|

Global recovery under way :

Likely to be slow - IMF

* Global activity now on the rise

again, expected to reach three percent next year

* Rebound driven mainly by China, India

* Restoring financial sector health, continued macro policy support

remain priorities

After a deep recession, global economic growth has turned positive,

driven by wide-ranging, coordinated public intervention that has

supported demand and reduced uncertainty and systemic risk in financial

markets, according to the IMF's latest report on the global economy.

The recovery is expected to be slow, as financial systems remain

impaired and support from public policies will gradually have to be

withdrawn. Households in economies that suffered asset price busts will

continue to rebuild savings while struggling with high unemployment,

according to the October World Economic Outlook (WEO), released on

October 1.

"The recovery has started. Financial markets are healing," said IMF

Chief Economist Olivier Blanchard. "In most countries, growth will be

positive for the rest of the year, as well as in 2010," he said. But he

stressed that, to sustain the recovery, private consumption and

investment will have to strengthen as high public spending and large

fiscal deficits are unwound.

"The

current numbers should not fool governments into thinking that the

crisis is over," he said at a press conference. He urged countries to

coordinate policies to achieve a global rebalancing and sustain the

recovery. "The

current numbers should not fool governments into thinking that the

crisis is over," he said at a press conference. He urged countries to

coordinate policies to achieve a global rebalancing and sustain the

recovery.

The report was released ahead of the IMF-World Bank Annual Meetings

being held in Istanbul, Turkey.

Projected growth numbers

Key WEO projections include:

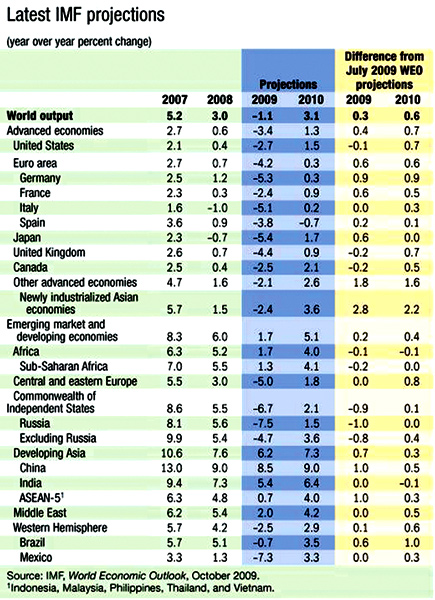

* World growth. After contracting by about one percent in 2009,

global activity is forecast to expand by about three percent in 2010

(see table).

* Advanced economies are projected to expand sluggishly through much

of 2010. Average annual growth in 2010 will be only modestly positive at

about 11/4, following a contraction of 31/2 percent during 2009.

* Emerging and developing economies. Real GDP growth is forecast to

reach five percent in 2010, up from 1 3/4 percent in 2009. The rebound

is driven by China, India, and a number of other emerging Asian

countries. Economies in Africa and the Middle East are also expected to

post solid growth of close to four percent, helped by recovering

commodity prices.

Helpful steps

The pace of recovery is slow, and activity remains far below

precrisis levels. The pickup is being led by a rebound in manufacturing

and a turn in the inventory cycle, and there are some signs of gradually

stabilizing retail sales, returning consumer confidence, and firmer

housing markets. As prospects have improved, commodity prices have

staged a comeback from lows reached earlier this year, and world trade

is beginning to pick up.

The triggers for this rebound are strong public policies across

advanced and many emerging economies that have supported demand and all

but eliminated fears of a global depression. These fears contributed to

the steepest drop in global activity and trade since World War II.

Central banks reacted quickly with exceptionally large interest rate

cuts as well as unconventional measures to inject liquidity and sustain

credit. Governments launched major fiscal stimulus programs, while

supporting banks with guarantees and capital injections. Together, these

measures reduced uncertainty and increased confidence, helping to

improve financial conditions. This was seen in strong rallies across

many markets and a rebound in international capital flows. However, the

environment remains very challenging for lower-tier borrowers. More

generally, as emphasized in the October 2009 Global Financial Stability

Report (GFSR), the risk of a reversal is a significant market concern,

and a number of financial stress indicators remain elevated.

Risks to recovery

The key policy requirements remain restoring financial sector health

while maintaining supportive macroeconomic policies until the recovery

is on a firm footing.

However, policymakers need to begin preparing for an orderly

unwinding of extraordinary levels of public intervention,

The key short-term risk is that the policy forces driving the current

rebound will gradually lose strength, and the real and financial

forces-although slowly building-will remain weak, as financial sectors

have not yet been restored to health. Thus, premature exit from

supportive policies must be avoided.

On the financial front, a concern-mainly for the major advanced

economies-is that continued public skepticism toward perceived bailouts

for the very firms considered responsible for the crisis undercuts

public support for financial restructuring. This could pave the way for

a prolonged period of stagnation, according to the WEO.

Beyond 2010

Sustaining healthy growth over the medium run will depend critically

on addressing the supply disruptions generated by the crisis and

rebalancing the global pattern of demand.

To complement supply-side efforts, there must also be adjustments in

the pattern of global demand. Specifically, many economies that have

followed export-led growth strategies and have run current account

surpluses will need to rely more on domestic demand and imports. This

will help offset subdued domestic demand in economies that have

typically run current account deficits and have experienced asset price

(stock or housing) busts, including the United States, United Kingdom,

parts of the euro area, and many emerging European economies.

To accommodate demand-side shifts, there will need to be changes on

the supply side. This will require actions on many fronts, including

measures to repair financial systems, improve corporate governance and

financial intermediation, support public investment, and reform social

safety nets to lower precautionary saving. |