Sri Lanka's rubber industry needs 21st century thinking

Dr N Yogaratnam

Sri Lanka is one of the nine major producers of Natural Rubber (NR)

in the world. In terms of productivity, it is now the third best.

However, if Sri Lanka is to retain, or better still, improve its

position in the fast expanding and increasingly competitive global

rubber business in the next ten years, it has to pull itself up by the

bootstraps, smoothen the many rough edges, and adopt new technologies

and practices, suited to the local agro-climatic and socio-economic

conditions.

|

|

Dr N

Yogaratnam |

Despite impressive progress in the Sri Lankan rubber industry, it is

still plagued by a series of critical issues such as declining planted

area, labour shortage -more specifically skilled tappers, low land and

labour productivity, an ageing labour force, inadequate resources, and

high cost of production.

Present scenario

Rubber is grown in the rain fed low lands of the South Western,

Southern and Central parts of Sri Lanka, though the dry, medium higher

ground is also being explored now with varying degrees of success.

Rubber is grown in as many as 15 districts. But the top growers are:

Kegalle, Kalutara and Ratnapura, with Colombo being a distant fourth.

However, the area under cultivation had fallen sharply since the

1970s, when over 200,000 hectares were under rubber. By 2004, only

115,300 ha were under rubber. This increased to 124,300 ha in 2009. The

total extent is now 127.5 ("000) hectares of which the area in tapping

is 101,720 ha. The area under tapping increased from 89,000 in 2004 to

95,300 in 2009 to 101,720 in 2011.

The rubber tree has to be replanted every 30 years. However, the area

under re-planting has been modest. It was 5200 ha in 2007; 1000 ha in

2008; and 3,600 ha in 2009. The government wants to increase the new

planting area to 40,000 ha, but this appears to be unlikely to be

achieved due to technical as well as non-technical reasons, and also

because increases in rubber prices seem to act as a discouraging factor

on re-planting.

Rubber production had been increasing in Sri Lanka, from 94.7 million

kg in 2004 to 136.9 million kg in 2009 and was 157.9 million kg in 2011,

which was a 3.2 percent increase over the figure for 2010.

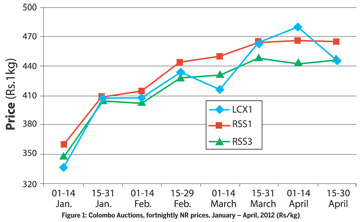

The Global as well as domestic NR prices continue to be remunerative

to growers, although they show signs of volatility, as was in the past

(Figure 1).

Productivity

Rubber has witnessed a ten fold increase in productivity in the last

133 years. In the early days, it was only 300 to 400 kg per hectare per

year, due to the use of unselected seedlings. But later, genetically

improved clones secured yields exceeding 3000 kg per ha when grown under

optimum conditions.

In Sri Lanka, it was only 653 kg per ha in 2001. But in 2004, it had

shot up to 1064 kg per ha. In 2009 it was 1437 kg per ha. The yield in

2010 was 1683 kg per ha, and in 2011, it was 1728 kg per ha.

However, the Sri Lankan yield has been lower than those of India and

Vietnam. In 2011, India recorded the highest yield with 1835 kg per ha

of tapped area. Vietnam came second with 1733 kg per ha. Sri Lanka was

in the third place with 1728 kg per ha; and Thailand was fourth with

1688 kg per ha.

In the popular imagination, Malaysia is the home of rubber. But the

yield there is just 1500 kg per ha in 2011. The figures for the other

countries are: Philippines, 1533 kg/ha; Cambodia, 1150 kg/ha; China,

1144 kg/ha; and Indonesia, 1057 kg/ha.

Long way to go

The present Sri Lankan national yield is less than 50 percent of the

achievable. The corporate sector's yield is about 40 percent of the

maximum potential. However, going by the standards achieved by other

leading global rubber producers, and given the operational skills of Sri

Lanka's scientific and management personnel, it should not be difficult

for Sri Lanka to meet these targets, if a genuine effort is made.

The foremost challenge before research institutions and the rubber

industry here is to develop a golden clone which will not only be very

high yielding but also have other positive attributes, such as

compatibility with over exploitation, low frequency tapping without loss

of yield and so on. Research efforts have to be given top priority.

Exceptional performers at the micro level have to be selected and

efforts should be made to replicate their work rapidly. There should be

hybridization of selected parents for subsequent selection of potential

clones. Bio-technology should be used to improve the genetic make up of

the trees.

If Sri Lankan scientists and plantation firms fail to do these, MNCs

may bring out genetically altered transgenic rubber clones for sale to

rubber producing countries at exorbitant prices.

There may be royalty claims too.

Antibiotics from rubber

It is possible to alter the technological properties of rubber so

that more uses could be found for the product. He believes that the

rubber tree could be a future factory for the production of antibiotics

and that attempts are already being made to do so.

A wide variety of rubber products are now manufactured in Sri Lanka.

The country has the potential to be one of the world's leading rubber

product manufacturers due to its high quality raw materials; top grade

natural rubber with very low level of proteins; and the relatively low

processing cost.

Among the rubber products made in the island are: surgical, household

and agricultural gloves, balloons, hallowing masks and rubber toys. The

latex or rubber industry has expanded significantly in the last decade

and it presently accounts for about 35 percent of the local consumption

of natural rubber.

The leading Sri Lankan manufacturers of rubber products in the island

are: Ansel Lanka; DSI; Loadstar; Hanwella Rubber Products; Lalan Group;

Dipped Products; Trelleborg; Associated Motorways; and Richard Peiris.

