Export proceeds and foreign exchange leakage - Part 3

Nihal Amerasekera Former Chairman PERC

Continued from yesterday

IMF ‘Article VIII Status’ is essentially, vis-a-vis, the

‘liberalisation’ of imports and exports, that too, subject to, quotas,

restrictions and sanctions, imposed even by several countries with ‘free

economies’, and such ‘status’ does not prevent countries from

‘monitoring and enforcing’ the correct repatriation of export proceeds.

Exports must necessarily result in proceeds being repatriated back to

the country, within a stipulated period of time. Furthermore, exports

ought not be permitted to be effected, without the export documentations

being channelled through the banking system. Exports must necessarily result in proceeds being repatriated back to

the country, within a stipulated period of time. Furthermore, exports

ought not be permitted to be effected, without the export documentations

being channelled through the banking system.

Given the ‘perilous’ state of the economy, Sri Lanka could

‘ill-afford’ the prevalent ‘lunacy’! Given the overall impact on the

national economy, to avoid doing so, on the pretext that bank charges

are prohibitive would be ‘nonsensical’!

Where any exceptions are warranted due to emergencies and/or bank

holidays, separate procedures and guidelines ought be adopted. The

banking system is not costly, as baselessly and curiously,

‘questionably’ so made out to be, by those interested in ‘tediously’

‘siphoning out’ foreign exchange from the country!

As per the IMF Report 2004 on ‘Exchange Arrangements & Exchange

Restrictions’, it is disclosed that 98 countries enforced exports

proceeds ‘repatriation’ requirements, whilst 75 countries further

enforced export proceeds ‘surrender’ requirements, where export proceeds

are compelled to be ‘surrendered’ and ‘converted’ into the currency of

that particular country.

Countries that had done away with export proceeds ‘repatriation’ and

‘surrender’ requirements, are those developed countries, with

‘considerable foreign exchange reserves’, and those attracting the

‘inflow of foreign capital’. Sri Lanka, on the other hand, is ‘begging’

for ‘foreign investments’ and ‘foreign borrowings’!

To compare Sri Lanka, with practices in developed countries, who

enjoy substantial foreign exchange reserves and attract foreign capital,

is puerile, ill-logical and misleading! On the other hand, to compare

with those practices in countries, such as Indonesia and Philippines, is

far worse!

To adduce that several countries are moving away from export proceeds

‘repatriation’ and ‘surrender’ requirements, is no ‘justification’ to

cover-up, what had happened in Sri Lanka since 1993!

Unlike Sri Lanka, those countries have now developed adequate foreign

exchange reserves and foreign capital inflows! The cogent question is,

what were the procedures and practices in those very countries, during

the years 1993 to 2004, and even upto 2006?

Among the countries in the region that enforce both exports proceeds

‘repatriation’ requirements and exports proceeds ‘surrender’

requirements, are India, Pakistan, China, Malaysia, Thailand and South

Africa.

All these countries, like Sri Lanka, are ‘Article VIII Status’

countries. Hence the question arises, as to how, and why, Sri Lanka had

not and does not enforce export proceeds ‘surrender’ requirements, or in

the least enforce exports proceeds ‘repatriation’ requirements?

Even the Republic of Korea enforces exports proceeds ‘repatriation’

requirements, whilst South Korea mainly transacts and deals in US Dollar

terms. Are not the economies of these countries very much larger and

stronger, than that of Sri Lanka?

Ironically, on the other hand, Sri Lanka in fact ‘borrows in foreign

exchange’ from some of these very countries! Whilst these countries have

procedures to enforce exports proceeds ‘repatriation’ requirements and

exports proceeds ‘surrender’ requirements, Sri Lanka, on the other hand,

does not enforce such requirements, not even exports proceeds

‘repatriation’ requirements since 1993, consequent to the two

‘questionable’ gazetted Orders referred to above! Sri Lanka could have

‘ill-afforded’ such liberty, warranting investigation and

‘rectification’ in the given crisis now!

‘Contractual obligation’ to repatriate export proceeds

The IMF Resident Representative in Sri Lanka in 2005, Jeremy Carter

supportively concurred with the foregoing, and in fact, urged that the

Government ought to monitor the ‘repatriation’ of export proceeds, at

least where the Government had granted concessions to exporters,

vis-a-vis, through the BOI, and other tax holidays and concessions, zero

rated VAT, concessionary interest, etc.

Such concessions granted by the Government foregoing ‘public

revenue’, contractually obligated and bound the exporters to ensure the

repatriation of export proceeds to Sri Lanka. If not, what is the

purpose of having granted such ‘concessions’ to promote exports,

foregoing valuable ‘public revenue’? What is the basic logic?

Is not the realisation of exports proceeds, the very objective of the

Government, in granting to exporters, such very concessions, foregoing

‘public revenue’? Sri Lanka is a ‘foreign exchange seeking country’,

through ‘earnings’, ‘investments’ and ‘loans’!

