|

Business Tea Report

Seasonal and brighter teas in high demand

Bartleets Weekly Tea Surveillance up to February 19:

|

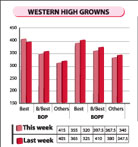

Better Western BOP’s appreciated by Rs. 5-10 and more on select

invoices following special inquiry. Others declined particularly

the thin liquoring varieties. In the below best category few

clean leaf coloury teas appreciated Rs. 5 selectively others

were barely steady. Selected BOPF’s in the western region

appreciated by Rs. 10-15 and more following special inquiry

others declined upto Rs. 15. Below best and plainer sorts which

were Rs. 10-15 lower at the commencement declined further by Rs.

25 per Kg.

|

|

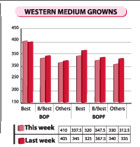

Medium BOP’s were irregular and barely steady whilst the BOPF’s

lost Rs. 15 per Kg and more by the close. |

|

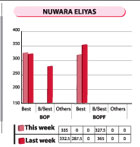

Nuwara Eliya BOPs appreciated by Rs. 5-10 per Kg whilst BOPF’s

declined upto Rs. 40 per Kg. |

|

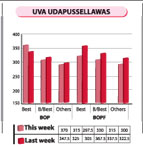

Udapussellawa BOP’s appreciated by Rs. 5-10 per Kg. Select best

clean leaf coloury Uva’s were firm to marginally dearer all

others declined by Rs. 5-15 per Kg. Udapussellawa BOPF’s lost Rs.

10-15 per Kg whilst the Uva’s lost by a similar margin. However

progressively declined further upto Rs. 25 per Kg. |

|

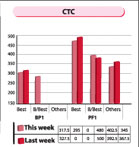

Poor demand. BP1s lost by Rs. 5-10 per Kg whilst the low growns

lost by Rs. 10-15 per Kg. PF1s continued to follow a similar

trend, however progressively lost upto Rs. 25-20 per Kg. |

The quantity of tea arriving at the Colombo Auction this week

increased to 6.800 mkg from 6.466 mkg traded in the previous sale. The

Ex-estate crops too have increased to 0.856 mkg from 0.755 mkg.

Market segments: In the Ex Estate segment, seasonal teas and brighter

teas were in demand and sought after by Japan and the UK. The immediate

impact of the Kenyan crisis is set to ease-off somewhat and lead to a

normalization of the prices for most varieties in the upcoming sales.

However, the brighter teas will not be affected. Meanwhile plainer

varieties too are witnessing an overall lower demand. In the Tippy

market segment, lower demand was witnessed for most types with buyers

from Iran and CIS playing a very selective role at the sale whilst

Turkey and Saudi Arabia maintained a moderate buying pattern.

In the Leafy-grade segment, the market showed an improvement with the

Best OP, OPAs and Pekoes in particular meeting with strong demand. The

bottom teas too had a higher demand with most of the shippers to Iraq

being active. With the offerings of the future sales maintaining a

figure of approximately 6 mkg most local buyers have confirmed their

orders with their foreign counterparts.

Crop Analysis: Total tea production in January topped 26.277 mkg as

against 21.301 mkgs in the corresponding month of 2007. Whilst the CTC

teas experienced a net fall in production, the Orthodox teas gained by a

healthy 26.33 per cent, year-on-year. Elevation-wise, production was

significantly higher all round with the High-grown teas gaining by 22.8

per cent, the Medium-grown crops by 53 percent and the Low-gown by 18.25

per cent.

Supply analysis: According to industry sources, Sri Lankan tea prices

are anticipated to stay strong in 2008 due to international supply

disruptions caused by the violence in Kenya which may have long-term

repercussion as thousands of Kenyan tea estate workers are said to have

fled their lands due to fear of tribal violence.

The first quarter of the year will reflect this trend impacting on

global supply whilst long term repercussions will unfold in the second

quarter and third quarter of the year. Commentators have also noted that

out of the 304 mkg of tea manufactured per annum, almost 300 mkgs is

being exported overseas, representing over 90 per cent of the

production.

As this is a low import input industry which can demand a BOI status

just like any garment factory it should be extended BOI concessions and

facilities that will help to drive exports to $2 billion by 2017 and

firmly establish the island as the worlds’ favourite tea source.

Demand analysis: From the demand perspective, the forecast is of

rising demand from consumers in oil-rich countries who have started to

enjoy a higher standard of living in recent years from the increased oil

wealth. This will serve to boost Sri Lankan tea according to most sector

analysts.

Another market filled with promise in 2008 is to be found in China

where the impact of a number of promotional activities has appeared to

have had an impressive impact as exports have grown by 65 per cent. All

the more remarkable when considering that the Chinese are essentially

green tea and Oolong tea drinkers.

However, since 2003 black tea consumption has grown from 172 tonnes

to 880 metric tonnes up to November 2007. The islands tea also enjoys a

preferential tariff rate of 7.5 per cent under the APTA as against the

general tariff of 15 per cent. Currently, there are 35 tea exporters to

China as compared to 26 in 2006.

Trade Data: External trade performance for 2007 indicated a

relatively moderate growth of 5.6 per cent with a trade deficit of US$

3560 million. Exports had recorded a growth of 12.5 per cent for the

entire year amounting to US$ 7740.5 whilst tea had been the largest

contributor in the agricultural sector amounting to 16.3 percent growth.

However, according to the Plantation Ministry, the past three years

had witnessed a gradual decrease in production from 317 mkg in 2005 to

310 mkgs in 2006 and 305 mkg last year.

The main reasons for the drop have been given with reference to

climatic changes, soil erosion, increase in cost of production, lack of

re-plantation and labour unrest.

Meanwhile, according to some research a five percent drop in the use

of fertiliser can have a foreign exchange earning loss of Rs. 2.8

billion for Sri Lanka.

Yet, performing against all odds, the tea industry demonstrated a

record performance in 2007 reporting an export growth of 22 per cent to

reach a magical number of Rs. 112 billion, where as the revenue had

increased by nearly 42 per cent year-on-year.

Company news: As Coca-Cola is diversifying beyond carbonated

beverages it has agreed to pay $43 million for a 40 per cent stake in

Honest Tea Inc. Sources claim that it is also looking to buy the rest of

the company following a three year period. The strategy is aimed at

improving Coca-Cola’s stake in the beverage market and winning back

consumers who have cut back on sugary sodas.

Stocks/Currency: The positive market forecasts in the industry has

served to revive the plantation stocks that surged early this week

helping to prop-up the ASPI and MPI. The charge was led by Madulsima

plantations on Monday which shot up 4.75 rupees or 42 percent to 16.75

rupees.

With reference to the weekly surveillance of the 19 plantation

stocks, 18 were high in value whilst one reported static. Madulsima,

Horana and Bogawanthalawa witnessed a significant gain of 51, 36 and 30

percent respectively week on week. The dollar traded at between Rs.

107.85 and Rs. 107.86.

|