Risk management and enhancing capacity

D S W Andradi Partner, SJMS Associates

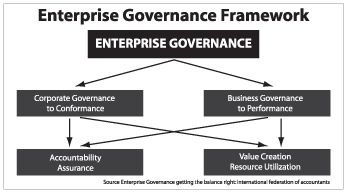

Enterprise Governance Framework

Enterprise Governance

Corporate Governance le Conformance

Accountability Assurance

Business Governance le Performance

Value Creation Resource Utilization

(Source: Enterprise Governance - Getting the Balance Right:

International

Federation of Accountants)

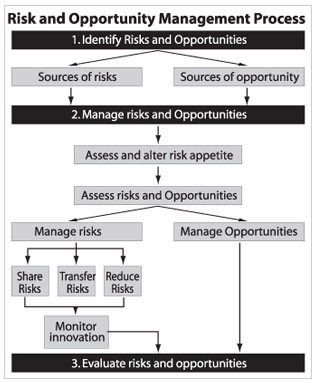

Risk and Opportunity Management Process

1. Identify Risks and Opportunities Sources of Risks Sources of

Opportunity

2. Manage risks and opportunities

Assess and Alter risk appetite

Assess risks and Opportunities

Manage Risks Manage Opportunities

Share Risk Transfer Risk Reduce Risk

Monitor Innovation

3. Evaluate Risks and Opportunities

(Source: Management Accounting Guideline - Managing Opportunities and

Risks Authoured by: Tamara Bekefi, Marc J Epstein and Kristi Yuthas

Published by SMAC, AICPA and CIMA)

Strategic Scorecard

Strategic Position

Strategic Options

Strategic Implementation

Strategic Risks

(Source: Enterprise Governance ‘Getting the Balance Right:

International Federation of Accountants)

CMA Sri Lanka presentation at the 52nd National Cost Convention

organized by the Institute of Cost and Works Accountants of India in

Chennai held from January 4 to 6, 2011

Since the spectacular collapse of the Barings Bank in 1995 there has

been an ever growing interest in risk management. This has been fuelled

by subsequent high profile corporate debacles, as well as natural and

man-made disasters - 9/ 11, Enron, Worldcom, Ahold, Parmalet, the 2004

Tsunami, Hurricane Katrina, Northern Rock and Lehman Brothers, to name a

few. Risk has been viewed, more and more, as something negative - a

hazard, that need to be managed, if not avoided or eliminated altogether

; a value destroyer. Understandably, governments and regulators have

reacted with stringent regulatory initiatives such as the Sarbanes -

Oxley Act 2002, Basel 2 Accord, accounting standards, and numerous codes

of corporate governance.

It is needless to say that hazardous risk - risks which have only a

downside (examples : accidents, corporate fraud, human error, disasters)

need to be managed rigourously, in order to preserve value and to ensure

the sustainability of companies.

Otherwise, companies could lose money. However, it is important not

to focus only on downside risks. Many risks, business risks in

particular (examples: business acquisitions, new products, investments

in technology, innovation) have an upside as well as a downside - a

positive side as well as a negative one. It is the upside of risks,

which provide opportunities for growth and profit. Whilst it is

necessary to manage the downside of such risks, it is also vital that

the upside should be exploited.

After all, risk-taking is the engine that drives business and propels

growth, as suggested by the well-known adage Nothing ventured, nothing

gained: Business enterprise is essentially about taking risks.

Companies, which focus only on the downside of risks, could miss

opportunities, which might have initially appeared too risky, and not

properly analysed. Exploiting the upside of risks , i.e. opportunities,

is at the centre of value creation process. One should be mindful of

opportunities to create value,that could be hidden in risk.

In many instance, risk and opportunity are a duality ; they are like

the two sides of a coin. Accordingly, a risk could present opportunities

for innovation and competitive advantage, which in turn could lead to

short - and long term growth and profitability.

In such instances, ‘risk management provide a window for ‘opportunity

management’, which leads to ‘Risk and Opportunity Management’.

As explained above, focusing exclusively on the downside of risk

could be harmful to the well-being of organizations. Several initiatives

have been taken to remedy this situation. Two somewhat early responses

are : (1) Enterprise Risk Management - Integrated Framework 2004 of the

Committee of Organizations Sponsoring the Treadway Commission (COSO),

and (2) Enterprise Governance - Getting the Balance Right, 2004, of the

International Federation of Accountants (IFAC) and the Chartered

Institute of Management Accountants (CIMA). Both initiatives are

attempts to address risks in a broader and holistic manner, rather than

viewing risk as a mere threat to be avoided.

Enterprise governance

They look at risk in the context of the organizations strategy,

culture, and operations. Of these two initiatives, the Enterprise

Governance approach and methodology has a distinct orientation toward

addressing the much neglected value creating upside risks.

