At the Conference on the World Financial and Economic Crisis and its

Impact on Development in June, United Nations Member States agreed that

debtor countries could seek, as a last resort, to negotiate agreements

on debt standstills to help mitigate the adverse effects of the crisis

for a larger group of countries.

Reduced export earnings have diminished the resources available to

service existing debt while balance-of payments difficulties have

required a number of developing countries to increase their external

borrowing. These developments point to the need for a broader

multilateral framework if the international community is to deliver

fully on its commitment in the Millennium Declaration to “deal

comprehensively with the debt problems of developing countries.”

From the MDG Gap Task Force Report 2009 titled “Strengthening the

Global Partnership for Development in a Time of Crisis |