Way forward for hospitality industry

Sugath Rajapakse

Consultant (Commercial), Mihin Lanka

DESPITE VARIOUS sales and marketing initiatives taken both by the

Tourism Authority and the Tourism Trade, arrivals continue to lag far

behind those numbers in 2006.

However even 2006 figures may not be a proper benchmark. In the past

many years the inbound market to this country has experienced marked

variations due to the many vicissitudes faced by this nation.

Therefore comparing arrival figures against the previous year may not

necessarily be indicative of the real health of hospitality industry. health of hospitality industry.

Thus a better bench mark would be Net Operating Income Per Available

Room or NoiPAR. Another indicator available to the hospitality industry

RevPAR or revenue per available room indicates the overall revenue

performance of the property.

For more than three decades the industry has relied upon the

traditional distribution channels for the lion portion of their

business.

In this distribution process two key modalities comes into focus, In

addition to the traditional annual brochure and various limited

releases, the foreign tour operators use their own web portals and even

independent e-distribution systems for the distribution of their end

products to the consumer.

The dwindling fortunes of the hospitality industry indicates that it

is no longer worthwhile to hang on to the traditional marketing and

distribution channels and that there is a compelling need to change the

way business is done.

In order to understand the problem, one needs to have understanding

of the way business is done by the tour operators in the generating

countries.

In developing their annual revenue plans, based on the existing data

captured for the current operation a forecast of the number of units

that may be sold in the ensuing year is obtained. This forecast is then

optimised based on the ground realities that may exist in the coming

year. In developing their annual revenue plans, based on the existing data

captured for the current operation a forecast of the number of units

that may be sold in the ensuing year is obtained. This forecast is then

optimised based on the ground realities that may exist in the coming

year.

A spike in numbers generated to one country may be due to a special

event which may not occur in the next year while a drop may be due to

some unusual events that has occurred in the destination country and

hence the need for optimisation of the forecast.

Contracting for airline inventory and the hotel rooms and other

facilities in the destinations is based on the optimised forecast and

Tour Operators use Revenue Management Systems for forecasting and

optimisation.

If for some reason there is a possibility of not realising the goals

and objectives set for a particular destination, based on a gap analysis

the shortfall would be directed to destinations where demand exists.

Thus, if there is a drop in demand within their sphere of influence

to Sri Lanka that shortfall may be covered with greater focus by

diverting business to other destinations.

It may be noted that tourism industry is a composite demand composite

supply business.

For Sri Lanka given this scenario, while trying to revive the

existing channels there is a compelling need to seek alternative

solutions.

Web and the cyber customer

While there is an increase in independent hotel sites coming up in

the internet, yet as per current estimates not more than 10% of the

hotel bookings account for internet direct sales.

Whilst of the shoppers in the internet about 20% shoppers are known

to book in the same site.(* Crystal, Ferguson, Higbie & Kapoor,

Comparison of unconstraining methods to improve RM systems), it is also

known that third party web site sales are growing at a much faster rate

than own web sales. It has also been noted that web sales peak on Sunday

evening and Monday morning.

These facts tells us that,

1. Internet sales are on the increase through independent as well as

own sites

2. Only about 20% of the shoppers actually make bookings from the

same site. The hybrid cyber consumer or “Centaur” is known to shop

online and purchase offline and vice versa

3. Third party web site sales are growing faster than own web sales.

This would be due to the choice of offerings product and price wise in

third party systems

4. Web sales peak during Sunday night and Monday morning. After

Saturday night out most remain at home on Sunday and browse the web and

any specials noted and taken up. On Monday the word goes to colleagues

in the office who before commencing work would check on.