When concessions are afforded to promote exports by way of import

duty exemptions, granted even prior to any exports being effected, with

subsequent tax holidays, concessionary rates of interests, zero rated

VAT, etc., thereby foregoing valuable ‘public revenue’, then would not

there come into force and operation, a ‘contractual obligation’ on the

part of the exporters, who had obtained such concessions, at the cost of

valuable ‘public revenue’, to ensure that export proceeds are

‘repatriated’ into Sri Lanka?

Central Bank concedes that export proceeds, not repatriated back to

Sri Lanka, could not be used for the acquisition of properties or other

capital assets outside Sri Lanka, and questionably ‘conjectures’ that

such non-repatriation could have been to ‘cover up exporters foreign

currency expenditure, payment defaults, etc’.

Without proper documentation and monitoring, how could there be any

such postulation or conjecture? Would not the ‘export of goods’, with no

inward repatriation of foreign exchange therefor, tantamount to the

‘outward remittance’ of foreign exchange from the country, which is

subject to the provisions of the Exchange Control Act, with heavy fines

imposed?

Ought not the expenditure incurred on exports, be necessarily

‘monitored’ by the Controller of Exchange, inasmuch as foreign exchange

‘outward remittances’ are monitored and controlled in terms of the

Exchange Control Act, including those of overseas Offices, established

with the permission granted by the Controller of Exchange? Why the

double standards?

Would not the ‘systematic non-repatriation’ of exports proceeds

tantamount to the ‘export of capital’, which is prohibited, without the

approval of the Controller of Exchange.

In certain instances, this has led to a number of industries crashing

in the export sector, with investors having decamped, with considerable

exports proceeds not repatriated back to Sri Lanka; leaving statutory

and other debts, and the employees in the lurch; resulting in the

appointment of a Cabinet Sub-Committee, chaired by the Minister of

Labour, to deal with the consequential problems, ‘saddled’ on the Sri

Lanka Government!

Ironically, on the other hand, ‘importers are subject to strict

supervision’, with warnings of dire consequences, by the Controller of

Exchange, including also on petty Credit Card payments! Ought not

exporters, who have been granted concessions and incentives foregoing

valuable ‘public revenue’, also be similarly subjected to ‘equal

treatment before the law’, as the importers are subjected to? If not,

why?

Whilst a ‘blind-eye’, as it were, is turned on the exporters, high

import duties, taxes and other conditions are imposed to restrict

imports to ‘prevent’ and/or ‘reduce’ the ‘outflow of foreign exchange’,

directly adversely impacting on the ‘cost of living’!

There is no argument, whatsoever, for not mandating the export

proceeds ‘repatriation’ requirements, particularly when exporters had

been given import duty concessions, even before the commencement of

exports, and thereafter several other tax and other concessions,

foregoing ‘public revenue’.

This would be the Government’s ‘investment’ to achieve exports, not

mere ‘reported figures’, but the actual realisation of the export

proceeds, to ‘protect’ the much needed foreign exchange requirements of

the country.

One simply cannot understand, what is so ‘sensitive’ as ‘purported’

for mandating export proceeds ‘repatriation’ requirements and enforcing

the same, when there is a ‘contractual legal obligation’ to have done

so? Whereas importers and Credit Card payments are being dealt with

otherwise, without any such purported ‘sensitivity’! Why such hypocrisy?

The Central Bank recently permitted ‘indirect exporters’ to maintain

‘foreign currency accounts’, ‘strictly’ for the purpose of utilising

such foreign exchange for the purpose of importing ‘input requirements’

of the ‘indirect exporters’, and the Central Bank stipulating that no

cash or travellers cheques should be issued from such ‘foreign currency

accounts’, and further stipulating that any excess at the end of each

month, over US $ 5000/-, should be ‘surrendered and converted’ into Sri

Lanka Rupees at the end of each month!

Does it therefore not stand to logical reason, that the ‘direct

exporters’, also necessarily must be subjected to the same restrictions

and enforcement procedures, without any discrimination and ‘unequal

treatment before the law’?

What is the reason not to have done so, and not to do so? Why such

discrimination of the ‘small indirect exporter entrepreneurs’? Is it not

‘unequal treatment before the law’, violative of the fundamental right,

to ‘equal treatment before the law’, guaranteed under the Constitution?

Even prior to the voluntary ‘survey’ carried out by the Controller of

Exchange, the then Governor, Central Bank, Sunil Mendis by letter dated

October 20, 2004, admitted that it is estimated that only 80% of export

proceeds have been repatriated to Sri Lanka.

