Will natural rubber business bounce back by 2010?

Dr. N. Yogaratnam, Chairman, Tree Crops Agro

Consultants

The International Rubber Study Group (IRSG) in its revised estimates

for the global rubber industry, based on an IMF report and other

sources, says that world rubber consumption growth which was estimated

to slip to - 3.1 percent (22,179,000 tonnes) in 2008, and to slip

further to 4.4 percent (21,2009,000 tonnes) in 2009. It is also

estimated to be in for a turn around to 7.6 percent (22,823,000 tonnes)

in year 2010.

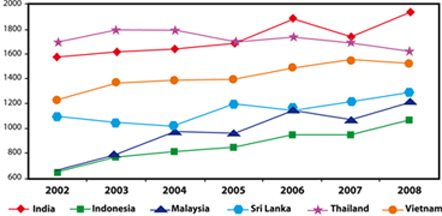

Figure 1: Total Production

Trends in NR

|

|

Long term forecasts for rubber industry’s consumption growth

indicates that it would dip to 3.5 percent (27,140,000 tonnes) in 2015

and further down to 1.7 percent (28,540,000 tonnes) by 2018.

Natural Rubber (NR) consumption is forecasted to emerge from a

negative -0.09 percent growth in 2009 to recover to 5.6 percent growth

in 2010 followed by 4 percent and 2.4 percent growth in 2015 and 2018.

Although recent developments have confirmed the general belief that

world rubber economy always depends heavily on the global economy, yet

the unexpected worldwide recession in such a magnitude has made all such

forecasts undependable, NR market dip, from boom to doom; from over U$ 3

per kg to around U$ 0.7 per kg was unexpected and is unimaginable.

NR Production/ Productivity

The production trend in NR in 2008 indicated that the Asia Pacific

region has continued to dominate with 88 percent share of global NR

production with Sri Lanka’s share still around one percent (Figure 1).

Production in Thailand increased by 0.8 percent only, even after

expansion in mature area by 32,000 ha Indonesia’s rate of growth has

come down to about 3.6 percent in 2008, from 16 percent in 2006 and 4.5

percent in 2007, despite the expansion in mature extent by 17,000 ha.

Malaysian NR production, dipped by 4.7 percent, possibly due to a

decline in mature area by 173,000 ha in 2008. Production trend in India,

however, regained it’s normal level after a drastic fall in 2007.

According to IRSG, India consumed 1,141,000 tonnes of rubber in 2007

with a share of 5 percent of the total global consumption. The Indian

demand for rubber is projected to exceed 2,188,000 tonnes by 2020 and

the share is likely to go up further by 7 percent of the global demand.

It is forecasted that India may be the only nation that is likely to

consume rubber at a faster rate. U$ consumption is likely to dip in the

short and long run, while Japan and Germany are expected to remain flat,

China, the largest consumer will slow down in the near future but will

still remain on top in respect of consumption.

Policy changes

Policy changes on choice of perennial crops and other recent

developments in three major NR producing Thailand, Indonesia and

Malaysia - may preclude them from playing a large role with regard to

meeting the expected rise in global demand for NR. Hence, India as the

world’s fourth largest producer of NR and ranked as No. 1 in terms of NR

productivity, has a potential role in an environment of increasing

global demand for NR, forecasted by year 2010 and after.

Vietnam increased its NR production by about 8.1 percent, which was

supported by the expansion in mature area by 35,000 ha.

In Sri Lanka, the rate of growth increased to 9.9 percent from 7.3

percent in 2007 although the expansion in mature area had been marginal.

Productivity (Yield/ha/yr) has shown an increasing trend, yet it is

still much lower than what had been recorded in India, Thailand and

Vietnam (Figure 2)

Options

Available options for enhancing yield from the existing yielding

trees have been almost fully exploited during the period NR prices have

been, consistently high prior to mid 2008. Further scope for significant

yield increase is therefore very limited until the new/replanted areas

reach the peak productive stage. Postponement of replanting induced by

high NR prices in the past, is also a matter of concern. As and when NR

prices rebounce, productivity of ageing trees can still continue to be

low.

Forecasts

IRSG forecasts that the global NR production would touch 13.7 Mn

tonnes by 2020 as against a prospective consumption of the same amount

or even more. The production projections for NR are however dependant on

the planting policies of the rubber growing countries.

The share of NR in total rubber consumption had been 43.3 percent in

2005, but was down thereafter to slightly over 42 percent in 2007. IRSG

estimates that this will touch around 44 percent or a little more by

2020.

Limitations

Figure 2: Productivity of NR

; (Kg/ha) 2002 - 2008

|

|

Mature rubber area is likely to decline or at least stagnate at the

present level, as replanting have been postponed to take advantage of

the high rubber prices in the past. At global level, there had been a

decline of 1.3 percent in 2008, from 5942,000 ha to 6631,000 ha in 2007

and then 6545, 000 ha in 2008. In Sri Lanka, there had been a marginal

change in the extent of mature areas (Figure 3).

A policy shift in favour of food crops in NR planted/potential area

is likely after the global food crisis that was experienced in early

2008. Moreover, three major rubber producing countries e.g. Thailand,

Indonesia and Malaysia have already initiated action to regulate NR

supply under the aegis of IRCo to minimize the impact of the current NR

market slump.

Thailand is moving towards converting the traditional NR growing

areas in the south of the country to oil palm. Malaysia is also going

for large scale conversion to oil palm and for rubber wood production.

