Beverages

John Keells Tea Report:

Bidding frenzy for BOP and BOPF grades

The markets during the December sales was expected to be quiet, given

the balanced supply and demand situation around the world, and as the

demand from CIS markets was expected to improve only in January.

However, what transpired at the Ex Estate sale for High Grown, and

Medium grown teas was totally the opposite.

There was a frenzy of bidding for both BOP and BOPF grades, with the

market improving at all levels. Christmas cheer and a festive mood

prevailed in the auction room.

Some of the BOPs advanced by over Rs 50 and others by a lesser

amount. BOPF increased by Rs 5 to 15.

There appeared very strong buying for Russia, whilst activity from UK

and Japan was also evident.

The Low Grown market commenced steady, with certain grades slightly

dearer. However, here too, the market improved as the sale progressed

and this week’s average can be expected to have improved several rupees.

Dusts and Off grades added to the joy of the producer, with a gradual

improvement in prices.

The 3.4 mkg of Low Growns that were on offer met with fairly good

demand.

The better BOP1/OP1s gained Rs 5 to Rs 10, however the balance shed

by a similar margin. Better OP/OPAs and Pekoes too were dearer at times,

however the balance declined Rs 5 to Rs 10.

There was slightly better demand for the small leaf varieties,

particularly at the bottom end prices moved up Rs 5 to Rs 10. The better

FBOP/FF1s were firm however the good Tippy varieties eased a few rupees

on last levels. Russia, Iran and Saudi Arabia lent useful support.

Western Teas

Select Best BOPs advanced Rs 5 to Rs 10, Other Good Invoices gained

Rs 15 to Rs 20, Below Best and plainer varieties advanced sharply by Rs

20 to Rs 30 and more as the sale progressed. Select Best BOPFs declined

Rs 5 to Rs 10,Other Good Invoices were firm, Below Best sorts were firm

to Rs 5 dearer, plainer varieties gained Rs 5 to Rs 10 on average.

Medium BOPs advanced Rs 15 to Rs 20, whilst the BOPFs gained Rs 5 to Rs

10.

Nuwara Eliya Teas

Brighter BOPs declined Rs 10 to Rs 15 Others were firm. BOPFs

advanced Rs 5 to Rs 10 and more.

Uva Teas

BOPs advanced Rs 10 to Rs 15. BOPFs gained Rs 5 to Rs 10.

Udapussellawa BOPs gained Rs 20 to Rs 30, whilst the BOPFs were Rs 5

to Rs 10 dearer.

CTC Teas

Low Grown PF1s advanced Rs 10 to Rs 15. BP1s were firm. High and

Medium PF1s gained Rs 5 to Rs 10 and more. BP1s gained Rs 10.

Low Growns

Good demand. Select Best OP1s appreciated Rs 10 to Rs 20, Best types

were firm to Rs 5 to Rs 10 lower following quality, Below Best and poor

sorts maintained last levels.

|

Tea pluckers |

Select Best BOP1s gained Rs 10 to Rs 15, Best types were steady,

however the Below Best varieties tended lower by Rs 5 to Rs 10 , poor

sorts were irregularly lower by a similar margin. Select Best OP/OPAs

advanced Rs 5 to Rs 10, the Best and Below Best types were steady during

the early part of the sale, however advanced Rs 5 to Rs 10, as the sale

progressed, poor types were firm. Select Best Pekoes were firm to Rs 5

to Rs 10 dearer at times, the best types were irregularly lower by a

similar margin, Below Best bold Pekoe varieties were advanced by Rs 5 to

Rs 10, flaky types were firm.

Shotty Pekoe1s eased Rs 5 to Rs 10, Best types too tended lower by Rs

10 to Rs 15, Below Best and poor sorts maintained last levels. Select

Best BOP advanced Rs 5, Best and Below Best types were firm, poorer

sorts advanced Rs 5 to Rs 8. Select Best BOP.SPs shed Rs 5 to Rs 10,

Best and Below Best types too were lower by a similar margin, poorer

types were barely steady.

Select Best FBOPs maintained last levels, Best types moved up Rs 5,

Below Best types were lower by Rs 5 to Rs 8, poorer types advanced Rs

10.

Select Best and Best FBOPF1s were firm, Below Best types shed Rs 5,

poorer types advanced Rs 5 to Rs 10 Select Best tippy varieties met with

good demand but tended a little irregular towards last, Best and Below

Best followed a similar trend, poorer sorts were lower by Rs 5 to Rs 10.

