Ceybank Trust Fund nets Rs 3,700 m

Ceybank Unit Trust, equity linked Unit Trust Fund with net assets

over Rs 3,700 million as at end March 2010, has performed admirably to

report 121 percent growth (net asset value per unit) during the

financial year ending 31st March 2010.

"This

performance of over 120 percent was possible due to the aggressive

growth oriented investment strategy taken by the Fund Managers" Ceybank

Asset Management CEO/Executive Director Chitra Sathkumara said. "This

performance of over 120 percent was possible due to the aggressive

growth oriented investment strategy taken by the Fund Managers" Ceybank

Asset Management CEO/Executive Director Chitra Sathkumara said.

The Fund realised its biggest ever trading profit of Rs 615 million

as capital gains from share trading during FY09/10, up 383 percent from

Rs 127 million in the previous year.

The Manager has decided to utilise Rs 157 million for distribution

for the FY 09/10.

The unit holders have the option to reinvest this dividend in the

Fund without the usual 5 percent front-end fee, and the majority of the

Investors re-invested their dividends back in the Fund expecting more

capital growth Sathkumara said.

The Manager, CeybankAML, with the concurrence of the Trustee to the

Fund, Bank of Ceylon, have announced an increased dividend of Rs 1 per

unit to all the registered unit holders of the Fund as at March 31,

2010.

This amounts to an increase of 100 percent over the previous year's

dividend of -/50 cents per unit. Based on the Ceybank Unit Trust offer

price as at April 1, 2009, this gives a dividend yield of 8.6 percent to

its unit holders in addition to the capital appreciation.

The Fund Manager, with the intention of achieving capital growth with

the expected upward movement of the market in the medium term, has done

major changes in the asset allocation.

Taking advantage of the down turn in the market, some of the blue

chip shares of potential value, specially in the Hotel Sector, has been

aggressively acquired at very low prices and disposed of less potential

ones. The Fund's investment in the equity has been increased to gain

from the expected post war rally in the Colombo Stock Market.

Investments are well diversified and the equity is heavily weighted

towards Hotels and Manufacturing sectors. These sectors are expected to

rebound and therefore, Ceybank Unit Trust is well placed to take

advantage of the expected upward market movement.

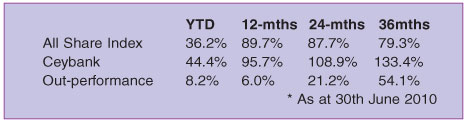

This aggressive strategy paid off as shown by the exceptional

performance. During 2010, the ASI has grown by 36 percent and Ceybank

Unit bid price appreciated by 44 percent, up to end June.

Therefore, investors of Ceybank Units can expect fair capital gains

in the medium term, Sathkumara said.

|