ICAAP regulations - revolutionary

Saloni Ramakrishna

ICAAP regulations if implemented in letter and spirit would

fundamentally change the way banks plan and strategize their business.

“All courses of action are risky, so prudence is not in avoiding

danger (it’s impossible), but calculating risk and acting decisively.”

Niccolo Machiavelli

As bankers across the world go back to their strategy tables to

rework their risk management framework, they would do well to heed that

advice. Given that not taking Risk is not an option, prudence is in

understanding risks being taken, calculating and acting on them and that

is what ICAAP (Internal Capital Adequacy Assessment Process) aims to do.

Given the current challenges facing the global financial services

industry, ICAAP, which falls under Pillar II of the Basel regulatory

framework, could not have been mandated at a more appropriate time. Given the current challenges facing the global financial services

industry, ICAAP, which falls under Pillar II of the Basel regulatory

framework, could not have been mandated at a more appropriate time.

It provides banks with a valuable opportunity to understand and

manage their risk canvas in a brand new and holistic manner.

In fact, ICAAP is a quiet revolution, disguised as a regulation as it

broadens and deepens the risk canvas of a bank.

Pillar II or ICAAP is the central pillar of the spirit of the Basel

regulatory framework. Pillar I was a prescriptive approach that laid

down specific and detailed rules; Pillar II, requires banks to think for

themselves within a broad framework.

It centers around the critical idea that banks face both quantitative

risks such as concentration risk, liquidity risk or interest rate risk,

as well as qualitative risks such as reputation risk, strategic risk or

business risk in addition to the traditional Credit, Market and the more

recent Operational Risks.

ICAAP expects banks to understand their entire risk universe and

identify which of those are material based on their individual

businesses, operations and future plans.

It encourages banks to define their risk appetite, capture the

essence of their risk profiles and choose appropriate approaches and

risk systems to best manage their businesses and finally arrive at

appropriate capital buffer.

While this may be a liberal and empowering approach, the challenge is

that banks will have to defend their ICAAP to regulators in supervisory

reviews.

Thus, while the risk management and the Capital Planning process is

internal, its defence will be external.

The ICAAP mandate also brings to life the complexities of the banking

business; it provides a three dimensional effect to risk management. In

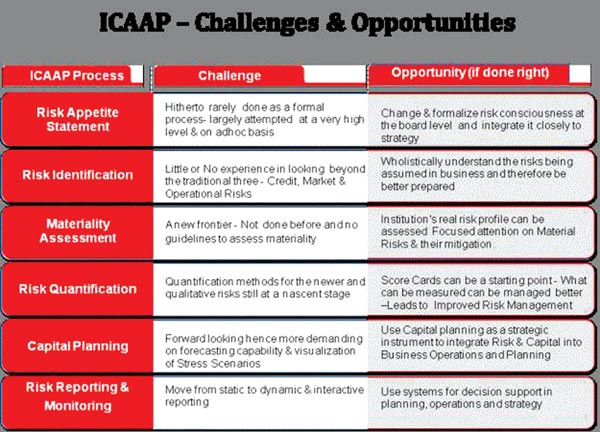

implementing the new framework, banks will have to use a six-step

process.

Banks must state their risk appetite, identify risks that the

business carries, assess which of those risks are material, quantify the

risks, do capital planning, allocate capital to businesses, and have a

risk reporting framework.

It is important to note that each of these steps throw up several

challenges, but if implemented well ICAAP offers great new opportunities

for banks.

The challenges

In a nutshell every step of the process does throw up tough

challenges, none of which can be trivialized. Having said that the

bright side of the exercise is that if the process is implemented as

envisaged would creates such huge opportunities that the effort is more

than well worth it.

A crucial part of the ICAAP process is that it is forward looking.

Banks cannot depend on history alone to assess future risks because of

newer products, newer ways of doing business, shrinking of global

financial borders, lack of standardization etc., the demand on banks to

have great clarity about their proposed balance sheet and risks it

entails as also its capacity to withstand stressed situations becomes

critical.

This approach tests a bank’s real capability to envision the risks of

its future plans, including those of new strategic initiatives, new

geographies and business lines.

