ASEAN - going for single market like EU?

SL exports as at end February 2011 is +52 percent:

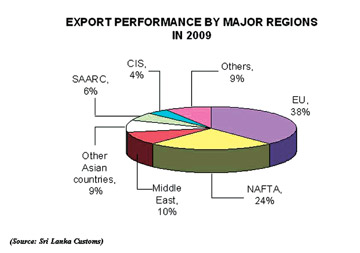

SL Exports to ASEAN countries is below 10 percent:

Rohantha ATHUKORALA

|

|

Rohantha

Athukorale |

Sri Lanka registering a strong 8.6 percent GDP growth in quarter four

of last year, whilst in the first two months of 2011 exports increasing

by 52 percent augurs well for the country. However the issue is that

policy makers have been challenged once again to focus on an activity

away from the economic agenda due to global complexities.

What's important to note is that whilst Sri Lanka is strategising the

way forward on this new challenge, our neighbouring nations - ASEAN, are

making plans by 2015 to have an European style single market economy.

This may include a single currency that can result in a further surge

to the current foreign direct investment of $38 billion recorded in the

recent past so that member countries can drive towards stronger export

growth and economic resurgence that can drive double digit growth being

achieved in the near future.

The power of ASEAN is so strong that already India has had

discussions for a probable trade pact with ASEAN so that the key country

in South Asia can outsmart its rival China on trade and overall quality

of life of its population.

Focusing of Sri Lanka once again, it is commendable that Sri Lanka

has registered an 8.1 percent growth in the first full year post-war in

'2010' with all sectors performing extremely well with a eight percent

plus GDP growth that indicate to the world on the potential talent that

the country can unleash.

The 144 percent increase in profit in private sector performance

further justifies the strength of the economy apart from the buoyant

stock market hype. Given that over seventy five percent of the economy

is private sector driven, the profit numbers flashed in the private

sector annual reports mirrors the strong macro economic performance that

is being announced by the state.

One key issue highlighted is that Sri Lanka's exports accounting for

only 17 percent of GDP can be argued by some as a weakness given that in

the 1990's the exports were 33 percent of the GDP.

But, in my view this is a strength given that in the 1990's the GDP

of the country was only twenty billion dollars whilst today it is at

almost $42 billion plus meaning that the economy has doubled even though

the export sector contribution halving. This gives us an indication of

the sheer power of the rest of the economy.

Apparently in the 1990's the service sector contributed to a mere

twenty percent to the total economy but today this is almost sixty

percent which tells us of the new growth agenda that has taken shape in

the country.

I guess the 41 percent growth in hotels and restaurant sub sector in

2010 tells us the continuity of this segment that will further surge the

service economy of Sri Lanka.

Another way of analyzing this point is that only 17 percent of the

economy is dependant on the external environment namely the global

consumer. Hence in the event another global crisis happens like the

recent financial meltdown or the commodity bubble bursting there will be

a lesser impact on Sri Lanka.

But whilst being positive to the status quo it's important that we

make the export industry 20 billion dollars by 2020.

The good news is that Sri Lanka is on track to achieve this objective

with sharp private sector led strategies supported by the relevant

government agency.

Now the challenge is not to get de-focused or allow unforeseen events

to hinder this progress purely from an economic perspective.

South Asia - growing at 9 percent

If we analyse the performance of South Asia, India leads the way with

a nine percent plus growth with a strong non agricultural sector

performance in excess of ten percent whilst Pakistan has rebounded to

deliver a five percent growth.

|

|

ASEAN countries consist of 10

countries that currently attract $ 38 bn on FDIís annually |

Bangladesh has expanded to six percent mainly due to high remittances

and vibrant service sector but is faced with many industrial labour

issues that is working for Sri Lanka positively.

Nepal is staggering at a 2 percent due to the intense conflicts in

the country but is sure to rebound strongly as it has been in the past

as the government is linking with global infrastructure development

organizations and driving towards improving road access and connectivity

that stimulate livelihood development.

Sri Lanka which recorded a 8.1 percent GDP growth and export revenue

touching a 17.3 percent growth has continued the positive trend in the

first two months of 2011 with a 52 percent increase in value.

The Apparel earnings have grown by 21.9 percent to $385 million with

cutting edge innovation and marketing initiatives whilst the overall

industrial sector performance in January has continued to demonstrate

strong growth.

Rubber sector has grown by 18.7 percent with solid tyres and tubes

leading this growth but we need to watch the implications post the

Japanese Tsunami that has impacted the output of vehicles from Japan.

