RUBBER

Natural rubber market dips

Dr N Yogaratnam

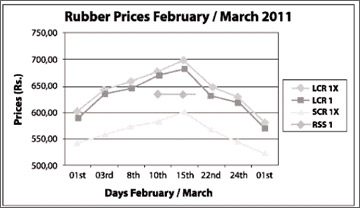

Natural rubber (NR) prices at the Colombo Auctions have dipped by

10-17 percent, since the third week of February from their historical

high (Table 1 & Figure 1) and similar tendencies were observed in the

other NR markets too. While the tightness in the supply continues, crude

oil and currencies of NR exporting countries provide further support to

the market in absorbing the bearish sentiments caused by a weak demand

and a strong Japanese yen.

Production

Total production of NR from Member countries of the Association of

Natural Rubber Producing Countries (ANRPC) is projected to rise this

year first quarter by 6.0 percent on year.

This is a remarkable growth as the comparison is with a big base. The

first quarter in the year before was a period of abnormal growth (17.9

percent) as detailed in Table 2.

Normally, yield is low during the wintering season, but attractive

prices will induce growers to continue to tap, which some, particularly

the smallholders in some countries, normally avoid during wintering.

Meanwhile, delayed occurrence of wintering this year and more rains

received in January help Vietnam to continue tapping until end of

February.

The country used to enter wintering off season in the first week of

February every year. In Indonesia, the second largest producer, about 70

percent of the tappable rubber area is in the south of the equator where

wintering comes only in July every year. Supply from only the north of

the equator is affected by the present wintering.

The total area under tapping in the ANRPC is estimated to expand this

year by 200,000 ha as young trees attain tappable maturity and a limited

extent of aged low-yielding dormant trees opens for tapping.

The expansion in tappable area will be more pronounced in Thailand

where 114,000 ha of trees planted during 2004 and a portion of 173,000

ha planted during 2005 are expected to attain tappable maturity this

year.

However, yield from these trees would be low, as rubber tree attains

peak-yielding phase only by the tenth year of planting. Moreover, the

new trees to be opened for tapping this year are concentrated in the

country’s north and north-east which are agro-climatically less suitable

compared to the traditional region in the south.

While the new trees attain tappable maturity, a portion of existing

aged trees is expected to be uprooted this year. As countries revised

their earlier-reported preliminary estimates, ANRPC’s total supply in

2010 now stands at 9.322 million tonnes, at 4.7 percent rise from the

previous year.

In line with ANRPC’s indication given before, Malaysia produced only

0.939 million tonnes as against 1.0 million tonnes targeted. Thailand

also has revised down the figure on finalization of data for 2010.

Revised figures for 2010 and targets for 2011, of respective

governments are indicated in Table 4. It may be noted that the annual

figures for 2011 are governments’ optimistic targets fixed by assuming

favourable weather conditions and continuation of high prices during the

whole year.

An assessment made by the ANRPC points to the supply rising by 4.8

percent during 2011, 5.2 percent during 2012, 6.3 percent during 2013,

7.0 percent during 2014 and 7.5 percent during 2015.

Average yield

The trends in average annual yield (table 3) indicate that Sri Lanka

is forging ahead with significant yield increases, now in the region of

1610 kg/ha, which is not far away from the Indian and Vietnam yields.

Key Economic Developments

It would be useful to examine the emerging economic trends, as

reported by ANRPC, as they are crucial in determining the pace of NR’s

demand growth

ANRPC reports that speculative investments aimed at short- term

returns, popularly called “hot money”, continue to flood Asia’s emerging

economies, putting upward pressure on their currencies and thereby

reducing export competitiveness.

Malaysia’s ringgit touched a 13-year high to the U.S. dollar and the

Thai, Philippines and Singapore currencies have all gained substantial

strength, The general perception is that the U.S. Federal Reserve’s

decision to massively pump liquidity into the U.S. economy has

accelerated capital flows into property and other assets in emerging

economies, as interest rates in the U.S., Europe and Japan remain at

near-zero levels.

The resultant appreciation in currencies has forced governments in

many Asian countries to intervene in foreign-exchange markets during the

past few weeks. Unlike foreign direct investment in long-term projects,

short-term investments can be a burden for the economy by boosting

liquidity and thereby putting upward pressure on asset prices.

Adding further to the inflationary pressure caused by the inflow of

“hot money”, crops in many countries have been damaged by bad weather,

keeping prices high across the board.

Floods in Australia and damage to China’s wheat crop have added

difficulties for governments in effectively controle inflation.

At the same time, soaring food prices have assumed a political

dimension, compelling governments to defuse unrest among the people,

especially in the context of developments in Egypt, Tunisia and other

countries. The United Nation’s overall food price index in January shows

a 28.3 percent annual increase, with cereals up 44.1 percent.

