Natural rubber producers and consumers

Dr N Yogaratnam

Natural rubber (NR) is an inseparable part of most rubber -based

products like tyres and gloves. The tyre and other rubber based

industries are currently reeling under the impact of high natural rubber

prices.

Although, tight supply and growing demand for NR is here to stay on

the long run, the need of the hour is to evolve well balanced strategies

that are mutually beneficial for the growers and consumers so as to

ensure the healthy growth of the industry as a whole.

|

A rubber tapper at work |

NR production in key growing countries may miss estimates this year

as supplies from Indonesia and Philippines is slow, according to the

Association of Natural Rubber Producing Countries (ANRPC).

Output from member countries, representing 92 percent of global

supply, may expand 4.9 percent to 9.94 million metric tons this year,

less than the 5.8 percent gain forecast last month. Production last year

was 10.03 million tons.

Lower supplies may help stem a 26 percent slide in rubber futures

from a record 535.7 yen a kilogram reached on Feb. 18 and potentially

increasing costs for companies such as Bridgestone Corp., Michelin & Cie.

and Goodyear Tire & Rubber Co., the top three tyre makers.

The slowdown in natural rubber supply and the weakening of the

Japanese yen have contributed to hold the price from falling further.

Natural rubber prices are likely to stay fragile until global economy

returns to a clear recovery path and the demand gains momentum.

October-delivery contract on May 26, rose 2.7 percent to settle at

396.1 yen a kilogram ($4,836 a ton) on the Tokyo Commodity Exchange.

Prices have gained about 40 percent in the past year.

Production may increase 5.8 percent by end June, less than the 10.5

percent increase estimated last month, the group said. Supply jumped

10.1 percent in the first three months of the year.

Persistent rains

Persistent rains in southern Thailand, the biggest grower, have

disrupted tapping, slowing the resumption of the rubber harvest after

the traditional February-to-May low-production season.

Production in Indonesia, the world’s second-biggest grower, may be

2.89 million tons, 2.7 percent less than the April forecast of 2.97

million tons, the ANRPC says.

Exports from key producers may grow 3.2 percent this year to 7.71

million tons. Imports are expected to expand in China and Malaysia in

the second quarter and may decline in India.

Demand from China, the largest importer, may jump 27.5 percent in the

April-June period from a “low volume” in the year earlier. China’s

rubber imports are predicted to total 245,000 tons in May and 235,000

tons in June, compared with 261,000 tons in April.

Imports of natural rubber by Malaysia in the second quarter may surge

23 percent, while purchases may tumble 43.1 percent in India, says the

ANRPC.

NR price rise effects

Currently, global NR prices are in the region of US$ 5.50 to 6.00 /

Metric Ton and Synthetic rubber prices are trading at record levels of

US$ 3500 to 4000 / Ton. NR prices are, however, expected to stabilize

around US$ 4.50 to 5.00 by end 2011.

Global NR latex consumption

Global NR latex consumption was 1.2 million tonnes in 2010, 9 percent

lower than in 2009. Across the major latex consumers, Chinese, Malaysian

and Indian consumption dropped by 9.9 percent, 4 percent and 2.4 percent

respectively in 2010, driven by rising NR latex prices, reports IRSG.

|

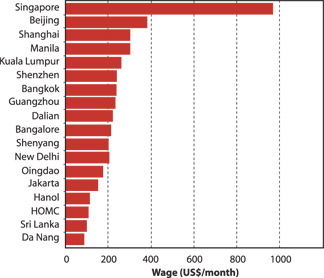

(Source;JETRO, January2010, except Sri Lanka) |

Global NR latex production was 0.97 million tonnes in 2010, 5 percent

lower than the previous year. Malaysian, Thai and Indian production

dropped by 15 percent, 6 percent and 1 percent respectively while

Chinese production was flat in 2010 compared to the previous year.

The growth in NR latex exports was down 8 percent in 2010 to 0.66

million tonnes, while net imports were down by 4 percent. Significant

players in the global NR latex industry, is of late facing unprecedented

challenges at a time when the demand for latex-based products is on the

rise across the globe, whether be it for gloves, condoms, catheters or a

host of other products like toy balloons and rubber bands.

A major challenge facing the latex consuming industry at present is

the acute shortage of latex concentrate, which is directly linked to the

NR prices.

Tyre Industry

It is known that NR constitutes as much as 50 percent of the cost of

tire production. The NR price increased over 240 percent from the

February 2009.

