Indices close modestly high on volatile trading

Volatility continued this week amid signs of positive sentiment being

witnessed towards the latter part of the week.

The market saw indices being relatively flat on Monday while Tuesday

saw the indices falling. The ASPI (All Share Price Index) closed the

week at 3563.1 points up by 48.5 points or 1.4 percent Week on Week (WoW).

Meanwhile the MPI (Milanka Price Index) too retained a similar trend to

close the week at 4099.3 points, up by 59.9 points or 1.5 percent

compared to last week’s closing levels.

JKH continued to remain the highest contributor towards weekly

turnover, managing a contribution of Rs 762.4 million for the week. A

0.6 percent WoW fall in share price was observed during the week with

prices closing slightly low at Rs 179.00 per share.

The counter traded within the range of Rs 178.00 and Rs 180.50 per

share for the week, trading 4.3 million JKH shares for the week.

Renewed interest was witnessed in Environmental Resources Investment

(GREG) this week with 5.8 million of its shares being traded.

Investors showed significant reaction to the announcement of 1 for 2

Rights issue with attached warrants on GREG on Tuesday, leading the

counter to close the week with notable gains.

The counter closed at Rs 119.25 per share with the share price

reaching a high of Rs 132.00 per share and a low of Rs 70.00 per share

for the week. Contribution from GREG towards weekly turnover amounted to

Rs 600.9 million. Apart from this renewed interest was observed in

Ceylon Leather Products (CLPL).

Week saw 411.8 million shares of CLPL being traded with the bulk of

the quantities being traded towards the latter part of the week.

The counter closed the week at Rs 109.75 per share, reaching a high

of Rs 133.00 per share and a low of Rs 55.50 per share. CLPL was the

third highest contributor towards weekly turnover contributing Rs 411.8

million for the week.

The stock came amongst the week’s best performers, reflected by the

96.0 percent gains posted. Turnover for the week stood at Rs 6.1 billion

while the average daily turnover for the week stood at Rs 1.5 billion

compared to Rs 2.2 billion posted during last week. The major

contribution of Rs 2.2 billion came on Wednesday with turnover being

sizably high due to GREG contribution.

Foreign purchases amounted to Rs 1.0 billion this week, while foreign

sales totalled to Rs 1.2 billion resulting in a net foreign outflow of

Rs 229.9 million. During the week foreign participation stood at a low

of Rs 18.4 percent of total activity.

Volume based highest traded stocks for the week was Kshatriya

Holdings, East West, Environmental Resources, Renuka Agri and JKH.

Is the market going too fast?

Below is an analysis of the market movement and the corporate

earnings of the Colombo bourse.

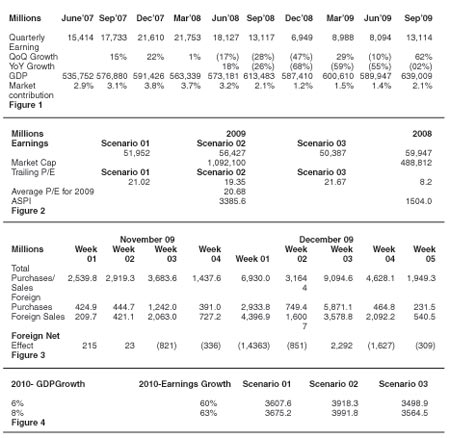

Figure 01 Source: ASB Research

Based on the above tabulated corporate earnings we have calculated

the market trailing PE levels under figure 02.

As per figure 02, the formulation of three scenarios were due to,

Dec’ 2009 quarter earnings not being available as at the current moment.

Hence, the each scenario would constitute a different final quarter

earnings figure, to calculate the total corporate earnings for 2009.

Scenario 1

Scenario 1 would be the highest recorded quarter earnings for the

last ten quarters. Thus, the March’ 08 figure of LKR 21,754 million.

Scenario 2

As depicted in the figure 1 it is clear that as of recent past the

quarterly earnings have been improving. Thus, the scenario 02 would

depict a very optimistic outlook where we have doubled the Sep ‘09

quarter figure.

Scenario 3

The scenario 3 is based on an expected GDP for the year 2009, and the

quarterly earnings calculated invariably based on the GDP. We have

assumed a 4 percent real GDP growth for the year 2009.

Figure 2 Source: ASB

Research

Figure 3 shows the foreign investor sentiment in terms of foreign

activity for the last 9 weeks at the Colombo bourse.

Figure 3 Source: ASB

Research

Hence, the table depicts predominantly a foreign net selling

position.

Conclusion

In light of the above information on the market P/E and the sentiment

of the foreigners, one could argue that the Colombo bourse is over

heated at the moment.

Albeit, the overheated argument, “expected earnings growth for the

next year supports the market climb” could be another school of thought.

Hence, we have formulated another two scenarios assuming a real GDP

growth of 6 percent and 8 percent for the year 2010, and invariably

calculating the corporate earnings levels of 60 percent and 63 percent

growth respectively.

Further, inline with the scenarios, an estimate of an optimum ASPI

index (assuming a market PE of 14) have been reached.

Figure 4 Source:

ASB Research

Considering all above various options, we could arrive at an average

ASPI index of 3709.4. In comparison with the current ASPI of 3514.6, the

expected potential upward movement based on sheer fundamental

calculations is a maximum of 194.7 points. Also, a noteworthy point is

that Index movement for the first week of 2010 was 129.03 points. Thus,

assuming to move on with the fundamental ASPI figure, the bourse would

reach the critical mass within the month of January, 2010.

Hence, considering all above we feel that investors should be

cautious buying. Though the bourse ‘as a whole’ looks to be moving too

fast, it does not portray that no under valued stocks remain.

It is important to identify the real undervalued and execute a ‘BUY’.

Hence, once the market starts cooling down it will invariably create

more and better opportunity to create capital appreciation.

The information

contained herein has been compiled from sources that Acuity Stockbrokers

(Private) Limited (ASB) believes to be true and reliable but we do not

hold ourselves responsible for its completeness or accuracy. No matter

published herein create any liability of any kind on ASB.

All opinions,

views, findings and conclusions included in this report constitute ASB’s

judgment of this date and are subject to change without notice. ASB has

the sole copyright for this report and the information and views

contained cannot be reproduced or quoted in part or whole in any form

whatsoever without the written permission from ASB. |