Prudent fiscal policy, management

Prudent fiscal policy and management by the

Central Bank of Sri Lanka and the Treasury have enabled the reduction of

the overall national debt in the five year period from 2005 to 2010.

The Gross Domestic Product, which has also

been a steady 6 percent and above from 2005 to 2010 and highest at 8

percent in 2010, has risen higher in relation to the rises in the

national debt which has reduced the national debt.

The interest rates have also declined

sharply, resulting in the cost of debt of Government borrowings

considerably.

Here, Central Bank Deputy Governor Dharma

Dheerasinghe speaks to Daily News about the statistics of the reductions

of individual components of the national debt and the strategies adopted

to achieve them.

|

|

Dharma

Dheerasinghe |

The Government debt as a percentage of GDP declined to 81.9 percent

in 2010 from 86.2 percent in the previous year due to improvements in

fiscal operations.

Higher revenue collection which reduced the borrowing requirement,

the reduction in the discount factor (which is the net difference in the

book value and the face value of issues and maturities of Treasury bills

and Treasury bonds) as a result of declining yield rates in government

securities and the appreciation of the rupee vis-à-vis major foreign

currencies, as well as higher economic growth contributed to the

reduction in the debt to GDP ratio.

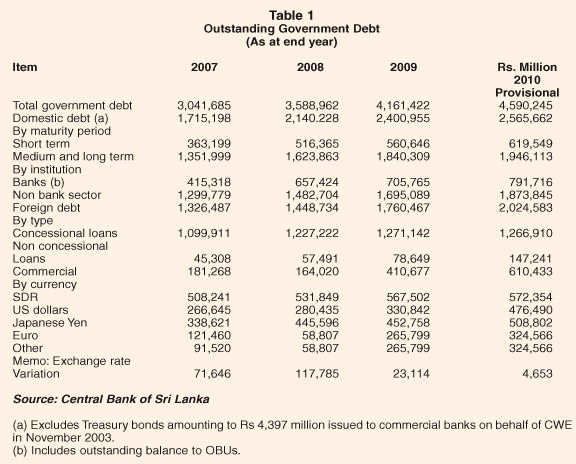

In nominal terms, the total outstanding government debt increased by

10.3 per cent to Rs 4,590 billion as at end 2010.

As a percentage of GDP domestic debt declined significantly to 45.8

percent of GDP in 2010 from 49.8 percent of GDP in 2009, while foreign

debt declined to 36.1 percent of GDP in 2010 from 36.5 percent of GDP in

the previous year.

The share of domestic debt in total government debt declined further

in 2010 to 56 percent from 58 per cent in 2009. Repayment of high cost

domestic borrowings with the proceeds of the international sovereign

bond and the increase in availability of foreign funds reduced the share

of domestic debt in the total debt stock.

The share of medium to long term debt to total domestic debt stock

declined marginally to 76 percent in 2010 from 77 percent in the

previous year, while 84 percent of medium to long term domestic debt

comprised Treasury bonds. The share of Treasury bills in short term

debt, increased to 83 percent in 2010 from 79 per cent in the previous

year.

The outstanding stock of Rupee loans continued to decline to Rs 88

billion in 2010 from Rs 112 billion in 2009, due to the repayment and

non issuance of Rupee loans during the year, as the debt management

strategy has been to move towards more market oriented debt instruments.

Reflecting the increasing reliance on non-bank borrowings, the

outstanding debt held by the non bank sector increased by 10.5 per cent

to Rs 1,873.8 billion in 2010.

Accordingly, the outstanding stock of Treasury bills and Treasury

bonds held by the non bank sector increased by 19.5 per cent and 12 per

cent, respectively, in 2010. The EPF and NSB continued to be the major

investors in government securities, accounting for 46 percent and 15

percent, respectively of the outstanding debt stock held by the non bank

sector.

The outstanding debt obligations of the government to the domestic

banking system declined by 2 percent to Rs 691.7 billion in 2010. The

outstanding debt held by the Central Bank declined by Rs 31.2 billion to

Rs 78.4 billion, while outstanding government debt held by commercial

banks increased by Rs 17.2 billion to Rs 613.3 billion in 2010.

Consequently, the share of banking sector debt in the total domestic

debt stock declined to 27 percent in 2010 from 29 percent in 2009.

Retirement of the Central Bank's holdings of Treasury bills reduced

the government debt outstanding to the Central Bank. While, Treasury

bill holdings of commercial banks increased by Rs 60 billion to Rs 220

billion, Treasury bond holdings of the commercial banks declined by Rs

26 billion to Rs 162 billion, reflecting the appetite of investors for

short term instruments.

Further, other outstanding government debt held by commercial banks

declined to Rs 230.8 billion in 2010 from Rs 247.5 billion in 2009.

Although there was an increase in foreign currency denominated

domestic debt in US dollar terms, the rupee value of these debts

declined marginally due to the appreciation of the Sri Lanka rupee

against the US dollar.

The outstanding domestic debt denominated in foreign currency

declined to Rs 190.5 billion (US dollars 1,717 million) by end 2010 from

Rs 191.8 billion (US dollars 1,676 million) at end 2009.

