The fallacy and the reality of IMF Standby Arrangement for Sri Lanka

Manoj Akmeemana - MBA(Sri J'pura),

BSc BAdm. (Special Honours) (Sri J'pura), Chartered Marketer (CIM UK),

AIB (SL), CMA (Aus.)

International Monetary Fund (IMF) has been the centre stage for

decades for its role, way of governance and policy stances which have

often aroused many debates and arguments amongst political economists,

policy makers, the member countries and even intellectuals the world

over. Even in Sri Lanka, the IMF has become a "hot" topic nowadays

especially among local politicians merely for the sake of political

advantage and not on more objective aspects such as the IMF policy

framework and importance of its financial assistance to governance.

Hence, it is imperative to understand the IMF's policy framework and

global economic outlook prior to expressing judgments or opinions and

arriving at conclusions.

IMF - birth as one of the Bratton Wood Twins

Just

after the World War II, representatives of 45 countries agreed to have

two distinguished financial arms to face specific financial challengers

of a war-torn world. While the World Bank (WB) was established to assist

reconstruction and rehabilitation of countries, the IMF was established

to provide financial assistance to countries that experience economic

difficulties and balance of payment issues. Just

after the World War II, representatives of 45 countries agreed to have

two distinguished financial arms to face specific financial challengers

of a war-torn world. While the World Bank (WB) was established to assist

reconstruction and rehabilitation of countries, the IMF was established

to provide financial assistance to countries that experience economic

difficulties and balance of payment issues.

The funding base of IMF is deposits from member countries .The

governance of IMF is through a Board of Directors which consists of 25

directors from member countries. Today, the membership of the IMF is

represented by 186 countries.

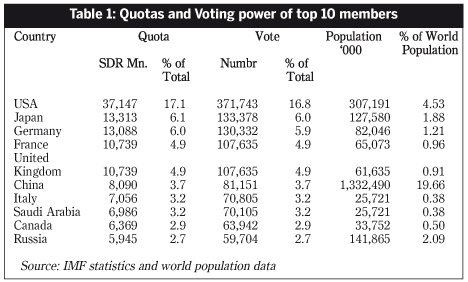

A member quota is dependent on the relative size of a member's (i.e.

member country's) economy to the world economy. A member quota in IMF

determines the amount of its subscription, its voting weight, its access

to IMF financing and allocation of Special Drawing Rights (SDR).

However, the United States has the exclusive veto power, due to their

contribution and initiative for funding.

IMF share of criticism

IMF has its share of criticisms from its inception. Many argue that

member quotas and voting powers are not democratic and do not

representing the global realities due to the dominance of the USA and EU

in the governing body. Table 1 below illustrates the present quotas and

voting rights of the 10 top members, which also indicate the disparities

in representation of the world population.

One could argue that if the value of contribution or investment is

higher, then that person should have a comparatively higher 'say' or

vote.

Even in business, the voting rights of a quoted company are dependent

on the number of shares held by a person. However, despite these

arguments the debate is on how to change the governing structure of the

IMF to represent the new world realities.

Among the many political and economic criticisms on the IMF policy

framework, the Marxist revolutionary icon Che Guerra (1959) once said

that, "interest of the IMF represents the big international interest

that seems to be established and concentrated in Wall Street".

A former Vice-President and Chief Economist of the WB, Joseph E.

Strighty argues in his book 'Globalization and its Discontents' that "by

converting to a mere Monetarist approach, the fund (IMF) no longer had

valid purpose, as it was designed to provide funds for countries to

carry out Keynesian reflections, and the IMF was not participating in a

conspiracy, but it was reflecting the interest and ideology of the

Western Financial Community."

The fire branded leftist leaders, President of Ecuador, Rafael Correa

and Venezuelan President Hugo Chavez announced that their countries

would withdraw from the World Bank and IMF, but as to date both

countries remain as members of those institutions.

The bitter reality is today no country can isolate itself from the

world financial system and stand alone as idealistic independent

financial systems in the globe.

New Global imperatives & IMF

The sub-prime crisis in the US financial markets spread across the US

and the rest of the developed world as a major financial crisis much

like an epidemic during the 3rd quarter of 2008, starting with the

collapse of Lehman Brothers in September 2008 and spreading to several

major financial institutions - and the rest is history!

One by one, from financial institutions to industrial, retail and

consumer goods manufacturers in USA and other developed markets started

to collapse while unemployment ratios shot to the highest levels in

recent history.

Developing

nations and emerging markets that had built their economies through

exports and imports with these developed markets were forced to face

severe repercussions. Developing

nations and emerging markets that had built their economies through

exports and imports with these developed markets were forced to face

severe repercussions.

Being strong advocates of free markets and neo-liberal economics,

these developed countries were compelled to hurriedly workout massive

bailout packages to rescue the fallen banks and industries in their

respective economies.

It's estimated that the bailout package for USA alone is a trillion

dollar budget. With these bailouts, it is quite evident that radical

changes in ownership structures of most of these companies happened

overnight with most of them being converted from private to state

ownership and being termed as "Nuclear Solutions" or "state ownerships".

The Governments of these large economies intervened by spending the tax

payers' money to rescue these fallen companies as opposed to their

popular neo-liberal idealism which they had for decades tried to force

developing nations to adopt.

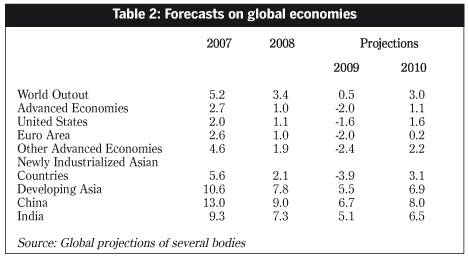

With these changes and repercussions, the optimistic forecasts that

were given for several years on the future global economies were

downgraded within a matter of months!

Under this scenario, the members of the G20 summit held in London in

April 2009 agreed to boost global liquidity, an agreement that was

welcomed by the International Financial and Monetary Committee. As such

the Board of Governors of IMF had in August 2009 approved a general

allocation of SDR equivalent to US$ 250 billion to provide liquidity to

the global economic system by supplementary funding for member countries

to strengthen foreign exchange reserves. It is this action that allows

any member country to apply for a Stand-by Arrangement (STB) or Loan

from the IMF.

The Sri Lankan Economy in the global context

The Sri Lankan economy during the last two decades developed a

comparatively far greater resilience power to withstand any internal or

external shock.

The Sri Lankan economic fundamentals had been sound and showed

improvements in several fronts during the year 2008 despite the

governments determined efforts to annihilate terrorism with intensified

military operations in the back drop of many local and foreign

challenges. The following charts illustrate several aspects of the

economy of Sri Lanka for the last 8 years.

As Sri Lankans and as individuals who are not blinded with coloured

politics, one should give due credit and recognition to the respective

authorities for prudent monitory and fiscal policies that contributed to

an extent in safeguarding the Sri Lankan financial system from the

global financial crisis.

Though many have often criticized the highly regulated financial

regime of Sri Lanka, it is this very system that protected the nation

from the global financial crisis.

However, during the fourth quarter of 2008, Sri Lanka's external

sector began to experience a level of negative implications resulting

out of the global financial crisis.

Foreign investors who had to face the bitterness of the global crisis

were forced to withdraw their investment in Government securities. FDI's

and other forms of commercial funding for various projects started to

drop.

To be continued

|