Extreme weather and aging trees in the key rubber-growing countries

of southeastern Asia are expected to reduce NR production to 10.25

million metric tons this year. Meanwhile, NR consumption is expected to

be around 10.31 million metric tons.

Looking ahead, projected demand of 11.26 million metric tons in 2011

will outpace anticipated production of 11.0 million metric tons.

The bullish NR demand and price outlook is supported by the fact that

inventories of the material, used to make gloves, hose, gaskets, and

condoms as well as motor vehicle tires, are projected to fall to 67 days

of demand in 2011, according to economic analyses.

That’s because of a projected 16.4 percent rise in world automotive

production this year, according to IHS Global Insight, and an 8.5

percent expansion in 2011.

Since this ‘bullish-phase’ in the NR will continue to lag behind

soaring demand for some months to come, tyre makers have had to boost

prices to offset the higher cost of their key raw material.

Global tyre demand exceeding supply

Global tyre demand is expanding at a faster pace than production, led

by growth in China, as vehicle sales are increasing, according to

Sumitomo Rubber Industries Ltd. Tyre sales in China, the world’s largest

auto market, may increase 30 percent this year or at 10 times the global

rate. Sumitomo Rubber, the largest Japanese tyre maker after Bridgestone

Corp., said sales will increase 3.1 percent to 93.7 million tyres this

year.

Rubber prices climbed 38 percent in the past year and reached a

record in February after auto sales in China surged 32 percent in 2010

to an all-time high, surpassing the U.S. market for a second year.

Increasing costs spurred tyre makers from Bridgestone to Akron,

Ohio-based Goodyear Tire & Rubber Co. to raise prices.

Commodities beat stocks, bonds and the dollar for five straight

months through April, prompting central banks from Beijing to Brasilia

to raise interest rates to cool inflation.

|

Natural rubber prices are likely to stay fragile until global

economy returns to a clear recovery path and the demand gains

momentum. |

“Tyre supply and demand is tight globally and particularly in North

America,” says Goldman Sachs Group Inc. Analysts say “In contrast to

many makers that retrenched due to the financial crisis, Bridgestone and

Sumitomo Rubber increased capacity and are benefitting from growth in

demand amid a global supply shortage,”.

Bridgestone shares advanced 24 percent in the past year and traded at

1,825 yen in Tokyo on May 27, while Sumitomo Rubber shares increased 15

percent to 923 yen.

China sales

While auto sales in China reached a record 18 million last year, they

slowed in 2011 as the nation increased retail gasoline and diesel prices

and tightened monetary policy to cool the fastest inflation since 2008.

The government increased interest rates and raised bank reserve-ratio

requirements to curb price gains that have exceeded the government’s

four percent target every month this year. Demand for replacement tyres

is growing in China as car ownership expands.

Sumitomo Rubber, which controls about 6 percent of the global tyre

market, said it can process 46,000 tons of rubber a month this year, up

3.5 percent from last year. The Kobe-based company said that it is

building a plant in Brazil that will have a capacity of 2,200 tons a

month by 2013 and is also expanding production capacity in Thailand and

China.

“Our production capacity is not large enough to meet expanding

demand. The shortage may worsen as global consumption is expected to

grow by 3 percent annually in coming years,” they say.

Tyre demand

Global sales of passenger-car tyres are forecast to grow 6.1 percent

this year from 2010, while sales of commercial- vehicle tyres are

forecast to rise 11 percent, according to IRSG forecast.

Tyre price hikes

Due to increasing raw material prices, Michelin North America Inc. is

increasing prices by an average of 12 percent on Michelin and BFGoodrich

brand replacement commercial truck tyres. The price increase also

includes Michelin Retread Technologies retreads sold in the United

States. The increase will go into effect July 1. This is the second

price increase announced by Michelin this month (see Michelin) will

raise prices in Canada. Michelin joins several other tyre manufacturers

in raising prices due to raw material cost increases.

Consumer

Effective June 1, 2011, Toyo Tire U.S.A. Corp. was expected to

increase the dealer base price on passenger car and light truck tyres up

to an average of 8 percent. Falken Tire Corp. will increase prices up to

8 percent on its consumer tyres effective July 1.

Commercial

Double Coin Holdings Ltd. will raise prices up to 6 percent,

effective June 1, on all Double Coin produced radial truck, OTR, crane

and industrial tires. That includes associate and private brand radial

truck tyres. Falken Tire Corp. was expected to raise commercial truck

tire prices by up to 10 percent effective June 1. Hankook Tire America

Corp. was also expected to raise prices on its commercial tyres,

including Hankook and Aurora, effective June 1. The increases will be up

to 9 percent.

