Measuring performance in financial services organizations

The Balance Scorecard is a strategic planning and management system

that is used extensively in business organizations worldwide to align

business activities to the vision and strategy of the organization. The

Balance Scorecard improves internal and external communication, and

monitors organizations’ performance against strategic goals.

|

|

B W S

Premaratne

Chartered Marketeer CIM (UK) |

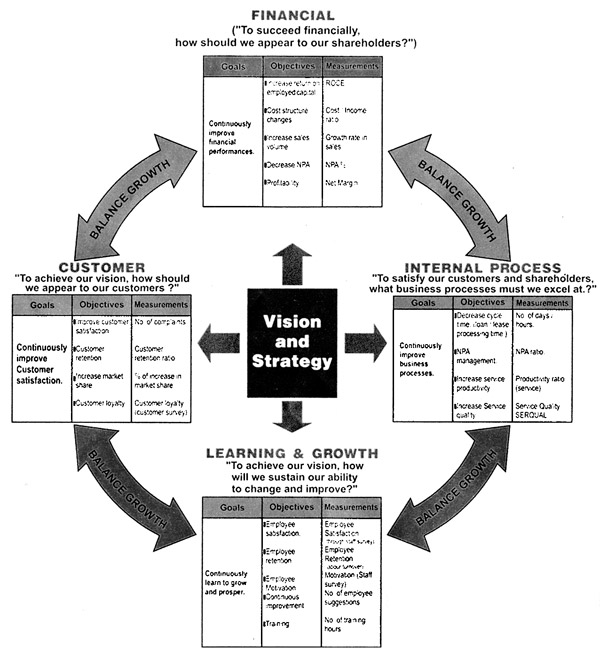

Balance Scorecard is a multi-source business performance management

system based on the most critical organizational measures. These major

components are named as ‘Key Performance Indicators’ (KPIs) and include

the following: financial perspective, customer perspective, internal

business process, and learning and growth measures.

Traditional performance evaluation systems provided information about

past financial performance, and were incapable of offering information

about future performance. BSC (Balance Scorecard) gives attention to the

importance of strategic measurement systems including both non financial

and financial measures. BSC also lets managers see whether they have

improved in one area at the expense of another.

Perspectives

The BSC suggests that there are four perspectives in measuring

organizational performance. They are:

Customer perspective: How do customers see us? Recent management

philosophy has shown an increasing realization of the importance of

customer focus and customer satisfaction in any business. The customer

is the most valuable asset in the business organization. If the

customers are not satisfied, they will eventually find other

organizations that will meet their needs. These are leading indicators

(performance drivers). Poor performance from this customer perspective

is thus an indicator of future decline; even though the current

financial position of the company may look healthy. Customer

satisfaction, the customer retention ratio, the size of the customer

base, and the frequency of complaints are some of the indicators of the

customer perspective.

The learning and growth perspective: Through learning and growth, we

can continue to improve and create value for the customer. This

perspective includes employee training and corporate cultural attitudes

related to both individual and corporate self improvement. In a

knowledge-worker organization, people are the main repository and

resource of knowledge and skills.

In the current climate of rapid technological change. It is becoming

necessary for workers to be in a continuous state of learning and

growth.

‘Learning is more than training’. It also includes on-going mentoring

and tutorship within the organization, as well as ease of communication

among workers that allows them to readily get help on a problem when it

is needed.

Business process perspective: This prospective facilitates business

performance through internal processing improvement. Customer-based

measures are important , but they must be translated into measures of

what the company must do internally to meet its customers’ expectations.

Afterwards, excellent customer performance -derives from process,

decisions, and actions occurring throughout an organization (Kaplan and

Norton, 1992). Metrics based on this perspective allow the Managers to

know how well their business is running , and whether its products and

services conform to customer requirements. These metrics should be

carefully designed by those who know these processes .

Financial perspective: How do we look to shareholders? Financial

performance measures indicate whether the company’s strategy,

implementation and execution are contributing to the bottom-line

improvement. Financial objectives are typically related to profitability

measures, for example, by operating income, Return On Capital Employed (ROCE),

or more recently EVA (Economic Value Added). Alternative financial

objectives can be rapid sales growth or generation of cash.