Rising domestic use

Much of the rubber and rubber products produced by Sri Lanka is

consumed locally. In 2009 for example, 84.09 million kg were locally

consumed and 56 million kg were exported. The items exported were tyres,

tyre cases, tubs, plates, sheets and strips, surgical and other gloves,

floor coverings and mats.

In 2009, exports of natural rubber were worth Rs.11.3 billion and

those of manufactured rubber products, Rs.44.3 billion. The total

exports were worth Rs.56 billion. In 2010, the total had gone up to

Rs.64 billion. In 2009, exports of natural rubber were worth Rs.11.3 billion and

those of manufactured rubber products, Rs.44.3 billion. The total

exports were worth Rs.56 billion. In 2010, the total had gone up to

Rs.64 billion.

Previously, however, exports outstripped domestic consumption. Even

as recently as in the 1990s, domestic consumption was to the tune of

just 21 to 35 percent, but now it has gone up to about 65%.

The change which occurred in the last decade or so is attributed to

the emergence of local rubber based industries.

Out of the 136, 880 metric tones produced in 2009, 54,550 mt went

into the manufacture of sheets, 31,000 mt went into the manufacture of

latex crepe, and 29,934 mt into the making of centrifuged latex and

other products. As for exports, sheets accounted for the bulk. Again, in

2009, out of the 55,991 metric tones of exports, sheets accounted for

24,402 mt, and latex crepe 13,683 mt.

Small holders and SMEs

Most of the land under rubber in Sri Lanka is under small holders,

who number about 130,000 families, concentrated in the Low Country Wet

and Intermediate Zones. In 2009, out of a total of 124,300 hectares,

72,719 ha were under small holders and 51, 581 ha under the "estate

sector".

However, over the years, there has been a sharp decline in the area

under small growers.

In 1990 for example, out of a total of 199,048 hectares, 139,488 ha

were under small growers and only 59,560 were under the big holders or

the estate sector.

A study of the key socio-economic characteristics of the new small

holder rubber cultivators in Moneragala district shows that they are

uneducated, though on an average they are young, that is, under 50 years

of age. The average level of education is primary. This is a constraint

to the adoption of new techniques for improving productivity. Another

factor impacting productivity is the low level of income. It is just

Rs.10,000 per month.

Strategic small holdings

The socio-economic profile of this key sector of the Sri Lankan

population calls for the treatment of the small scale rubber sector as a

strategic sector needing urgent attention. This sector should be the

target for special ameliorative measures and state aid, because the

established or "mature" rubber cultivators earn more, on an average,

Rs.25,000 per month. The awareness level among the "immature"

cultivators of techniques of maintaining land was just 21 percent. And

about disease control, the awareness was 34 percent. Awareness of

planting methods, inter-cropping and soil fertility management was

moderate (49, 45 and 50 percent respectively). The study found that

awareness of the proper tapping method was below 40 percent.

Inferior quality plants

In the immature holdings, the number of plants per hectare is lower

than the recommended 500 plants per hectate.

The farmers cite drought and the poor plants given to them as reasons

for not planting as many trees as they should. In 97 percent of the

holdings, cover crop is not present. Weed control is practiced in 98

percent of the cases, but the recommended method is not followed.

However, the small holders get a fertilizer subsidy, and 78 percent

use it. More that 60 percent use it in the recommended way. However, the small holders get a fertilizer subsidy, and 78 percent

use it. More that 60 percent use it in the recommended way.

Mature fields

In the "mature" fields too, the number of trees per hectare is less

than the recommended number. It is 414 per ha, and not 500. The number

of trees which can be tapped is even less at 268 trees per ha. Farmers

give drought as the reason for the deficit but the poor quality of the

plants is also cited as a reason.

Fertilizer was not applied in 54 percent of the mature holdings. But

the method of application accorded with the prescribed method in 57

percent of the cases. The study says that due to high demand for

planting material, poor quality planting material had been supplied in

some cases.

Grower efficiency

Scientific measurements of the efficiency in rubber cultivation

showed that the greater the extent of land, better the efficiency. But

farmers find it difficult to get land for rubber cultivation.

They had not received permits from the Divisional Secretariats for

cultivation. Nearly 53 percent of the farmers said that they were

occupying state land on lease or having Swarnabhoomi or Jayabhoomi

deeds. Some were encroachers.

Delay in subsidy payments, marketing problems, and lack of training

facilities were also cited as reasons for poor productivity in the small

scale sector.

Problems of mature farms

Production efficiency levels in mature rubber lands in Moneragala

district averaged 59 percent, which meant that 41 percent of the

potential maximum productivity was lost due to inefficiency.

Those who tapped their own trees showed highest efficiency levels

than those who employed non family workers. A family which tapped its

trees showed an efficiency of 60 percent and that which employed

outsiders showed 55 percent. Those who had an education of GCE O/L

showed an efficiency of 62 percent, while those with a lower educational

qualification showed an efficiency level of 57 percent.

Value chain

The value chain assessment showed that in Sri Lanka's the failure of

an appropriate and working technical support and monitoring system has

resulted in:

a) Low spread of high yielding clonal planting material

b) Failure to halt spread of low yielding clones

c) Poor cultivation practices which result in 50% - 70% less

productivity in both traditional as well as in non traditional areas

d) Proliferation of poor tapping practices which reduce the tapping

lifespan by around 10 years, i.e. 50%.

e) Very limited recognition of the environmental benefits of rubber

agro forestry in designing replanting programs.

In conclusion it is recommended that proper extension programmes,

especially in the non-traditional rubber growing areas keeping in mind

the poor educational status of the farmer. It is also stressed the need

to monitor the use of the government subsidy to minimize the wastage of

scarce resources.

|