Canada

Yokohama Tyre (Canada) Inc. raised prices on its consumer tyres on

May 1, 2011. According to the company, all pricing on unfilled orders

placed before May 1 “will be re-calculated at the new prices.” The price

increases vary by tyre category: High Performance, 5 percent; Light

Truck, 4 percent; Passenger Touring, 4 percent; winter, 4 percent.

Michelin North America (Canada) Inc. was expected to raise consumer tyre

prices up to 10 percent effective June 1, 2011.

Shift in location

It had been reported that the dominance of Akron, Ohio, USA in the

tyre business in the first three quarters of 20th century was on the

decline and business activity is now shifting to China with a prediction

that, by the end of the decade, as much as 80 percent of world tyre

production would come from there. China attracted most multinationals by

offering them everything they looked for- cheap labour, good quality,

necessary infrastructure and the like.

However, things, as expected, are taking a bad turn of late. China’s

advantages are on the decline. The supply of low -cost labour from

interior parts of the country is declining. At present, Vietnam appears

to be very attractive for future plant location (please see chart 2 ).

In Sri Lanka, plantation sector worker wage is in the region of Rs

10,125 (Rs 405 x 25), equivalent to US$ 92.89 (1 US$= Rs 109). This

appears to be comparable to that in Da Nang city in Vietnam.

Tyre manufacturing even in China is much more dispersed. This is a

feature of all mature industries so the likelihood is that we will not

see Akron’s like again, even in the new China or other developing

countries in the Asian region.

Colombo Auctions

NR prices at the Colombo Auctions have been fluctuating, since the

first week of January, with the historical high of Rs 700 for LC1X grade

on 15/02/2011. The highest price ever recorded for RSS3, the main grade

used in tyre manufacture, had been Rs 730 in the same month. The monthly

average price movements in 2011 as indicated in chart 3, shows that NR

prices are moving around Rs 500 to 600 for the three grades indicated.

Formulating new flexible marketing strategy and to respond accurately

to the changes of the markets should be the medium to long-term concern

of both producers and consumers.

Sri Lanka’s Dipped Products for example says gains from its

plantations helped compensate narrower margins in its rubber gloves

manufacturing business, due to rising NR prices.

In any case, NR prices at the Colombo Auctions are expected to

stabilize around Rs 450 to 500 for LC1X, Rs 400 to 450 for RSS1 and Rs

450 to 500 for RSS3 even after NR supply eases and despite the adverse

fallouts of climate change, high costs of inputs like labour, shortage

of tappers, non-availability of cultivable land etc.

Branding of NR

A brand is a powerful tool in your hands, a visual image that

encapsulates a perceived value associated with our country’s product or

service by customers and potential customers. As competition

intensifies, business should realize the power of branding as an

alluring marketing and sales tool.

In order to create a brand image to the Indian NR, a logo has been

developed and made available to the public. NR exporters who join the

branding scheme are permitted to use the LOGO of the Rubber Board on all

their produce that conform to the relevant standards.

As this logo carries the quality assurance by the Rubber Board, it

commands a strong brand call. It symbolizes a seal of trust on the

quality of natural rubber produced and export from India. Can something

similar to this be evolved for our Sri Lankan Crepe which is a unique

grade? The “Latex Crepe IX”, used by the pharmaceutical, medical and

food ancillary industries has its uniqueness.

The uniqueness of Sri Lanka’s rubber is its whiteness, which cannot

be matched by any other country. This seems to be a clonal,

environmental and processing characteristic.

Sri Lanka ventured overseas with its first attempt at branded rubber

- “Lankaprene”, a premium quality crepe product. The low protein product

was positioned as an alternative to synthetic options that is petroleum

based and so priced higher. Sri Lanka is the only producer of crepe

rubber in the world. Lankaprene was expected to be used for mostly

medical applications and sports goods. Lankaprene was launched in the

United States on a trial basis in April 2004. Since then consignments

have been delivered at 25 percent above regular latex crepe prices, and

producers were gearing up to deliver higher volumes, but its progress

now seems to be unknown even to the Sri Lankan NR industry. A lot has

been said about “Ceylon Tea”; why not we do branding of an equally

unique product, “Ceylon Crepe”, the traditional Ceylon rubber.

|