Balance scorecard framework for financial services organisations

Objectives: Within each perspective, objectives identify what needs

to be done in order to achieve the overall mission. They answer the

following questions: 1What must we do (from each perspective) to achieve

the overall mission? 2.What is most important (from each perspective) to

achieving the overall mission? Measures: Measures provide a way to

determine how an organization is doing in achieving the objectives

within the perspectives, and in turn the overall mission (Hubbard,

2007). They are the most ‘actionable’ component in the Scorecard. These

measures help answer the question: How do we know how well we’re doing

in achieving our objectives, and in turn our overall mission?

Targets: Targets are set for each measure to monitor and evaluate the

progress towards the objective (Hubbard, 2007).

Initiatives: These are the set of activities that are planned within

each perspective in order to achieve the targets set for each measure.

Application of BSC in financial services organizations

Most of the financial organizations in Sri Lanka are still using only

the traditional financial measures such as return on capital employed (ROCE),

earning per share (EPS), and budgeted versus actual in measuring

organizational performance.

A company could measure performance based on how much money the

company makes. To a certain extent, it is right. Financial measures are

the critical ‘bottom-line results’ that companies must deliver to

survive. But, if the top management of the company only focuses on the

financial health of the organization, several unfortunate consequences

may arise. One of these is that financial measures are ‘lagging

indicators (outcomes)’ rather than ‘leading indicators (performance

drivers)’. This means that these indicators may have happened months or

years before, and may not be controllable in the present. Being in a

plane falling from the sky is not the time to realize that you should

have done routine maintenance. Another of the consequences of just

focusing on financial measures is that the company is not

customer-oriented. Decisions may be made that help your organization

financially, but hurt the long-term relationships with customers; the

customers may eventually reduce purchases or leave all together. As an

example: you may have gone to get your car serviced, but later found out

that you have paid too much. The outcome is you may never go back to

that service station again.

The management of a financial organization needs to be aware of

inter-play of numerous factors that can impact the organization’s

performance. An organization is required to take care of these numerous

factors and devise a plan to attain a ‘balance growth’. Key performance

indicators are set on two major aspects in a financial organization -

lending and borrowing, The key performance indicators are instituted to

streamline the operations and goals of the company.

Various factors can be tracked by the company’s BSC: financial

indicators such as the ROCE, capital adequacy, the movement of profit

and cost margins can all be used to measure the success of the company.

Financial organizations need to keep track of their assets and risks. A

financial organization’s Balance Scorecard could be used to assess

whether or not the company is maximizing their resources or taking too

much risk. BSC could provide this information easily.

With so many uses for a BSC, the company would be able to track its

own progress and focus on giving better service. Once the company knows

where to concentrate their strengths, and lessen their weaknesses, it is

much easier for the management and marketing of target opportunities. With so many uses for a BSC, the company would be able to track its

own progress and focus on giving better service. Once the company knows

where to concentrate their strengths, and lessen their weaknesses, it is

much easier for the management and marketing of target opportunities.

BSC framework will guide the company to set the four perspectives,

measures and criteria, in order to assess measuring the organization’s

performance. Unlike other organizations, a financial organization is

required to ‘watch their steps’ in an extremely careful manner. This is

to keep an account of the way things and operations have been

progressing in the company.

Building a balanced scorecard

The process of building a Balanced Scorecard can be divided into

seven steps that can be categorized into three phases:

Phase 1: The Strategic Foundation

Step 1: The organization must be aligned around a clear and concise

strategy. The strategy is what feeds the Balanced Scorecard. Therefore a

strategic plan needs to be constructed at this stage. This includes the

identification of the specific objectives that tell people what to do

and a set of targets to convey what is expected. For example, a

strategic objective may be to decrease the loan/lease cycle time by 20%

over the next 12 months through more decentralized approval systems.

This step is at the heart of Balanced Scorecards as the whole

organization needs to be aligned and rallied around strategic objectives

and targets set at this stage.