Recent planting trends in Indonesia show massive planting of oil palm by

large multi-nationals, while rubber is mostly confined to smallholdings

with low yield potentials.

Increasing shortage of skilled labour may compel rubber growers to

shift to crops having relatively less labour inputs.

Diminishing availability of skilled tappers, in the estates and

smallholdings is of grave concern. The changing weather patterns with

prolonged monsoon and exceptionally high rainfall which interferes with

tapping operations in also of concern. Tapping and collection operations

are labour intensive and there is no sight at least in the short/medium

term, of mechanization/ automation of tapping and collection operations.

Rubber planting in non-traditional areas has not been fully achieved

as desired, possibility due to several limitations in technical and

non-technical issues in initiating and completing such programs.

Strategies

In Sri Lanka, however, there is ample scope to increase commercial

productivity at least to a level somewhat close to the research yield of

3,000 to 3,500 kg/ha/yr.

It is known to the industry that crop productivity in terms of

kg./ha/yr, is a function of tree productivity per tapping (g/t/t),

tapper productivity per tapping, the number of trees tapped, stand per

hectare and number of tappings per year. If all these variables can be

done in an effective manner, the industry should be able to achieve at

least 75 percent of the research yield.

Fertilizer

Fertilizer to mature rubber had long been a much debated subject,

possibly due to lack convincing research evidence to support such

programs. Application of fertilizer to yielding trees through out the

mature phase is not the answer.

Yield profile of clone indicates that yield, increases with age from

the time of commencement of tapping and reaches the peak level in year

07/08 from the commencement of tapping. Yield in the early stages of

mature phase is comparatively much lower. The demand for added nutrients

would there fore arise from say year 5/6 of the mature phase.

It is, therefore, logical to start applying fertilizer from year 5/6

and continue until year 12/13,under a soil and foliar survey program,

after which fertilizer may be discontinued. Trees are known to have

adequate nutrient reserves by the time they reach the productive phase,

if effective soil management practices are adopted during the mature

phase.

Besides the applied fertilizer, the decomposing leguminous ground

covers are also known to contribute a significant amount or nutrients

due to effective recycling during this period.

From the foregoing, it is clear that the limiting factors of rubber

productivity are not nutritional. It is possible that the mature yield

(and harvest index) may be increased by methods related to exploitation

rather than continued manuring practices.

Consolidation

In Sri Lanka, like many other NR producing countries, the bulk of NR

is produced from uneconomic - sized holdings of 0.5 ha or less in the

traditional rubber growing areas.

The size of the holding does not have the economy of scale for

effective operation and successful transfer of technology, a structural

weakness in the NR industry.

Although productivity in the smallholdings is the highest in the

world but domestically (in Sri Lanka) it is lower than that achieved by

the estates. Therefore, consolidation of uneconomic sized holdings

appears to be an effective strategy.

This would also to some extent overcome skilled tapper shortage

problem in smallholdings. For example, groups of 9 to 12 small holdings

in a given locality should engage the contract services of a common

tapper to tap 3 holdings in a day with 9 holdings tapped over three days

on d/3 frequency or 3 holdings a day with 12 holdings tapped over 4 days

d/4 frequency.

However, the mode of payment for contract tapping will have to follow

the system practised in Thailand and Malaysia where the contract tapper

shares the crop with the owner at a 50: 50 ratio or 60: 40 ratio in

favour of the owner.

In view of the acute shortage of tappers in estates, the Regional

Plantation Companies (RPCs) can also adopt such contract tapping systems

to minimize the impact of the skilled tapper shortage in plantations.

CDM/Carbon Credits

In the absence of large extents of additional lands suitable for NR

cultivation in Sri Lanka, the RPCs should, like China and Vietnam,

explore the possibilities of off-shore NR cultivation in counties such

as Myanmar, Kampuchea, Papua New Guinea, Indonesia, and several West

African countries having abundant land suitable for NR cultivation.

These countries can comply with the criteria required for CDM funding

through sale of CERs, since cultivation of new plantation will be

accepted under the process of a forestation and reforestation.

The RPCs can enter into three-way partnerships with the host country

and tyre manufactures from Europe and Japan who need to purchase the

CERs from cultivation of new rubber plantations to off-set their GHG

emissions.

It is projected that a hectare of rubber can generate 605 CERs which,

at current prices of US$30 per tonne of CO2, can generate an income of

US$ 18,150, which may be adequate to plant approximately 4 ha of rubber.

NR prices

Figure 3: Trends in Mature NR

Areas (’000 ha)

|

|

The factors that influence NR prices are known to be (1) Fundamentals

of Demand / Supply (2) Speculative fund (3) Crude oil prices (4)

Currency movement.

In mid 2008, prices in the commodity markets suffered a decline of,

between 30 percent to 40 percent. This bearish sentiment resulted in the

market loosing confidence and creating uncertainties. The continued

global economic crisis and slow down in the automotive industry will

continue to affect demand for NR and will have an impact on the upward

price movement in short/medium terms.

In any case, if the forecasts of IMF, IRSG and other sources are

realistic, with the trend in NR consumption beginning to pick up in

2010, NR prices would also be expected to stabilize at a reasonably

attractive level.

To summarise, the challenge to the Sri Lankan rubber industry is,

therefore, to transform the developing favourable features of the rubber

industry to a sustainable long term growth through creation of a perfect

business environment and culture to address the deficiencies in the

plantation systems through human and technological upgradation, land and

crop strategies for the rubber industry to contribute their share as a

partner to attain macro-economic stability in the country. |