The early responses to corporate failures were mostly in the form of

codes of corporate governance. These codes attempted to seek compliance

with rules and regulations on issues such as board structures, Chairman

and CEO, non - executive directors, executive remuneration, internal

control, and oversight mechanisms ( examples : audit committees,

remuneration committees).

They sought to bring about improved accountability and assurance.

Whilst the philosophy of Enterprise Governance accepts the importance of

corporate governance, it argues that good corporate governance on its

own cannot ensure success: ‘Good corporate governance is a necessary,

but not sufficient, foundation for success.’

Bad corporate governance can ruin a company, but cannot, on its own,

ensure its success (Enterprise Governance - Getting the balance Right: (IFAC)

It goes on to assert that companies must balance conformance with

performance.

Enterprise Governance is defined as ‘the set of responsibilities and

practices exercised by the board and executive management with the goal

of providing strategic direction, ensuring that objectives are achieved,

ascertaining that risks are managed appropriately and verifying that the

organization’s resources are used responsibly’ (Information and Systems

Audit and Control Foundation, 2001).

There are two dimensions to Enterprise Governance, viz conformance

and performance. Conformance is also called ‘Corporate Governance’,

whilst performance is also called ‘Business Governance.’

The performance dimension focuses on strategy, value creation and

resource utilization. It seeks to help the board to make strategic

decisions; understand its risk appetite and key drivers of performance.

Enterprise Governance philosophy recognizes that the performance

dimension cannot be easily subjected to regime of standards and audit.

Hence, it seeks to develop a set of best practice tools and

techniques in performance related areas such as ‘Enterprise Risk

Management’, ‘Acquisition Process’ and ‘Board Performance’.

Unlike in the case of the conformance dimension, the performance

dimension lacks a formal board oversight mechanism. Hence, the IFAC

study on Enterprise Governance has proposed the ‘strategic scorecard’ to

bridge this ‘Oversight Gap’.

The strategic scorecard is neither a detailed strategic plan nor a

substitute for the Balanced Scorecard. It aims at helping the board of

director ensure that all the aspects of the strategic process have been

completed thoroughly. The strategic scorecard has four quadrants -

Strategic Position, Strategic Options, Strategic Risks, and Strategic

Implementations. Thus, risks , in the form of strategic risks, have been

embedded in the performance dimension of enterprise governance , i.e.

business governance..

Risk management and value creation

The need to proactively approach risk - taking, in order to take

advantage of value creating opportunities, should not be underestimated.

Intelligent risk-taking is essential in order to build value; it needs

to be operationalized.

The management accounting guideline titled ‘Managing Opportunities

and Risk’, jointly published by the Society of Management Accountants of

Canada, the American Institute of Certified Public Accountants and the

Chartered Institute of Management Accountants of the UK, provide a

comprehensive and invaluable framework in this area.

The guideline expands the risk assessment model to include

opportunities and innovation, and provides the needed tools and

techniques to capture the positive side of risk, while rigourously

managing its downside impact.

It asserts that ‘an organization may come to see that developing a

greater capacity to identify and mitigate risk allows it to capture

opportunities that the competition cannot.’

It goes on to state, ‘Effective risk management practices and tools

are necessary for companies to seize opportunities and gain competitive

advantage over companies that do not know of these practices and tools,

or cannot effectively implement them’.

It encourages taking a portfolio view in regard to risks as managing

some risks well create the opportunity to take risks in other areas. It

also proposes techniques that organizations can use to alter risk

appetites to capitalize on opportunities.

In addition to following the traditional risk management practices,

the management accounting guideline ‘Managing Opportunities and Risks’

emphasizes the need to (1) Identify and manage opportunities, often

related to innovation, and manage related risks, and (2) Identify and

manage opportunities where others see only unmanageable risks. The risk

and opportunity management process proposed by the guideline has the

following three major phases:

1. Identify risks and opportunities

2. Manage risks and opportunities

3. Evaluate risks and opportunities

The identification of risks and opportunities draws attention to the

following: (A) the sources of risk and opportunities, and (B) strategies

for identifying risks and opportunities.

Some key sources of opportunity are (1) supply chain, (2) product and

service offering, (3) processes, (4) technology, (5) new markets, (6)

customers, (7) political, legal and social forces. The strategies

recommended for identifying risks and opportunities are, (1) Learning

from the past, (2) Developing Customer Sensitivity, (3) Learning from

others, (4) Scanning, (5) Scenario Planning, (6)Seeing the market gaps

and change the game, (7) Developing idealized design and competing in

advance and (8) Developing market sensitivity.

