Market awaits direction

The market gained 92.58 points at the closing of the three days week.

However, southwards dip persisted during the week and the market

witnessed lowest levels since September ‘10. ASPI was down by 0.53

percent over last week to end at 6565 while Milanka declined by 42.52

points to close at 7115.43.

|

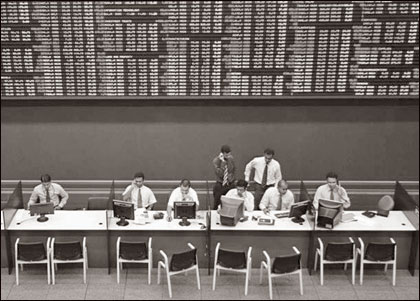

The Colombo stock exchange |

The cumulative market turnover for the three day week was at Rs 5.46

billion with an improved average of Rs 1.82 billion over the preceding

week’s average of Rs 0.87 billion.

Turnover rise was due to strategic acquisition of 3 percent stake in

Aitkens by Distilleries. Market Capitalization was recorded at Rs

2172.92 billion as against Rs 2,184.50 billion of the earlier week.

Diversified sector dominated the market turnover with nearly 50

percent share and a gain of 10.61 points with the sector index closing

at 2259.9.

Aitken Spence, JKH and Hemas Holdings were the counters that added to

the diversified sector, Banking, Finance and Insurance followed the

turnover statistics at 16.47 percent and Hotels and Travels at 14.16

percent.

Sampath and HNB added to the Banking sector while Hotels and Travels

were supported by Hotel Services and Keells Hotels.

|

Point of view |

| The activity levels though

suppressed during the week were strengthened towards the closing

with investor interest in selected stocks.

The market is waiting for directions with the

policy reforms to be tabled through the budget at the beginning

of the ensuing week. |

Aitken Spence contributed nearly 40 percent to the market turnover

with Rs 2.15 billion and 11.96 million shares.

Hotel Services was another major that added 11 percent amounting to

Rs 601.88 million to the turnover with share volumes of 23.6 million.

Sampath and JKH contributed Rs 327.75 million and Rs 299.6 million

respectively to the turnover.

The most traded scrip during the week was Hotel Services with 23.6

million shares to close at Rs 26. SMB Leasing, Piramal Glass and Spence

were other heavily traded stocks with volumes of 22.89 million, 14.6

million and 11.96 million shares. There was heavy selling by foreign

investors during the week with aggregate purchases of Rs 615 million as

against sales of Rs 2.62 billion. SMB Leasing (non voting) was the

week’s top gainer with 12.5 percent price rise and the counter closed at

Rs 0.90.

Mercantile Shipping and Hapugastenne were other major gainers that

closed at Rs 212.50 and Rs 57 with the gain of 12.32 percent and 11.55

percent respectively.

E B Creasy at Rs 931.30 was the major loser for the week which was

down by 15.34 percent.

The other major losers were Vidullanka, Blue Diamonds (NV) and Huejay

losing value by 10.45 percent and 10 percent each. |