Revitalizing the Japanese economy

Samangie Wettimuny

On March,11 Japan will mark the first

anniversary of 3/11 catastrophe. Here are excerpts from an interview

with Prof. Shujiro Urata of the Waseda University Graduate School of

Asia Pacific Studies, Japan held at the Foreign Press Centre, Tokyo on

Japanís economic issues, post earthquake economic recovery and the

Economic Partnership Agreements in the Asia Pacific region.

|

Prof. Shujiro Urata |

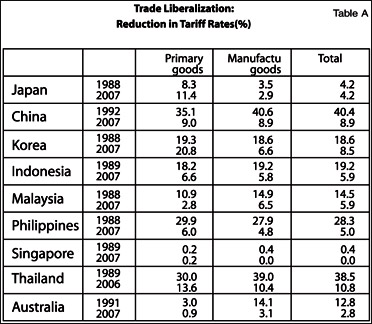

The major economic problems currently faced by Japan are low economic

growth, lack of dynamism, closed economy, declining and ageing

population, declining savings rate and growing huge government debt.

Although the Japanese economy is opening up in the recent years, still

it is largely a closed one. When considering the GDP growth rates in the

recent years, it is evident that Japanís GDP growth rate is below the

world average and below the US. Chinaís economic growth is phenomenal.

(See Graph 1) When compared to the US and China in terms of nominal GDP,

Japan was surpassed by China in 2010. Japan is number 3 in terms of

economic size after US and China. (See Graph 2)

The Japanese economy was hard hit by 3/11 disaster when the country

was affected by a massive tsunami, earthquake and nuclear radiation

leakage. However the countryís economy has not been doing quite well all

these years. As Prof. Urata said when the country was hit by the Asian

Financial Crisis in 1997-1998, the countryís economy was not only hit by

the crisis alone, but also by the increase of consumption tax that led

to deterioration in the Japanese economic performance. Currently there

are discussions on tax and social security issues and the government is

trying to raise the consumption tax. As the opponents argue the earlier

1997 experience has set a good lesson to the government not to increase

the taxes at a critical moment like this.

2008/2009 global Financial Crisis

At the time 2008/09 financial crisis initially hit the US and the

European economies, the East Asian countries including Japan were

confident that they wonít be affected as their economies were quite

stable. But the negative impacts were soon felt by the East Asian

economies mainly as a result of deduction of exports to the USA and

other European countries. In fact that led to substantial reduction in

Japanís growth rate.

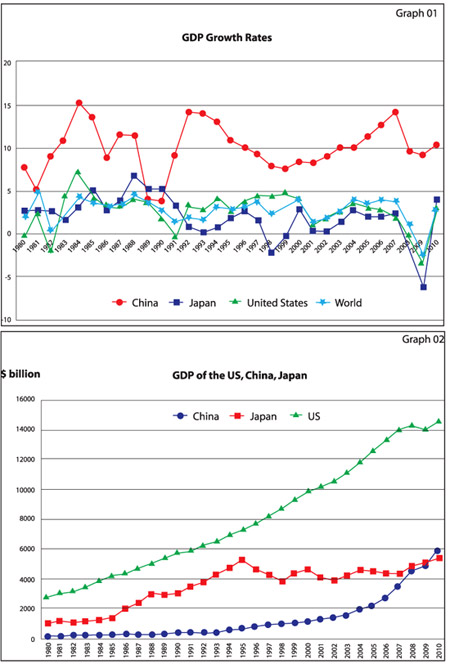

Even when firm entry and exit rates are taken into consideration, it

is evident that the Japanese economy is stagnant when compared to that

of US. In the US both rates are quite high compared to those in Japan.

That means new dynamic challenging firms enter the market, and others

exiting it which leads to more dynamism. But such dynamism cannot be

observed in the Japanese economy in the recent years. (See Graph 3)

Trade - GDP ratios and FDI-GDP ratios show the openness of the

economy and as the Graph 4 shows in terms of Trade-GDP ratios Japan and

US are relatively close compared to the world average and particularly

when compared with China FDI-GDP ratio, Japan is the lowest. That is one

of the reasons for the lack of dynamism in the Japanese economy.

Japanís population started to decline in 2007. In terms of

composition of population, those aged between 15 - 64 are labeled as the

labour force and that itself started to decline from the 1990ís (1995)

and the percentage of ageing population is on the rise. The three

fundamental supply side partners needed for economic growth are increase

in labour input, increase in capital input and increase in productivity.

Here in Japan the labour inputs are declining, so unless Japan opens up

the labour market for foreign workers or immigrants, economic growth

cannot be expected from labour inputs.

Capital inputs Capital inputs

In Japan Gross Domestic Savings (savings by domestic, government and

corporate sector) are also declining. Therefore, unless we successfully

attract foreign investment, the possibility of achieving economic growth

by increasing the capital inputs is not so likely. Hence to achieve

economic growth or maintain this living standard, it is necessary to

increase productivity.

When looking at the economic growth from the demand side,

consumption, investment, expenditure, exports-imports are taken into

account. Here what should be emphasized is that we cannot expect

government expenditure to push the economy forward as there is very

limited room for government expenditure to be increased due to huge

government debt. Government debt-GDP ratio keeps on increasing resulting

from huge government expenditure - mainly due to socially security

payments and particularly due to the 3/11 disaster. Hence the future

prospects concerning government debt-GDP ratios are not so bright.