Off Grades

Select Best liquoring Fngs1s were dearer by Rs 5, whilst the Best and

the Below Best types appreciated Rs 5 Rs 10, poorer sorts were dearer by

Rs 5. Select Best and Best BMs were firm to dearer by Rs 5, Below Best

types and poorer sorts appreciated Rs 30 to Rs 40 and more at times. All

BPs were dearer by Rs 5 to Rs 10.

All Low Grown Fngs appreciated Rs 20. Select Best BOP1As were firm to

irregularly dearer by Rs 5 to Rs 10, whilst the Best and the Below Best

too appreciated by Rs 10 to Rs 20, poorer sorts too were dearer by an

average of Rs 25 and more at times.

Dust

Select Best Dust1s declined Rs 5 to Rs 10, others in the Best and

Below Best category appreciated Rs 10 to Rs 20, whilst the balance

gained Rs 5 to Rs 10. All secondaries Dusts appreciated Rs 10 to Rs 15

whilst All Low Grown Dust/Dust1s gained Rs 10 to Rs 15.

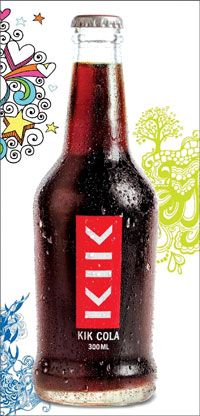

Elephant House launches ‘KIK Cola’

Elephant House, one of Sri Lanka’s strongest brands and a household

name for over 100 years, has always prided itself at keeping their

customer in focus and as such has evolved itself to always be innovative

and current while responding to the needs of the time. With a brand

rejuvenation in July this year, the company sent out an early indication

that this great brand was getting ready to do greater things - clearly

sending out a message that the brand understands the needs of the new

generation as well as the opportunities in a new Sri Lanka, and is now

gearing itself to leverage its strengths and serve the customers better.

In this journey, the respected iconic soft-drink manufacturer - who

is also the current market leader in the sector - has thrown a fresh

challenge at the market by making another bold move.

Elephant House, who has consistently retained its dominant position

with a range of soft-drink flavors - from Necto, Lemonade, Apple Soda

and Cream Soda to EGB, Soda, Ginger Ale and Wild Elephant etc. - has won

the hearts of the Sri Lankan consumers - proof of which is shown by

Cream Soda being voted as the most popular beverage by the local people

for the SLIM - AC Neilson Brand Awards for four consecutive years. As

such, after thorough consumer research which indicated a strong need for

the brand to enter the Cola category, Elephant House has now announced

that they are launching its own new cola, ‘KIK’ which for them is a

giant step towards covering the entire soft drinks market in their

existing product portfolio.

According to JKH Consumer Foods Group President Jitendra Gunaratne

“the company carried out extensive research to get the right

formulation, positioning strategy and packaging by drawing expertise

from both local and foreign sources.

We needed to get this right as for us it was a serious project

considering we were moving into the territory of international giants.”

The new cola, which hit stores from December four onwards, is now

available in both buddy and pet bottles and is competitively priced, he

said, adding that the unique bottle design alone will add to a brand new

experience in the world of cola.

“The formulation was tested over several months with focus group

tests, which showed outstanding results in taste preference and this was

a huge encouragement for our team. The packaging and communication

strategy was also developed and tested amongst the target groups and

after a bit of fine tuning we got the perfect fit,” he said.

The much anticipated, Lankan spirited ‘KIK Cola’ - which has gone

through heavy research and development over a period of almost half a

decade - is said to have successfully passed all the blind tests, coming

out on top in the category. “Essentially, we wanted to position our Cola

as one with an international class flavour and boast of strong local

values - it is in this effort that the KIK Cola brand name as well as

the tag line of ‘Lankan to the Last Drop’ was born.”

Internally as well, Elephant House has aligned all their staff - both

frontline sales personnel as well as their strong distribution network

to play their respective parts in this challenge to gain a dominant

position in the cola share of Sri Lanka.

“The sales staff were indeed thrilled and excited to now have a

complete portfolio in this segment,” said Gunaratne.

“We are proud that this now completes our offering to our loyal

consumers, and are very confident that there will be conversion from

other colas to ours within a very short period of time.” |