Natural rubber price upswing for how long?

Dr N Yogaratnam

The upward trends in natural rubber

prices in recent times with record breaking values continue to be a hot

issue. The trend is being watched with bated breath by the suppliers and

consumers alike for contrasting reasons

Experts and stakeholders of the industry unanimously rule out a major

slide and are of the view that prices are likely to stay high till the

next few years with intermittent dips.

|

Tapping in a rubber plantation |

Natural rubber has never witnessed such a boom as it is happening

now, at least in the last few decades. The price of NR has broken all

recent records driving on supply shortage as against the ever growing

demand mainly from the tyre industry, the largest consumer of NR.

But the crucial questions are: For how long? Is the current upswing

based on fundamentals like actual demand and supply? Is there a chance

of a price crash?

Experts and stakeholders of the NR industry agree on one thing - the

prices are here to stay at higher levels at least for the next two to

three years and a major price crash is not in sight.

Price to stay high

Prices of natural rubber will continue to remain quite high well into

2011.The effect of new planting during 2005-2008 will presumably result

in somewhat lower prices starting from 2012 onwards, but it is most

unlikely that prices will collapse.

Sri Lankan rubber industry is also expected to continue to benefit

from this market boom.

It is believed that according to the present indications and

available data plus market trends, the prices are likely to soften

further.

Therefore the rubber growers will not be unhappy in the next two to

three years, which means that the prices will continue to rule at

comfortable higher levels at least as far as growers are concerned.

The Association of Natural Rubber Producing Countries (ANRPC), which

is known for its reliable and authentic perception of the NR scenario,

notes that NR prices are of late showing trends of somewhat cooling down

after its amazing bull run.

This means that the prices are set to stabilize based not only on

pure fundamentals like demand and supply but also on a host of factors

including climate change, currency volatility and speculation.

According to ANRPC statistics, global rubber prices have only fallen

of late. RSS3 price in Bangkok fell from US$ 3.52 on July 1 to US$ 3.17

on July 23.

But in Kottayam, the price has been on the rise making a wide gap

from other markets.

|

Nural rubber processing |

The gap is likely to be narrowed down as monsoon season ends in the

Kerala State by the end of September.

Indian scenario

Meanwhile, in a recent development, the Indian Commerce Ministry,

which has earlier decided to reduce the import duty on NR from 20

percent to 7.5 percent apparently on persistent demand from the rubber

products manufacturers, mainly tyre industries, has now decided to

introduce a maximum ceiling of Rs 20.46 a kg, owing to intense political

pressure and growers' resistance, while retaining the duty as such.

This Rs 20.46 a kg cap is what exactly an expert panel constituted by

the Government on a court directive, had recommended.

The news of an import duty cut had already put brakes on the soaring

NR prices in the domestic Indian market on the soaring NR prices in the

domestic market which had shot up to as much as Indian Rs 186 a kg of

late while the international prices showed a softening trend.

The Indian growers are worried that allowing import at a lower duty

would lead to massive dumping of NR from abroad which, in turn, would

lead to a price crash in the domestic market.

But the Indian Government says the measure is intended to bring down

the domestic NR prices on a par with the international prices which is

in the best interests of both the growers and manufacturers.

Sri Lankan scenario

NR prices rose by 81 percent to an average of US$ 3.27 per kg in

August this year compared to 2009.

|

Rubber collection |

At an auction in Colombo in the same month this year, prices hit an

all time record, with a kilo of crepe rubber fetching Rs 526 and this

up-ward trend continued into October with a kilo of the same grade

fetching Rs 575 .

However this trend seems to have not been maintained and prices came

down to Rs 450 per kilo before going up again to Rs 475, then to Rs 525

and in the last week of October to Rs 540 per kilo.

The period from October until January next year is the season of peak

NR production in Sri Lanka. In any case it is most likely that the

prices would stabilize around Rs 475 to Rs 500 as supply is not the only

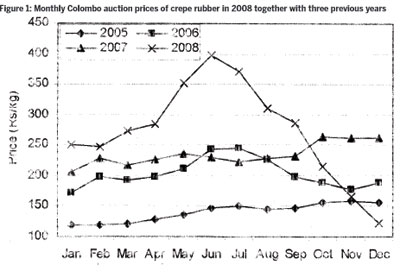

factor that governs prices as was seen in 2008 (Figure 1).

The highest ever prices were recorded in June 2008, but it declined

sharply in October of the same year although there had been no major

shift in NR supply.