Revitalization

ďNow giving all the problems that Japan is faced with how can we

revitalize the Japanese economy? One key element here is increasing

productivity. Unless we are successful in increasing productivity we

cannot achieve economic growth that we hope to achieve. And there are a

number of policies that the Japanese government can adhere to, to

improve the productivity and out of them opening up the Japanese economy

is a very important policy which could achieve this goal including

productivity.Ē

The role of FTAs

The DOHA development agenda under the WTO is not going anywhere. In

such a situation what could be done is opening up the economy

unilaterally, but that too is not quite easy. Hence the second best

alternative is Free Trade Agreements (FTAs) - the agreements which

eliminate tariff between the member countries. It is obviously

beneficial to Japan to enter into FTAs with Asian countries, especially

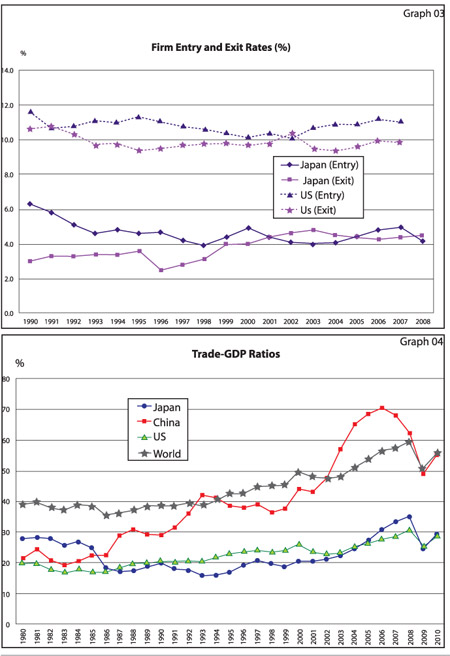

with East Asia. In recent years East Asian countries (including

developing countries) such as Japan, China, Korea, Indonesia, Malaysia,

Philippines, Singapore, Thailand and Australia experienced substantial

trade liberalization. (See Table A) For example Chinaís average tariff

rate in 1992 was as high as 40 %, but came down to 8.9% by 2007.China

entered WTO in 2001 and that of course was an important reason for

Chinaís reduction in tariff rates.However there are still high tariff

barriers, particularly for some sensitive industries. In the case of

China all the sectors still have very high tariff rates.

Although the tariff rate for Japan is quite low already, for some

agricultural products tariff rates are extremely high. The condition

shows that there is still room for further trade liberalization. As

Prof. Urata emphasized even for FDI liberalization the situation is

quite the same. Given different situations further trade and FDI

liberalization would lead to expansion of trade and investment which in

turn lead to economic growth. That is the way that world and Japan

should follow.

The special characteristics of Japanís FTAs are trade and FDI

liberalization, facilitation, economic cooperation and improvement of

business environment (improving customer procedure- simplifying

documentation of customer procedure and so on.) Characteristics such as

economic cooperation are very important when establishing FTAs with

developing countries. Also Japanís business is very keen on having some

content which deal with business environment and particularly Japan and

Mexico FTAs exclusively deal with this improvement in business

environment and they were successful. The special characteristics of Japanís FTAs are trade and FDI

liberalization, facilitation, economic cooperation and improvement of

business environment (improving customer procedure- simplifying

documentation of customer procedure and so on.) Characteristics such as

economic cooperation are very important when establishing FTAs with

developing countries. Also Japanís business is very keen on having some

content which deal with business environment and particularly Japan and

Mexico FTAs exclusively deal with this improvement in business

environment and they were successful.

The motives behind Japanís FTA s which are also common with other

countries are to expand export market for Japanese firms, improve

investment environment for Japanese firms, obtain energy and natural

resources, promote structural reforms in Japan (in the field of

agriculture), improve and establish good relationship with other

countries and to provide economic assistance to developing countries.

External pressure is necessary to promote domestic reforms.

Impact of FTAs

A major short run effect is the trade and Foreign Direct Investment (FDI)

expansion between and among FTA members. It is important to know that

the short term impacts of FTAs such as reduced production and employment

could be negative. The expansion of imports will replace domestic

production and reduce local employment opportunities. That is why there

is a great deal of opposition to the FTAs, especially from sectors such

as agriculture. Various measures including gradual phase in

liberalization, temporary assistance to negatively affected workers,

structural reform and other policy measures can moderate the negative

impacts during the transition period.

However economic growth is a major medium to short run effect of the

FTAs. Great impacts can be expected from FTAs which have comprehensive

components such as facilitation and economic cooperation. The larger the

membership the greater the impact of the FTAs.

As Prof. Urata finally noted East Asiaís rapid economic growth has

been attributable to rapid expansion of trade and FDI, which in turn

resulted from trade and FDI liberalization. To achieve further economic

growth, further trade and FDI liberalization and facilitation would be

effective. Region wide FTA should be established: EAFTA (medium level),

CEPEA (medium level), TPP (high level FTA), and gradual liberalization

should be pursued, Then it is necessary to expand it or merge with other

FTAs to lead to global trade liberalization. FTAs can also be

established with the rest of world Ė with the US, the EU and Latin

American countries. Japan should lead CEPEA and join TPP. Japan has

shown interest in joining the TPP negotiation and is currently

conducting talks with the negotiating members.

[email protected]

|