Agricultural products have continued to perform with a 28.9 percent

growth agenda which means that Sri Lanka is within the 10 billion dollar

export earnings mark for 2011.

What is ASEAN?

Whilst there has been a lot of media attention on ASEAN, let me give

more insights on this development. ASEAN consists of ten members -

Malaysia, Indonesia, Singapore, Brunei, Vietnam, Laos, Myanmar,

Philippines, Thailand and Cambodia.

This common market houses 560 million people but accounts for only 8

percent of global exports which is interesting.

Intra-regional trade makes up of only about a quarter of bloc's total

trade volume, compared to more than 70 percent in Europe.

Exports from Sri Lanka is below six percent but has the potential to

increase.

After years of clearing the first hurdle in cutting tariffs on

merchandise the ten member nation is now focusing on in-tense

discussions to tearing down the protectionists' policies, whilst

resolving ones domestic political stability issues like in Thailand.

|

|

Sri Lankaís landscape is fast changing

due to strong economic growth in the past two years |

The goal does not call for a single currency system as at now but has

the potential to be in the near future which Sri Lanka must carefully

monitor in my view given that Sri Lanka's rupee is managed.

ASEAN strategy and Sri Lanka

The bloc after having secured a pact with the United States is now

working towards a free trade zone with Australia and New Zealand as well

a as China, South Korea and India. This is in spite of the differences

in human rights of Myanmar which demonstrates the respect the bloc is

earning in the economic muscle of the world.

This presents an opportunity for Sri Lanka in my view to drive

exports indirectly by way of value addition. As most of the countries

are into the manufacture of automobiles we can focus on developing

products like rubber beeding, rubber bushes and tyres to name a few.

However, we need to be cognizant that, whilst there is a strong

cohesiveness by the counterparts there is a nationalistic spirit that

leads to non tariff barriers between members.

A recent study by PricewaterhouseCoopers revealed that unless the

nationalistic tendencies are shed, cross-border trade will suffer

significantly.

Sri Lanka needs to take a cue from this spirit as the country has a

unique identity and should not become a mini India.

While we should get the benefits of lower priced automobiles and

transfer of human capital the Sri Lankan identity should be preserved

with non tariff barriers and policy restrictions.

The best case in point is Malaysia which stipulates that in any

investment from its regional counterparts Malays must own 30 percent.

Thailand has banned all imports of rice into the country. In the

South Asian region we saw how India curtailed Sri Lanka's export of tea

into India where less than ten percent of the quota utilization has

happened in the last few years.

However, it must be noted that some of the non tariff barriers in

force has been relaxed.

Implications to Sri Lanka

What Sri Lanka needs to do is it needs to identify the industries

which are vulnerable to international competition and build safety nets

with non tariff barriers.

The logic being that no government in the world is a free trader that

ignores its own constituents back home. The logic being one can lose

elections in no time. Hence, it is time that Sri Lanka wakes up and

drives home a competitive advantage with non tariff barriers so that we

can also claim an identity in the economic stage whilst being part of

organizations like SAFTA and CEPA. The logic being that no government in the world is a free trader that

ignores its own constituents back home. The logic being one can lose

elections in no time. Hence, it is time that Sri Lanka wakes up and

drives home a competitive advantage with non tariff barriers so that we

can also claim an identity in the economic stage whilst being part of

organizations like SAFTA and CEPA.

But it must be said that the best non tariff barrier is to make one's

product so competitive that it can outsmart a competitive product at the

consumer end. But sometimes the private sector requires breathing space

and hence to some degree non tariff barriers are a useful tool to

practice. The second strategy to initiate is to identify the key

products that we have a comparative advantage and strengthen these

products in the supply chain so that we are ready to capture the looming

new opportunity. This can be with new technology and introducing

branding and marketing initiatives.

The third strategy is to venture into these markets and develop

business linkages so that when the market opens out in a common front

(post the signing of the trade arrangement) Sri Lankan exporters are one

up and already made inroads into these markets.

Whilst arming ourselves with strong and sharp strategies I strongly

feel there is nothing called 100 percent free trade. We must have a

built in flexibility to exploit opportunities but, we should be

sensitive to the realities of the domestic market and lay down our rules

very clearly. My view is lets be proactive at least this time around.

(The writer is a doctoral candidate at a top University in Asia. He

has a double degree in marketing and an MBA, winning the 'Best Marketer'

title in Sri Lanka and a 'Business Achiever' award from PIM, University

of Sri Jayawardanapura. He currently serves the International public

sector for South Asia, based in Sri Lanka.)

|