|

Saroja Gunatilleke turns a new leaf in feminine

history:

Unparalleled conquest

Ruwini Jayawardana

The idea of sitting for 15 examinations at a stretch makes you catch

your breath, but for 26-year-old Saroja Kamini Gunatilleke it was a

challenge which she was determined to win. This she did with flying

colours when she got first class honours for all the subjects and

achieved the status of a qualified actuary of the Institute of

Actuaries, UK.

|

|

Saroja Gunatilleke. Pictures by

Rukmal Gamage |

|

|

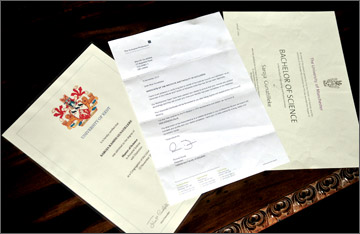

Saroja’s

academic feat |

“It is a very specialized field in financial sector. It is one of the

most prestigious and highly paid professions in most countries because

many insurance companies, banks, investment companies, pensions and

healthcare sectors seek the advice of actuaries before making a deal.

For example, if you take an insurance company, an actuary estimates the

liabilities of the company, designs and prices insurance products.

The regulatory body of the Sri Lankan insurance industry, the

Insurance Board of Sri Lanka (IBSL) has made it mandatory that all

companies conducting life insurance business employs an actuary,” Saroja

explained her off-the-beaten track venture.

She says that there are only two qualified Sri Lankan actuaries in

the insurance industry today. They look into the work of many insurance

agencies while other companies employ foreign consultants.

“It is no cakewalk. The occupation demands a lot of commitment and

hard work. Most people who decide to follow actuarial science drop

because they cannot stand the pressure,” noted the former pupil of

Visakha College, Colombo.

It had had not been all work and no play for Saroja. She has excelled

in tennis and had represented the team from the age of 10.

Taking part in national and international tournaments, Saroja became

the school’s tennis captain as well as school prefect before flying to

UK to complete three degrees: BSc Mathematics, Graduate Diploma in

Actuarial Science and MSc Actuarial Science.

During her stint at the university, Saroja was involved with a lot of

volunteering work.

She was involved with a play scheme for underprivileged children,

tennis coaching and worked as an assistant teacher at a primary school.

She was also the treasurer of the Sri Lankan Society and the course

representative for Actuarial Science Students at University.

Queried on why she decided to pursue the demanding profession Saroja

said that mathematics had always been a fascinating subject for her. “I

myself was not sure where my passion would lead me but later I learnt

about becoming an actuary through a friend. She told me a bit about the

subject when we were studying mathematics. Actuarial Science involves

statistics, financial mathematics and economics,” Saroja who is employed

as the manager of a private insurance company said.

One of her unforgettable experiences was attaining top mark for all

eight subjects which she had to face within eight months.

“I was the only one who was taking on 210 credits – double the amount

that was required from me. All my lecturers advised against my decision

but at the end of the day they were thrilled that I managed to get

through the lot,” she beamed.

According to Saroja one needs to complete 12 modules to become an

associate actuary while 15 modules need to be completed with work

experience to qualify as a Fellow Actuary (FIA).

Both her mother and brother are doctors while her father is an

engineer. Her aim is to qualify as a FIA. She needs to gain the required

work experience to attain this status.

|