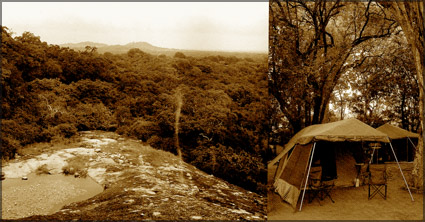

Audit of eco/nature hotels and small hotels

This writer recently did an audit of the nature/eco hotels and small

hotels on the following aspects,

1. Do they have a website and is it active

2. Pricing and are prices featured in the web

3. Is the site capable of taking online bookings

The audit revealed the following:

1. Some hotels have a URL address but so far no website

2. Those with sites most do not feature rates and are not capable of

taking online bookings. Bookings a re by email or phone only, and in

some cases pre-payment to be made to an account in a local bank branch

3. Absence of pricing dynamics with same rate being applicable

through a wider window

From the above the following inferences can be drawn

1. On their own these hotels do not have the product diversity nor

the critical mass in terms of inventory to influence the consumer or the

influencer

2. Individually the size of the inventory is insufficient to venture

out for an online booking operation with internet payment gateway

3. Collectively can create sufficient critical mass for an inventory

system for reservations and a forecasting and optimisation system

resulting in higher NoiPAR for each property

Indeed not only the smaller players, but even the bigger hotels who

may not have ventured out and who have already invested in a PMS should

consider following this path while continuing maintaining the

traditional distribution strategies.

Such a mixed operation can be accommodated with a PMS and a RM

system, and it allows the property to manage and also to optimise the

price and the inventory that is on offer to the real time booking modes

as well as those sell and report channels.

Indeed captured data in the first year of operations will create the

capacity to forecast the performance of the hotel/s at both the macro

level as well as at the various distribution channel levels.

Further using this data both price and length of stay booking hurdles

can be further refined in respect of the various market segments

enabling the hotels to further improve the prices on offer and the

inventory utilisation

E-Commerce

An audit of the major tour operators generating traffic from UK to

Sri Lanka revealed,

1. The websites featured booking engines in the home page

2. Booking engine format user friendly as with Low Cost Airline IBE

3. Special offers, promotional offers featured in the home page

4. IBE enables for customization of the offers to suit the buyer

5. Choice of multiple locations & destinations

6. Both online and offline offers for the hybrid cyber consumer

A critical mass of inventory created by clustering hospitality

products ranging from the city, beach, resort, eco, nature, safari,

boutique etc will enable our hospitality industry to cater to the

expanding cyber market. Such an offering will enable the industry to

provide the shoppers and consumers with a web strategy capable of

providing

1. Online booking power on real time basis

2. Choice of products ranging from eco to city hotels

3. Price offerings optimised by product, week of the month, month of

the year etc

4. Choice of special offers ranging from single property to a range

of properties

5. Promotional offers directed at the cyber consumer. The cyber

consumer has the capacity to network and to take advantage of such

offers.

While the formal offline offering is more inclined towards

standardisation, with booking site/s the customer becomes an active

participant and instead of standardisation there is more

customerisation.

While the offline process was targeted to mass markets & segments,

the convergence of the channels customerise the hospitality product and

the customer too has the opportunity to customise the end product to

suit his/her needs.

The convergence product creates customer communities and these

virtual communities are influencers amongst the community and across the

divide with physical communities.

E.g. A virtual community member may find a good promotion online and

may communicate with those with whom they have virtual contact and often

buy online to take advantage of such special offers.

Also with E-Strategy airlines today find that 35% of their bookings

come online as per the 2007 Airline IT Trends Survey - from Airline

Business and SITA.

Commented by Dominique El Bez, Director Portfolio Marketing at SITA,

during a webcast held by ATW on October 26th 2007, it is also seen that

passengers value the ability to plan trips online (39%) more than

loyalty to airlines (22%) as per the self service survey from SITA.

It is also found that 53% offer web check-in facility as well

(Dominique El Bez Director Portfolio Marketing - SITA, ATW webcast

October 26, 2007) and this may open parallel opportunities for the

hospitality industry.

Such an independent hospitality site (for that matter even hotel

sites) can be geared for advance web check-in by guests with online room

selection with incentives offered and the novelty of the feature will

add value to the E-strategy even if check-in time at the hotel may not

be a critical factor for the hospitality consumer.

Further availability of such independent sites may galvanise the

major tour operators in generating countries to actively promote this

destination as increasing influence of such independent marketing

channels across customer communities will diminish the influence they

have on the hospitality industry in this country. |