The second phase - ‘managing risks and opportunities’, consists of

the following four steps: (1) Assess and alter risk appetite, (2) Assess

risks and opportunities, (3) Managing risks and (4) Managing

opportunities. Assessing the risk appetite allows an organization to

decide how best to respond to the opportunities and risks it has

recognized.

Risk appetite is the risk exposure, or potential adverse impact from

an event, that an organization is willing to accept without taking

action. It is heavily influenced by the organization’s culture and

changes over time. It should be quantified in monetary terms. Risk

appetites should be defined and agreed upon at least annually; it should

be proposed by the senior management and endorsed by the board of

directors.

Once the risk appetite is assessed, the company should proceed to

assess all major risks and opportunities against it. For this purpose,

it is very important to quantify the risks and opportunities in monetary

terms.

If a risk exposure exceed the risk appetite threshold (also called

risk tolerance), measures could be taken to bring it back within the

accepted level, so that the exposure is in line with the risk appetite.

In the alternative, the risk appetite itself could be altered. A low

risk appetite could result in narrow assessment of risk, which could in

turn result in the rejection of promising opportunities.

If the goal is to capture an opportunity, and the existing risk

appetite is a hurdle, it might be desirable to alter the risk appetite.

This can be done by enhancing the capacity to accept more risk,

thereby shifting the risk appetite threshold. The guideline ‘Managing

Opportunities and Risks’ describes methods of altering risk appetites.

After assessing risks and opportunities, the company could reject

them, or proceed to manage them. The final phase is the evaluation of

risks and opportunities.

Role of the management accountant

Risk and opportunity management calls for expertise in areas such as

strategy, management, finance, management, management information and

control systems, and internal audit.

The management accountant is well placed to play a prominent role in

risk and opportunity management as he or she is skilled in these

disciplines. The management accountant could contribute in the following

activities:

* Establishing guidelines and procedures for strategic planning

around opportunities and risks

* Improving the identification, measurement, and management of risks

and opportunities

* Preparing the evaluation of risks and opportunities

* Integrating the model with other functions such as strategy

* Training managers to make more effective evaluations of risks and

opportunities

* Implementing processes to monitor and communicate business risks

and opportunities.

The IFAC Exposure Draft - ‘How Professional Accountants in Business

Drive Sustainable Organizational Success’ identifies eight drivers of

sustainable organizations, the third driver being ‘Integrated

Governance, Risk and Control’.

Further, the document identifies challenging roles for accountants as

(1) ‘Value Creator’, (2) Value Enabler, (3) Value Preserver, and (4) ‘

Value Reporter’, the first two coming under ‘performance’, whilst the

last two come under ‘conformance’.

The roles of the management accountant in the area of ‘Integrated

Governance, Risk and Control’, as a value creator and a value enabler

are:

(A) As Value Creator - facilitate an understanding of an

organization’s appetite for risk and deliver aligned and effective

governance, risk and control practices to achieve a balance between

conforming with rules and regulations and driving sustainable

organizational success.

(B) As Value Enabler - implement enterprise risk management and

control as a strategic activity and as integral part of an

organization’s governance system, as well as into all other decision -

making processes in the organization.

Role of management accountancy bodies

Risk Management, as a professional discipline, is continuously

expanding at a rapid pace. In view of the role that could be played by

management accountants in this critical area, it is important for

management accountancy bodies to foster the discipline in the following

manner:

* Provide education and training of members and students

* Be a Thought Leader by undertaking research and development in risk

management

* Create general awareness on the subject amongst the business

community, the state, civil society, and other groups of stakeholders.

The Sri Lanka experience

The Sri Lankan economy has been an open economy since its

liberalization in 1977. Accordingly, it has been vulnerable to the

fluctuations in the global economy.

Sri Lanka too has had its share of high profile corporate collapses

during the last decade.

These have been largely due to poor corporate governance.

During the past decade, there has been a growing awareness in risk

management in Sri Lanka. Many public seminars and workshops have been

conducted. The professional accountancy bodies have included risk

management in their syllabi.

On the practical side, it is understood that several blue-chip

companies - both national and multi-national, have formalized risk

management systems in place. However, generally speaking, there is much

room for improvement in this area both in the public and private

sectors.

Hazard risks - risk which only have a downside, should be necessarily

managed, if not eliminated altogether. That is essential in order to

preserve value and ensure the sustainability of companies.

However, risk management should not stop there. From a value creation

perspective, it is vital that risks with upsides as well as downsides

are managed in order capitalize on opportunities.

Further, it should be realised that better risk management systems

enable companies to take on more risks and thereby exploit

opportunities. In other words, sound risk management systems enhance the

capacity to build value.

Management accountants have a vital role to play in the process.

Management accountancy bodies could contribute by supporting members,

students, companies, and other stakeholders in the area of education,

research and development in the area of risk and opportunity management. |