Step 2: The major strategic areas on which the organization must

focus are then determined. It is important to restrict the organization

to select areas of key importance for strategic success; otherwise it

can find itself over-extended, doing too many things. Most

organizations’ strategic focus is on the stakeholder groups such as

customers, shareholders, and employees. Most public limited companies,

for example will have “shareholder value” as a major strategic area. The

strategic areas should be linked to the strategic goals defined in step

1. For example the strategic goal of having the most innovative ‘minor’s

savings account’ at a commercial bank by the year 2012, means that the

strategic area for the bank is to focus on ‘product innovation’.

Step 3: A strategic grid is built for each major strategic area of

the business. Having devised the strategy in step 1 and identified the

strategic areas in step 2, these are now translated into a set of grids.

As described earlier, Balanced Scorecards are structured over four

perspectives: Financial, Customer, Internal Processes, and Learning and

Growth. Strategic grids include these four layers. Within each layer,

the strategic objectives are placed, making sure everything links back.

Trying to develop strategic objectives and placing them into the correct

layers for all strategic grids is probably the most difficult step in

building the Balanced Scorecard (Kaplan and Norton, 1996).

Phase 2: Three critical components

Step 4: Measurements are established for each strategic objective in

the areas identified (Hubbard, 2007). The measurement criteria provide

the targets which can then be used to measure the level of success in

achieving them. For each strategic objective on the strategic grid, at

least one measurement is required. If there are several measurements for

a strategic objective, then chances are that there is more than one

strategic objective. Is it possible to have an objective without a

measurement? Yes, it is possible, but not having a measurement makes it

difficult to manage the objective.

It’s best to revisit this objective and ask the question: Why is this

objective without a measurement? Measurement makes it easy to quantify

the strategic objectives, asking the question: How well are we doing? (Niven,

2006).

Step 5: Targets are set for each measurement. Measurement alone is

not good enough. We must drive behavioural changes within the

organization if we expect to execute strategy. This requires

establishing a target for each measurement within the Balanced

Scorecard.

Targets are designed to stretch and push the organization in meeting

its strategic objectives. For example, suppose the strategic objective

is to improve customer satisfaction and the measurement is based on the

number of customer complaints.

If the average number of monthly complaints is 50 for the last 12

months, then a target of no more than 35 complaints could be

established.

Targets need to be realistic so that people feel comfortable about

trying to execute on the target. Therefore, targets should be mutually

agreed upon between management and the person held responsible for

hitting the target. One good place to start in setting a target is to

look at past performance. Past trends can be extended for modest

improvement.

Step 6: At this step, formal programs, activities, initiatives or

projects are designed and launched to achieve the targets set for each

area.

This is perhaps the trickiest part in the entire process. Some

typical examples of programs include quality improvement programs,

marketing initiatives, enterprise resource planning, customer relations

management and supply chain management. These programs usually have

certain characteristics such as: * Support by top level management. *

Utilization of designated leaders and cross-functional teams. * Presence

of deliverables, milestones and a timeline. * Requiring resources

(people, facilities, allocated budget, etc.)

Phase 3: Development

Step 7: The entire process of building a Balanced Scorecard is

repeated in other parts of the organization to construct a single

coherent management system. This integrates all parts of the

organization and allows successful execution of the strategy.

Budgeting and Balance Scorecard

BSC should work in conjunction with budgetary system for performance

measurement.

The budget which represents a set of financial targets is constantly

monitored through monthly performance reviews and remedial steps are

taken in order to rectify any significant variance.

BSC could be linked with the corporate plan of the company. Corporate

plan is a long-term plan that maps out the long-term goals of an

organization in line with its vision, mission and objectives. In this

case of measuring, it is easier to measure quantitative rather than

qualitative measures.

Balance scorecard can be used to look at a financial organization in

broader prospects under four main categories of financial, customer,

learning and growth and internal process to set organizational strategic

directions, evaluation and monitor actual performance.

No manager can ignore the bottom-line. What has happened is the key

indicator, but you need a ‘Balance Scorecard’ to measure, not just how

you’ve been doing, but also how well you can expect to do in the future.

Then the company will have a clear picture of reality, and can proceed

with confidence and success.

|