The country's export earnings have shown an increase in the first

half of 2010 when compared to corresponding period in 2009, purely due

to escalating NR prices in the global market.

As the bulk of rubber production in the country is consumed by the

domestic rubber products sector ( about 80 percent), the benefits of

improved export earnings remain restricted.

NR supply

ANRPC has pointed out right from 2007 on wards, the supply tightness

is expected to continue until 2011.

The supply after 2011, of course, depends partly on farmers' decision

on replanting of their aged trees.

Age structure of rubber trees in most of the producing countries

indicates possibility of large - scale replanting drive from the

beginning of the next decade (2011-20).

This indicates a possibility of shrinkage in yielding area until the

replanted trees attain yielding stage.

Severity of labour shortage is likely to prompt rubber farmers,

especially in Malaysia, to shift to labour saving crops such as oil palm

for which the gestation period is much shorter.

On the other side, there would be new supply from 2012 onwards. A

large extent of area was planted from 2005 onwards in response to

attractive prices. A total extent of 2.441 million hectare is estimated

to have been planted (new-planted or replanted) during 2005-2010 period

- in Thailand (0.927 million), Indonesia (0.435 million), China (0.323

million), Vietnam (0.319 million), India (0.196 million), Malaysia

(0.130 million), Cambodia (0.010 million), Philippines (0.069 million)

and Sri Lanka (0.032 million). There has been large-scale planting in

Myanmar, Laos, Cote d I'voire, Nigeria and Liberia which are countries

yet to come under ANRPC's umbrella.

Depending on the net effect of the above two opposite processes,

there could be a shift in the supply curve after 2011.

Price crash not imminent

ANRPC however, feels that the NR industry had a period (For e.g.,

April-August 2008) in which rubber market inflated without supported by

demand-supply fundamentals, taking cue from speculative boom in entire

commodity markets and even metals. But, the current recovery in rubber

prices is driven by strong market fundamentals rather than speculation.

They add that demand-supply fundamentals at least until 2011 are

likely to be favourable for rubber prices to stay high. But, it is

unrealistic to judge rubber prices on the basis of demand and supply

alone.

There are other factors influencing the rubber market, such as crude

oil price, Japanese yen, currency strength of rubber exporting

countries, commodity speculation etc.

However, possibility of a price crash in the coming years is remote

provided Asian economy stays strong.

There are actually multiple reasons behind the unusual and alarming

rise in natural rubber prices over the course of the past year. However,

the major reason is the gap between demand and supply. Not just in one

country, but globally, there is a demand-supply gap which is increasing

every day. This is fuelled to some extent by speculation, especially in

India where the rubber consuming industry is already facing the import

barrier in the form of higher Customs duty to the tune of 20 percent.

While the current good tidings in NR prices are more than soothing to

growers due to the sudden spurt in income from their good old rubber

trees, it is ironically hitting the NR consuming industry, mainly the

tyre industry, quite hard.

|

Rubber sheets |

Tyre industry's worry

Responding to the impact of the higher level of NR prices, the tyre

industry feels that, tyre, and nearly none of the natural rubber

consuming industries enjoy healthy profit margins. What this means is

even thinner margins for the consumers.

It is not possible for the NR consuming industries to pass on all the

costs since the burden would be too high. Lower profits in such a

scenario have larger implications on fresh investments in research and

development and higher capacity.

According to this industry circle, the options before the consuming

industry, especially tyre industry, is basically of tightening the belt

even more, cutting back on any expense which is not absolutely necessary

and also sweating all the assets to try and bridge this gap as much as

possible.

The other option is higher investment in research to try and find

ways of replacing natural rubber with synthetic rubber wherever

possible, without compromising any fashion aspects of safety,

performance and regulations.

It is the view of the industry that it is difficult to predict how

long the NR price will continue at higher levels. But any major economic

factor could affect prices, say for example, a slow-down; what we really

need is long term action; which means investment in a fresh crop,

increasing the acreage under cultivation, replacing older crops with

newer ones.

Simultaneously, we have to look at ways and means of replacing

natural rubber usage in tyres and allied items with synthetic rubber.

Prospects of NR substitution

On the question of substitution, it is said that, it is possible to

substitute natural rubber under certain conditions, but in Asian

countries, where the high ambient temperatures persist, substitution is

not possible after a certain point. It is easier in tyres that are used

in colder climates like northern Europe and North America.

Meanwhile, the NR industry doesn't anticipate a significant drop in

NR use following new tyre-making technologies, including new

compounding. So far, experts do not yet foresee a significant drop in NR

use: potentially only a somewhat lower growth, there are no developments

on the SR side which would have considerable impact on the NR market.