ICAAP offers banks the opportunity to holistically understand their

risk canvas and be better prepared in their business. It invites banks

to plan business growth by balancing risk and return and move from

forecasting just profit to economic profit, using risk-adjusted

performance measures. Thus, ICAAP has with a single stroke changed the

contours of business forecasting, profit planning and capital planning

and made forecasting a cognitive and deliberate process.

Arguably, the biggest challenge in implementing ICAAP is the lack of

guidelines on how to assess materiality, how to quantify newer and

especially qualitative risks, or how to relate these risks to capital.

Skills in these areas are in their infancy, especially since there

are no clear regulatory guidelines. For example, can a bank numerically

quantify reputation or strategy risk and decide how much capital is

appropriate to be allocated to such risks? It is here that ICAAP’s

evolutionary nature comes into play - since banks, academicians and

regulators are working hard in this area, over time there will be

answers to both how to quantify risks and how to relate them to capital.

In this context, score cards can be a good way to assess materiality.

The starting point is to break down these risks into their underlying

indicators and then methodically building a score card. For example,

reputation risk could include the risks of negative publicity, customer

complaints or possible lawsuits, each with potential costs.

Stress Testing is an effective tool for capital planning and

management. The skill lies in turning stress testing into an art, a

craft and a science. Banks must institutionalize stress testing

mechanisms that allow them to recreate historical scenarios as well as

to create blue-sky, hypothetical ones. Making Stress Testing a mere

statistical exercise defeats the purpose - it needs to be led by

business thinking.

On the reporting front, Pillar II calls on banks to change their

reporting systems from being static to being dynamic and interactive.

Such systems must capture not just risk-related information at a micro

level, but must be able to provide an aggregated view as well in the

form of a set of dashboards/ reports that give senior management an

instant and continuously updated view of multiple factors including

risk, capital positions, Stress Test results etc amongst other things.

This gives banks the opportunity to set up robust, interactive

reporting systems that provide decision support for risk planning,

profit planning and capital planning, as well as for operations and

strategy.

Implications for the stakeholders

This paradigm shift has interesting implications for all stakeholders

of the bank, both internal as well as external, and they are all

learning on the go.

First, the bank’s board will now have to focus on making planning a

forward looking process, it will have to define risk appetite in

concrete terms and take responsibility for those definitions.

ICAAP asks senior management to change their perspective from a

historical one to a forward looking, futuristic and realistic one:

predictive skills must be developed to formulate a future end state,

which must then be worked backwards into actual plans, business

operations and numbers.

Next, since auditors have now become the first line of defense ahead

of regulatory reviews, they are scaling up their skills and will

challenge business leaders on the projections and help them validate

their plans in an entirely new way. Shareholders will know the optimum

capital to be held against risks: too much capital means a loss of

revenue, while too little capital is a risk in itself.

There are interesting implications for the external stakeholders too.

Perhaps for the first time, the emphasis is on a dialogue between

regulators and banks rather than a one-sided compliance measurement.

Pillar II leaves a lot up to the individual bank in terms of assessment

and quantification; by implication it also leaves a lot up to the

judgment of the individual supervisor performing the regulatory review.

Thus, regulators will be challenged to perform effective reviews

without complete standardization. This problem will be more complex and

manifold for global banks which are required to meet regulations in

different countries, as well as for the regulators themselves. Thus both

regulators and regulations will continue to evolve based on the actual

supervisory experience.

The final set of stakeholders, the customers, will perhaps benefit

most from ICAAP. They will be dealing with banks that have developed a

more objective approach to business planning and a clear understanding

of their risk-return equation, which can only make them more stable and

robust organizations to deal with.

Conclusion

ICAAP poses short-term challenges but at the same time, if done well,

offers numerous opportunities. It invites banks to draw up a blueprint

for the future and work towards it consciously.

It asks banks to use planning and risk management as strategic

instruments and mesh them with operations for optimal results. Thus,

ICAAP has moved the realm of risk management away from a dusty corner

into the entire being of a bank.

(The writer is Principal Architect, Risk & Compliance Oracle

Financial Services) |