Inflation

High inflation adds pressure on many countries to allow their

currencies to gradually appreciate. A stronger currency can help in

reining in inflation by making imported food staples and fuel cheaper.

But, priorities vary across countries. For example, China does not

want the yuan to appreciate freely against the dollar in view of its

possible damage to the country’s export sector.

The government’s strategy is to allow the yuan to appreciate, but at

a slow pace. Chinese yuan has gained about 3.5 percent against the U.S.

dollar since June 2010.

Central banks in Asia, on their fight against accelerating inflation,

have raised interest rates in successive steps and increased the reserve

deposit to be kept by banks.

Peoples Bank of China raised its benchmark lending and deposit rates

for the third time in four months, by 0.25 percentage point effective

from second week of February.

China is likely to make further tightening moves in coming months

which may possibly hurt Chinese demand for commodities. The country’s

consumer prices in January were up 4.9 percent from a year earlier,

faster than 4.6 percent in December.

The food inflation jumped as much as 10.3 percent in January.

USA

The U.S. economy appears to have returned to the levels that

prevailed before the Lehman Brothers meltdown in 2008.

The GDP rose to a record high in the fourth quarter of 2010. But the

recovery has been fuelled to a large degree by aggressive government

support. As a result, investors are worried about the situation when

government support begins to wane in a few months.

High unemployment, badly damaged housing market and fragile

government finances pose serious threats to a sustained growth in the

U.S. economy. Budget deficit for 2011 is expected at 11% of the GDP,

which is the highest since World War II.

Japan

Japanese economy shrank in the fourth quarter of 2010 at 1.1 percent

annual rate whereas Chinese economy surged 9.8 percent during the same

period. Japan’s GDP in 2010 stood at 7 percent smaller than China’s.

Consequently, China passed Japan to become the world’s second largest

economy after the U.S., a position which Japan stood solidly since

overtaking West Germany in 1967.

China’s imports in January were up 51 percent from a year earlier

whereas exports jumped 38 percent. Surging imports reflect robust

economic activity within the country as well as higher prices for

imported commodities.

India

India’s overall inflation slowed to 8.2 percent in January from 8.4

percent in December. Government expects inflation would ease to below 7

percent by the end of the March. The Reserve Bank of India raised its

lending and borrowing rates by 0.25 percentage point each in January,

the seventh increase since March 2010. India has slightly raised its

economic growth forecast to 8.6 percent for the current fiscal ending

March 2011.

However, the country runs a high current-account deficit as approved

foreign direct investment fell 27 percent between April and November

2010 from a year earlier.

The deficit current-account for the fiscal year ending March 2011 is

expected to hit 3.5 percent of the GDP, which is the highest in two

decades.

As high global commodity prices will further strain the country’s

balance-of-payments, Indian rupee is likely to lose its strength against

the dollar further.

Indonesia

Indonesian economy grew at its fastest rate, 6.9 percent on year, in

seven years in the last quarter of 2010 mainly driven by exports which

were up 16.1 percent.

The government forecast the economy to grow 6.3 percent in 2011.

Surging inflation led the Bank of Indonesia to raise interest rate for

the first time in a year and a half.

Thailand

Thai economy emerged from a brief recession by posting 3.5%

annualised growth in the fourth quarter of 2010 in spite of damages

caused by widespread flooding during the quarter.

The economy which grew 7.8 percent in 2010 is expected to moderate in

2011 at 4.4 percent rate. The key driver of the growth in 2010 was the

28.1 percent rise in exports.

The government forecasts export growth will slow to 10 percent this

year due to high base and sluggish economies in some of Thailand’s key

trading partners.

The economy faces a few risks this year which include continued debt

problems in Europe, a weak Japanese economy, rising interest rates,

higher oil price and possible political uncertainty ahead of early

elections.

Vietnam

Vietnam, devalued its currency (dong) on February 11th to 20,693 dong

to the US dollar from 18,932. This suggests that the government’s top

priority is fostering economic growth by pumping up exports rather than

cooling inflation.

A weaker currency makes the country’s exports more competitive

abroad, but makes imports expensive and thereby fuels inflation.

Consumer prices which soared 12 percent in January 2011 from a year

earlier, is likely to worsen further. However, Vietnam government is

working on ways to curb inflation by scaling down the country’s credit

growth to below 20 percent from an earlier 23 percent.

Demand for NR

China, India and Malaysia, the three major consumers of NR in the

ANRPC, account for 48 percent of the commodity’s global demand.

The growth rates worked out for the first quarter this year point to

a slow down or decline.

