|

Perspectives for accelerated growth and development:

Road to economic recovery

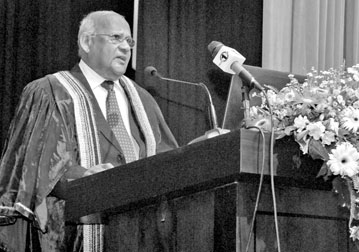

Presidential address by Professor A D V de S

Indraratna at the Sri Lanka Economic Association 2010 Annual Sessions.

First part of this article was published yesterday

Both of these we should be able to reach and sustain in the next five

years, 2011-2015. With the heavy physical infrastructure projects in the

road network, harbours and airports and IT, etc. that are being

implemented, it should not be a difficult task to reach and even go

beyond a level of 30 percent of gross investment.

|

|

Professor A D V de S Indraratna

addressing the Sri Lanka Economic Association Annual

Sessions |

The increase in the level of efficiency of investment or productivity

by around 10 percent is also attainable if we implement a host of

measures such as good governance with law and order but without waste

and corruption, a competent and independent public service, efficient

public institutions, simple tax, customs, license, BOI and other

official procedures, industrial peace with good employer-labour

relations and good labour laws. Mahinda Chintana - Idiri Dekma (MCID)

has highlighted some of these. Sri Lanka Economic Association, in fact,

formulated a four-strategy development framework showing this

possibility, before the MCID was launched, and this was recently

submitted to the relevant authorities for their consideration.

Level of investment

Then we have the other side of the equation to examine. That is the

increased savings required to finance this higher level of investment,

maintaining the average inflation at more less the present level of five

percent to six percent.

In other words, the increased resource gap has to be reduced by

increasing the domestic savings on the one hand and increasing the FDI

on the other. Savings must be promoted by reducing the budget deficit by

the Government and by encouraging private sector savings by maintaining

attractive real market interest rates (i.e., nominal rates markedly

above inflation).

Domestic savings

The Government has already put in place several measures to bring the

budget deficit down from last year's near 10 percent to eight percent.

The relatively much faster rise in current revenue plus grants of 20.3

percent, relatively to only 7.6 percent increase in current expenditure,

in the first seven months of 2010 is ominous of this.

Real interest rates have remained positive after 2008 with inflation

coming down to single digit. We can, therefore, expect domestic savings

to increase somewhat. But such increase will be hardly adequate to close

the gap between the required investment and the available savings.

Therefore, a substantial increase in FDI (Foreign Direct Investment) is

a must. Here the story of the recent past is disappointing. In 2008, our

FDI amounted to US$ 800 million (rounded), one of the lowest, if not the

lowest in the whole of Asia.

Good governance

This was a time when inflation was very high. In 2009 and the first

half of 2010, when our inflation has remained at single digit and our

economy has been rated high by foreign rating agencies, our FDI has

paradoxically come down. In 2009 it was US$ 690 and in the first half of

2010 only US$ 200 million. Was this trend due to the lack of a so called

enabling environment with good governance, law and order, industrial

peace with good labour laws, efficient public institutions, simple

customs, tax, licence, BoI and other official rules and regulations and

documentary procedures, to name a few, - the same environment to which I

have referred as a factor necessary for increased efficiency of capital.

Whatever the reason is, this trend has to be reversed to sustain high

growth, as increased foreign borrowing is in no way a substitute for FDI.

I hope the Government will be able to solve this impasse.

An average eight percent real growth rate in the next five years,

however, will raise the per capita real income only by about 40 percent,

even though it would be possible to have a doubling of the per capita

income in money terms or at market prices, with a slightly higher

average inflation than at present and a slightly appreciating domestic

currency.

At eight percent growth, Sri Lanka will take around 10 years to

double the per capita income in real terms and thereby double the living

standard of her people. This, I would consider both a realistic and a

record achievement. I consider it a record achievement because even

Republic of Korea, an Asian Tiger took 11 years to attain doubling of

her per capita real income, then considered an Asian miracle. This does

not mean, however, that I advocate Sri Lanka should not aim higher.

But the earlier she wants to do this, the higher the annual real

growth above eight percent she should be able to accomplish. This, of

course, requires a still higher level of investment, higher level of

investment efficiency and higher levels of domestic savings and FDI,

with the attendant constraints I spoke about.

Income distribution

I must now come back to where I began. That is economic growth as I

have discussed all this while does not necessarily improve by itself the

quality of life of all people of a country, unless the benefits of that

growth are equitably distributed, or shared. Though Sri Lanka has

doubled its per capita income at market prices from US $ 1,000 odd to US

$ 2000, still the bottom 20 percent get less than four percent of the

total, most of whom get less than US$ one per day at ppp.

These are the people who live below the poverty line. Around 40

percent of the people live below US $ two per day. Therefore growth must

be spread and not concentrated in one region or confined to one group,

it must be taken from urban to rural areas, where the bulk of the poor

live. All in all, growth must be pro poor.

Sri Lanka has a long way to go in the equitable distribution of its

national income. According to the latest statistics available, the Gini

Coefficient of incomes of spending units as well as income receivers is

less than 50 and has hardly improved since the late nineteen nineties.

Another important aspect of development is that it must be

environment friendly so that the growth is sustained and that the higher

growth is achieved not at the expense of the generations to follow.

Growth also must be accompanied with reforms in education and

improvements in health so that the manpower coming out of the national

education and health systems can meet the demands of development.

|