Capitalist economy in crisis

Recovery at high cost

Prof. Tilak ABEYSINGHE Prof. Tilak ABEYSINGHE

Singapore - Today, the whole capitalist economic system is being

questioned not just by Marxists or anti-capitalists but also by the

foremost followers of the free market capitalist ideology, said Prof.

Tilak Abeysinghe.

Prof. Tilak Abeysinghe is the deputy director of the Singapore Centre

for Applied and Policy Economics of the Department of Economics of the

National University of Singapore (NUS). Following are the excerpts of

his interview give to Gamini Warushamana, ANCL staff correspondent.

The global economic crisis triggered off by the financial crisis in

the United States is the most serious crisis that the capitalist world

has faced since the great depression in the 1930s.

Although it initially manifested through the US sub prime mortgage

crisis, the subsequent collapse of the financial giants and

unprecedented contraction of economies around the world is just

mind-boggling.

How it all started?

The US housing market was on upswing, mortgage loans soared. But no

bubble is forever. When mortgage rates started going up and house prices

started falling, the mortgage holders (especially the sub-prime group)

could no longer pay back the loan.

Banks in the meantime created sophisticated mortgage-backed

investment products by roping in other financial companies and sold

these products all over the world. The globalized financial market that

needs smoothly running credit lines came to a halt when the average

American mortgage holder couldn’t afford to pay back his loan.

|

Wall Street, US |

This is how the crisis started to unfold.

With no bailout-helping hand extended by the US government, the

financial giant Lehman Brothers collapsed and alarm bells started to

ring all over. Banks have become extra risk averse and stopped giving

loans. Without credit, production lines have come to a stop.

Consumers have become extra cautious with their spending and demand

for products and a service is dwindling. Everything is spiralling

downward dragging the world economy into the worst recession since World

War II.

The US created the crisis and exported to the rest of the world.

Paradoxically, excessive consumption in the US kept the world economy

going. As the US economy contracts, it drags the rest of the world with

it.

Exports of Asian countries are falling at alarming rates. Singapore’s

non-oil exports fell by 35% in January 2009 and similar numbers are

coming from other parts of Asia. In the fourth quarter of 2008 Japan’s

gross domestic product contracted by an annualised rate of 12.7%,

Taiwan’s by more than 8%. Euro zone is in deep trouble too.

Just imagine the unemployment that this contraction is going to

create. Although less developed countries are not directly affected by

the financial crisis they will also suffer from the fallout effect.

Unemployed foreign workers in developed countries will return in

droves and with that the money they repatriated to home countries will

dwindle.

So what is the solution?

Keynesian economics, once discredited by the Chicago school of

economics and its ardent adherents Ronald Regan and Margaret Thatcher,

has come to surface again.

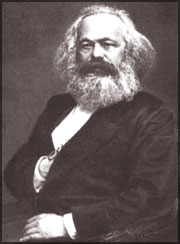

|

Karl Marx |

Keynes recognized that there is no mechanism within the free market

capitalism to recover on its own quickly; self-recovery would be a

protracted painful experience. So he recommended fiscal policy.

Governments of all affected countries have come up with massive

stimulus packages. Unfortunately how successful these would depend on

how quickly the US economy is going to recover. If protectionism creeps

in again the world is in for a protracted deep recession.

Stimulus packages are a quick fix to the problem. But the current

crisis should alert us to look into the deeper side of the problem.

We all know by now how the greed of few individuals in the financial

business threw all of us into the deep end.

More than US$18 billion paid as bonuses to few financial CEOs in the

US just over a year has stirred up the Obama administration. Some even

ask what these financial tycoons have created to deserve such payments.

Nobody seems to be bothered by the riches of Bill Gates because he has

created something real. But as for these financial tycoons people

question, “what real have they created to deserve those bonuses?”

Although socialism, at least the way it was implemented, proved to be

a failure, we can still learn from Marx’s analysis of capitalism. Marx

said cycles are an integral part of capitalism; boom creates conditions

for contraction, bust creates conditions for recovery.

Free market economists ignored this altogether and looked for causes

of crises elsewhere. After the recovery, with fiscal interventions or

otherwise, everyone forgets about the previous crisis and let unbridled

capitalism reign again until the next crisis hits without a warning.

This, by no means, explains that we should replace capitalism with

socialism. It was capitalism, despite the inequalities it creates, that

lifted up masses out of poverty around the world, not socialism.

But the current crisis is a stark reminder of what capitalism in a

globalized world could do to us in the absence of proper checks and

balances.

It is the responsibility of economists to re-examine and re-workout

their theoretical toolkit to provide guildlines for policymakers in

formulating regulatory mechanisms that do not hinder private initiative

and propel the market economy in the right direction.

As Keynes said “The ideas of economists and political philosophers,

both when they are right and when they are wrong, are more powerful than

is commonly understood.

Indeed, the world is ruled by little else. Practical men, who believe

themselves to be quite exempt from any intellectual influences, are

usually the slaves of some defunct economist.” |