Regarding prospects of NR substitutes like Guayule, it is produced on

a small scale and we do not yet foresee large-scale production, although

very high NR prices will definitely help.

Meanwhile, ANRPC says that substitution between NR and SR is largely

a theoretical perception having limited practicability.

For instance, substitution in favour of NR was marginal in 2000 in

spite of a much lower price for NR compared to SR. Rather than relative

price, it is technical considerations that determine the proportion of

NR and SR in a product. For example, truck radials need NR in a much

higher proportion than SR.

But, this is just the opposite in the case of passenger car radials.

Technical considerations often put cap on the flexibility available for

substitution between NR and SR.

Moreover, whenever NR demand rises, SR demand also rises because the

two elastomers are together used in the manufacturing of most of rubber

products.

Enhancing production

With regard to the NR price trend, the most crucial factors will be

whether there will be enough planting, how will productivity develop,

will the number of workers be sufficient, what will be the effect of

climate change and will the disease side be under control.

Meanwhile, ANRPC prefers to describe the current uptrend in prices as

a sort of a recovery of NR prices which, is mainly driven by supply

constraints. ANRPC in 2007 itself foresaw the possibility of a tight

supply during 2007-11.

This has been due to major reasons like the increase in proportion of

low yielding aged trees in the total yielding area of all major

producing countries and slow expansion in yielding area, especially from

2006 onwards.

Total

yielding area in the ANRPC member countries expanded only at a marginal

annual rate of 0.8 percent, from 6.788 million ha to 7.000 million ha,

during 2006 to 2010. This is due to the slow rate of planting undertaken

during the period 1999-2003 coincident with low rubber prices. Total

yielding area in the ANRPC member countries expanded only at a marginal

annual rate of 0.8 percent, from 6.788 million ha to 7.000 million ha,

during 2006 to 2010. This is due to the slow rate of planting undertaken

during the period 1999-2003 coincident with low rubber prices.

Commenting on the extension of rubber planting to low yielding

traditional areas, ANRPC says that this is due to a shift in policy

orientation of producing countries from maximizing rubber output to

maximizing farmers' profit and competitiveness.

Pointing out that this shift is not production-oriented, it says that

popularization of latex-timber clones and low-intensity harvesting

systems also largely reflect profit-oriented strategies rather than

production-oriented ones.

A marked deterioration in efficiency of harvesting due to severe

shortage of skilled trappers also affected output in major NR producing

countries, says experts and analysts.

While agreeing that climate also has affected the supply, the impact

of climate change on NR supply need not be one-directional.

For instance, less number of rainy days in June/July helps to have

more harvesting days and a better yield. This also helps in reducing

incidence of fungal diseases.

Futures trading

Regarding futures trading as a method to avert market uncertainty,

IRSG says that it could be one among the various measures that might be

very useful to reduce short-term price risk.

It cannot cure more structural shortages or surpluses in the market.

Meanwhile, what is needed is a kind of controlled futures trading in

rubber so as to ensure better price realization.

The slower growth rate of NR production capacity the world over is

the result of low levels of planting after the Asian crisis in 1997

stretching well into the first decade of this century.

Outlook

There are three main groups of factors that determine the outlook for

prices. They are: First, economic growth which impacts vehicle, tyre and

rubber consumption scenario, including the effect of availability of oil

on vehicle usage and sales.

Second, the impact on NR production potential scenario as a result of

planting policy implementation, productivity improvements and labour

availability, including the influence of climate change on NR

production.

Third is the effect of oil price, which will affect butadiene-SR

scenario. One has to see the availability and how this will affect

prices.

On the economic front, the future looks a lot better than in early

2009. However, there are still many uncertainties which may lead to a

slower recovery in parts of the world, e.g. Europe, and lower growth in

high-growth countries. This may spoil the good outlook for rubber

industry to some extent.

Another point is, the massive new planting by rubber farmers during

2005-2008. This will have a significant effect on the supply situation

starting in 2012.

The most likely scenario resulting from combining likely scenarios

based on the above three groups of factors is: prices of natural rubber

will continue to remain quite high well into 2011; the effect of new

planting during 2005-2008 will presumably result in somewhat lower

prices starting from 2012 onwards, but it is most unlikely that prices

will collapse.

The rubber prices are here to stay higher for some more time. All

indications are that the price spiral may turn around after 2012, but

will stabilize at reasonable levels that would ensure profitability to

growers and also some relief to consumers. |