Central Bank ‘admits’ only 80% repatriation of export proceeds

The then Governor, Central Bank further baselessly ‘postulated’, that

when ‘adjusted’ for ‘exports, where no foreign exchange has been paid

for corresponding imports of fabric and other accessories in the garment

industry’, that the ‘non-repatriation’ of export proceeds could be

estimated to be 12% of exports! What and where were the facts to support

such ‘postulation’?

The then Governor, Central Bank further ‘conjectured’, that this

balance ‘12% non-repatriation’ of export proceeds’ could be due to

“holding of export proceeds abroad to cover up exporters’ foreign

currency expenditure; identification and categorisation problems; and

payment defaults by importers etc”! What and where were the facts for

such ‘conjecture’?

Disregarding the baseless ‘postulation’ and ‘conjecture’ of the then

Governor, Central Bank, the percentage of non-repatriation of export

proceeds, reckoned by the Central Bank, as estimated to be 20%, is an

‘average’, where one exporter would have repatriated 100%, whilst

another exporter would have not repatriated at all, thereby having, in

effect, ‘exported Capital’ in the form of goods.

Would not the ‘export of capital’ be a violation of the provisions of

the Exchange Control Act, attracting penalties in such regard? Why did

the Central Bank turn a ‘blind-eye’ on such ‘miscreant’ exporters,

whilst on the other hand, strictly probing Credit Card payments,

comparatively of ‘insignificant’ amounts?

A 20% ‘non-repatriation’ would amount to US $ 13,436 Mn., a ‘15%

non-repatriation’ would amount to US $ 10,077 mn., and a 10%

‘non-repatriation’ would amount to US $ 6,718 mn., for the years 1993 to

2006. This is several times the country’s ‘foreign reserves’!

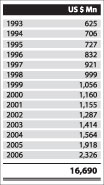

On the other hand, foreign inward remittances since 1993 to 2006,

essentially from the poor Sri Lankan employees working abroad,

undergoing much hardship, with the sacrifice of family life,

particularly working in the Middle East, as reported in the Central Bank

Annual Reports, have been as follows:

How could one ‘freely’ have permitted such cognisable ‘leakage’ of

foreign exchange in the region of US $ 6,718 Mn. to US $ 13,436 Mn. on

exports during the years 1993 to 2006, whilst poor immigrant workers

have remitted US $ 16,690 Mn. during the years 1993 to 2006, as per

Central Bank Reports?

Is it not a fact that these ‘foreign exchange remittances’ from the

poor Sri Lankan workers toiling abroad, contributed to sustain the

economy? In the absence of which, what would have been the state of the

economy?

Ironically, ought not these ‘foreign exchange remittances’ from poor

Sri Lankan immigrant workers, be compared with the estimated ‘leakage’

of export proceeds? If not for the ‘foreign exchange remittances’ from

these poor workers toiling abroad, what would have been the resultant

foreign exchange position today, vis-a-vis, financing of imports,

foreign payments, and foreign loans? Would not the economy of the

country have been in a far worse, perhaps even a ‘bankrupt’ position

today?

Central Bank

The summary of ‘revelations’ from the responses provided to the

Questionnaires of the subsequent voluntary ‘survey’ carried out by the

Controller of Exchange, without any supportive documentary proof or

evidence in support thereof, or certifications, as warranted, from

banks, enabling the verification of the correctness of the informations

contained in the responses, given by the exporters to the

Questionnaires, were reported by the Controller of Exchange on May 5,

2005.

Quite significantly, even these ‘voluntary’ responses in respect of

the third quarter of 2004, revealed that only 81% of the export proceeds

had, in fact, been repatriated into the country by December 31, 2004.

This indeed ‘corroborated’ the 80% estimate previously given by the

then Governor, Central Bank on October 20, 2004!

The balance 19% ‘non-repatriation’ by the exporters had specifically

been accounted for by them, that too, by only 51% of the exporters,

since ‘intriguingly’ there was no ‘compulsion’ imposed on the exporters

to answer the Questionnaires.

There was no ‘disclosure’ by the said ‘survey’ by the Controller of

Exchange, that 8% of the 20% leakage has been in respect of ‘garment

exports, where fabric and other accessories are provided by the buyers’,

as had been baselessly ‘postulated’ by then Governor, Central Bank.

Surely, are not such garment exports invoiced for the ‘value

addition’ of ‘cutting, making and trimming’? If the total value of the

made garments is invoiced for, then would not there be the need to pay

for the ‘import of fabric and other accessories’?

However, it was not intriguingly revealed that the balance 12%, after

the above baselessly ‘postulated’ 8% ‘adjustment’, to a large extent is,

in respect of “holding of export proceeds abroad to cover up exporters’

foreign currency expenditure; identification and categorisation

problems; and payment defaults by importers, etc’’, as the then

Governor, Central Bank had ‘conjectured’!

Nevertheless, this is an ‘overall average’ and not specific to

exporters, some of whom would have ‘swindled’ by expending well above

such ‘overall average’!

(Continued tomorrow)

|