This comprised outstanding OBU borrowings of Rs 16.6 billion (US

dollars 150 million) and SLDBs amounting to Rs 173.9 billion (US dollars

1,567 million).

Total outstanding foreign debt increased by 15 percent to Rs 2,024.6

billion in 2010, although as a percentage of GDP it declined to 36.1 per

cent in 2010 from 36.5 per cent in 2009.

The share of concessional debt in the total foreign debt stock

declined further to 63 percent in 2010 from 72 percent in 2009 as a

result of a marginal decline in concessional borrowing together with an

increase in non concessional financing in 2010.

Non concessional debt increased by 55 percent to Rs 758 billion,

raising the share of non concessional debt in the total foreign debt

stock to 37 per cent at end 2010 from 28 per cent at end 2009. The

increase in non concessional debt was mainly due to higher foreign

commercial borrowing, which increased by 49 per cent to Rs 610 billion

in 2010.

The gradual move of Sri Lanka towards middle income country status

reduced the availability of concessional foreign financing. The gradual move of Sri Lanka towards middle income country status

reduced the availability of concessional foreign financing.

However, the favourable environment in international financial

markets as well as the improvement in investor confidence enabled the

government to raise funds from non concessional external sources to

finance the overall deficit.

The rupee value of outstanding debt declined by Rs 4.7 billion due to

the impact of the variation in the exchange rate. The rupee value of US

dollar denominated domestic debt (FCBUs and SLDBs) declined as result of

the appreciation of the Sri Lanka rupee vis-à-vis the US dollar by 3.1

percent in 2010. The appreciation of the Sri Lanka rupee against other

currencies, such as the Special Drawing Rights (SDR) and the euro by 4.6

percent and 10.9 percent, respectively in 2010 also contributed to

reduce the outstanding foreign debt stock, since about 59 percent of the

total foreign debt stock is denominated in SDR (28.3 percent), US

dollars (23.5 per cent) and euro (7 per cent).

However, since around 25 per cent of the foreign outstanding debt

stock is denominated in Japanese yen, the depreciation of the Sri Lanka

rupee against the Japanese yen by 8.8 per cent had a negative impact on

the outstanding debt stock.

The improvement in public debt indicators signals a decline in the

future debt burden. The improvement in the fiscal sector, lower interest

rates and the appreciation of the rupee vis-à-vis major foreign

currencies together with the high economic growth reduced the debt to

GDP ratio in 2010.

The debt to GDP ratio in 2010 fell below the targeted level set in

the Medium Term Macro Fiscal Framework of 84 per cent of GDP by 2010.

Continuing the fiscal consolidation process and maintaining a high

economic growth would be required to reduce the outstanding debt stock

to the targeted level of 60 percent by 2016.

Debt service payments

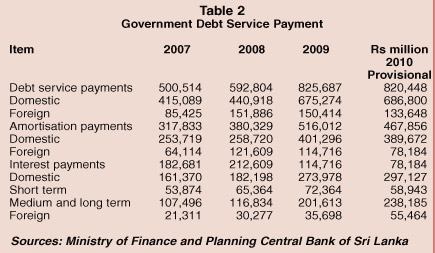

Total debt service payments declined by Rs 5.2 billion to Rs 820.4

billion in 2010 due to lower amortisation payments, as interest payments

increased during the year.

Total amortisation payments, which accounts for 57 percent of total

debt service payments, declined by 9.3 percent to Rs 467.9 billion.

Of the total amortisation payments, Rs 389.7 billion was made to

domestic sources and Rs 78.2 billion to foreign sources, including

deferred repayments on defence loans.

A decline in the maturing debt stock in 2010 and the appreciation of

the rupee, which reduced the rupee value of foreign debt repayments,

mainly contributed to the decline in amortisation payments to external

sources. Total interest payments increased by 13.9 percent to Rs 352.6

billion in 2010. A decline in the maturing debt stock in 2010 and the appreciation of

the rupee, which reduced the rupee value of foreign debt repayments,

mainly contributed to the decline in amortisation payments to external

sources. Total interest payments increased by 13.9 percent to Rs 352.6

billion in 2010.

Although domestic interest payments increased by 8.4 percent over the

last year, this was well below the 50.4 percent increase in interest

payments recorded in the previous year.

The main reason for the lower growth in domestic interest payments in

2010 compared to 2009 was the declining yield rates on government

securities in 2010.

Interest payments on foreign debt increased by 55.4 percent, mainly

due the increase in non concessional foreign borrowings.

Debt indicators improved in 2010 reversing the unfavourable trend

recorded in the previous year. The ratio of debt service payments to

revenue declined to 100.3 percent from 118 percent in 2009 with the

increase in revenue collection and the decline in debt servicing costs.

The higher GDP growth in 2010 together with the decline in debt

servicing costs contributed to the decline in the total debt service to

GDP ratio to 14.6 per cent in 2010 from 17.1 per cent in 2009.

Total interest payments to GDP also declined to 6.3 percent in 2010

from 6.4 percent in 2009. Further, the ratio of foreign debt to earnings

from the export of goods and services declined to 166.4 percent in 2010

from 170.7 percent in 2009 due to higher export growth in 2010.

- Compiled by Ravi Ladduwahetty

|