CSE resilient despite world decline

Market Capitalisation is Rs. 7 billion:

Hiran H. SENEWIRATNE

Sri Lanka’s value of the stock market has dropped by 34 per cent,

which is possibly one of the least affected stock markets in the world,

Director General Securities and Exchange Commission (SEC) Channa De

Silva said. Sri Lanka’s value of the stock market has dropped by 34 per cent,

which is possibly one of the least affected stock markets in the world,

Director General Securities and Exchange Commission (SEC) Channa De

Silva said.

|

|

CSE

Director General Channa de Silva

- Picture by Saliya Rupasinghe. |

“Therefore, with the total value of the market capitalisation of the

Colombo Stock Exchange (CSE) is around Rs 7 billion. In that scenario,

Sri Lanka was one of the least affected countries in Asia and perhaps in

the world,” De Silva told the Daily News Business.

He said from the global stand point, 39 countries, major stock

markets to date has erased in excess of 50 per cent of its value.

Therefore, in the Asian region Vietnam leads the drop a 65 per cent

decline, China 64 per cent, Hong Kong 54 per cent, India 58 per cent,

Singapore 52 per cent, Taiwan 50 per cent are some of them. Further, in

Europe 24 stock exchanges have fallen in excess of 50 per cent and

Iceland Stock Market has wiped out almost 90 per cent, while Bulgaria

and Ukraine has wiped out 75 per cent of their value of the Stock

Exchange due to the acute global financial crisis.

De Silva said one reason being Sri Lanka to have a least effect is

that the Sri Lankan economy did not have a bubble effect where the

market did not balloon as a result of this.

“Further, our decline was also limited as there was an optimism for

peace will also dawn in the country. Thereby economic expectations

flourished anticipating of inflow of foreign direct investments

received. With all that the industrial sector and the Diaspora also gave

a tremendous boost for the Sri Lankan economy” he said.

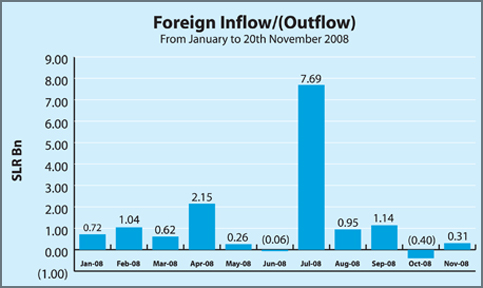

He also said that in November despite the global collapse, Sri

Lanka’s net foreign flow was Rs 310 million at the CSE.

He said that at present there is a Rs. 14 billion net foreign inflow

to the country and only months of June and October we realise net

foreign outflow which has not had a major impact the country. The

Director General said that John Keells Holdings Buy Back Offer at Rs 90

per share continued foreign surrender to shares of JKH has not lost

confidence of foreign and even local investors in the CSE. This resulted

in net foreign outflow of Rs 39 million.

With these developments relatively comforting factors like the drop

in oil prices also help to control the high inflationary pressure in the

country in the future.

Therefore, in the medium term it will facilitate the growth of the

stock market, he said.

|