Market rally fails to gather momentum

CB allows for margin credit by foreign firms:

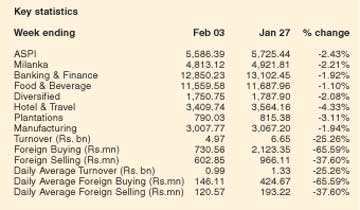

The ASPI declined 139.05 points over the week and the MPI declined

108.69 points, representing week-on week declines of 2.43% and 2.21%

respectively. The ASPI closed at 5586.39 points and the MPI closed at

4813.12 points.

Among the highest contributors to weekly turnover value were Acme,

JKH and National Development Bank Plc which accounted for 33.53% of

total market turnover.

Turnover value recorded a week-on-week decline of 25.26% amounting to

Rs 4.97 billion as against last week’s value of Rs 6.65 billion.

Average weekly turnover was Rs 1.00 billion relative to Rs 1.33

billion recorded the previous week. Market Capitalization declined by

2.42% to Rs 2045.03 billion.

The Banking and Finance sector continued to dominate the week’s

turnover value, contributing 35.63% (Rs 1769.53 million) to the market’s

total turnover value.

The Manufacturing sector accounted for 25.28% of turnover value or Rs

1255.58 million and the Diversified sector contributed Rs 581.50 million

or 11.71% of turnover value.

The Banking and Finance sector yet again led the weekly turnover

volume, accounting for 26.94% (or 52.88 million shares) of the market’s

total share volume. The Manufacturing sector trailed behind closely,

contributing 24.18% to turnover volume with 47.46 million shares

changing hands. The third highest contributor to the weekly turnover

volume was the Investment Trust sector contributing 19.09% or 37.46

million shares.

Swarnamahal Financial Services continued to lead the price gainers

list for the week, gaining 27.53% to close at Rs 157.50. Autodrome Plc

gained 21.80% to close the week at Rs 975.60 relative to last week’s Rs

801.00. Udapussellawa Plantations meanwhile closed at Rs 32.00,

representing a 17.22% gain, while Union Chemicals Lanka Plc and Chemanex

Plc were also amongst the top gainers with price increases of 13.85% and

13.44% respectively.

The top price losers for the week was led by Good Hope Plc which

declined 28.12% to close the week at Rs 1186.00 compared to last week’s

closing price of Rs 1650.00. Miramar Beach Hotel Plc closed the week at

Rs 160.00 down 19.40%, while Madulsima Plantations Plc closed at Rs

13.70 representing a week-on-week decline of 17.96%.

For the second consecutive week, the bourse recorded a net buying

position totaling Rs 127.71 million; this nevertheless, represented an

88.96% decline from last week’s net buying position of Rs 1.16 billion.

Total foreign purchases over the week declined 65.59% to Rs 730.56

million compared to last week’s Rs 2.12 billion. The daily average net

buying position amounted to Rs 25.54 million over the week.

Acme Printing and Packaging Plc topped the volume list, accounting

for 14.82% or 29.10 million shares of the week’s aggregate share volume.

Asia Asset Finance Ltd contributed 6.53% (12.82 million shares) of the

market’s total share volume.

Point of view

Last week’s rally failed to gather momentum as strategic stakes in

blue-chip counters failed to outweigh profit-taking by retailers on

speculative shares. Turnover levels hovered around the 1 billion mark

through the week, just over 1 billion (1.4 billion) on Monday but down

to 0.4 billion by Friday’s shortened trading day. We expect markets to

remain subdued in the shortened week ahead.

Policy rates which have been held steady since January 2011 were

raised this week by 50 bps each, bringing the Repo Rate to 7.50% and the

Reverse Repo Rate to 9.0%.

The move comes amid continued moderation in inflation levels (Jan

2012 inflation was 3.8% Y-o-Y down from 4.9% in December). However,

higher-than-expected credit growth to the private sector (34.5% Y-o-Y in

December 2011) coupled with liquidity shortages in money markets have

compelled the interest rate corridor to be raised.

The Central Bank also imposed a credit ceiling on banks while

providing a boost to the bourse by allowing for foreign firms to provide

margin credit. |