This is partly due to comparison with a big base as first quarter of

2010 was a period of abnormally high growth in import and consumption in

all the three countries.

However, China’s further policy moves aimed at cooling inflation

could affect demand from the country. At the same time, a further

appreciation in yuan could work on the other way.

The government’s policy is to allow the yuan to appreciate only

slowly without affecting the country’s export sector.

Indian automobile market, which is Asia’s third-largest, weathered

the global economic downturn better than the rest of the world.

Passenger car sales rose 26 percent over year to 184,300 numbers in

January 2011 reflecting rising personal income among the middle class as

the economy grows.

Availability of new models and easy bank loans encouraged people to

spend more on new vehicles.

The country’s total production of automobile tyres rose 28 percent

during 2010, with passenger car tyres posting 39 percent growth.

Moreover, India exported 23 percent more automobile tyres (all

categories together) during 2010 as compared to the year before. Export

of passenger car tyres recorded 32 percent rise during 2010.

The demand seems to have taken a slow pace so far during the first

quarter. However, Chinese buyers are likely to actively enter the market

after a strategic short withdrawal.

Apart from demand and supply, a host of others factors have been

influencing market.

Influence of NR exporting countries’ currencies

Nearly 80 percent of the global production of NR is internationally

traded in U.S. dollar terms. As such, currencies of NR exporting

countries influence NR prices significantly.

NR prices, quoted in the dollar terms, are expected to gain support

from an appreciation in currencies of the exporting countries. The

opposite is expected when the currencies weaken.

Given this background, let us attempt to examine the current trends

in NR market with reference to relevant currencies which have been

dynamic mainly on account of huge inflow of speculative investments from

abroad.

The movements of Thai baht, Malaysian ringgit and Indonesian rupiah

against U.S. dollar during the period from December 1, 2010 to third

week of February, 2011 indicate that the currencies sharply strengthened

on the US dollar from February 1 onwards.

Malaysian ringgit, for which the strengthening phase began much

earlier, gained further strength until the Bank Negara, the country’s

central bank, intervened causing a short-lived reversal of the trend.

About 87 percent of the global export of NR (including NR-rich

compounds) originates from the above three countries. With their sharp

strengthening, the three currencies have been exerting strong upward

pressure on NR prices from the beginning of February.

Influence of Japanese Yen

Japanese yen influences physical NR prices through TOCOM futures,

which are traded in terms of Japanese yen. Investors normally speculate

on TOCOM rubber futures with reference to the yen’s strength against the

dollar. A weak yen makes TOCOM futures less expensive and thereby helps

in attracting investors.

Therefore, NR futures in TOCOM are expected gain support when the yen

weakens. The opposite is expected when the yen gains strength on the

dollar.

Influence of crude oil

Crude oil price influences NR market through speculation on possible

substitution between NR and synthetic rubber (SR). Synthetic rubber,

being a petroleum-derived product, can become more expensive on a rise

in crude oil price.

Although the actual substitution between the two elastomers is

insignificant in the short-run, on account of technical reasons,

speculation works on the possible substitution and thereby influences NR

market.

Crude oil market has been bullish from the end of 2010. It gained

further momentum as political turmoil in Libya, followed by Egypt,

disrupted crude supplies.

As several oil companies in Libya are pulling personnel from their

companies, about 50,000 barrels a day production has been shut down. The

country which produces 1.58 million barrels a day is the seventh-largest

oil producer in the OPEC.

However, OPEC does not see any reason for concerns over supply as

Saudi Arabia alone has 3.5 billion barrels a day spare capacity to

comfortably cover any shortfall in Libya. On the other side, oil

industry analysts point out that replacement oil from other countries is

likely to be of poorer quality.

Conclusion

The current developments in NR market indicate that:

1. A 6 percent rise in supply is anticipated for the first quarter of

this year.

2. The demand stays weak as dominant buyers strategically stay away

from the market.

3. Currencies of Thailand, Indonesia and Malaysia support NR prices.

However, a continued support from the currencies seems to have faded

since mid February.

4. A sharp official devaluation in Vietnam dong has made the

country’s NR exporters more competitive, forcing exporters in other

countries to reduce offer prices.

5. Japanese yen, although supported NR market during the first half

of February, but appears to exert downward pressure on the market,

thereafter. 6. Surging oil prices continue supporting NR market.

However, due to weak demand and the yen’s strengthening, NR could not

gain from the spurt in oil market.

7. NR prices may continue to be volatile, but likely to stabilize at

Rs. 350.00 to 400.00 in Colombo.

8. It is unrealistic to judge NR prices on demand and supply alone.

There are many interacting factors.

(Reference; ANRPC Report, January - February, 2011) |