|

Sri Lanka debt management:

Public debt declines

Maintains good track-record:

The country’s total outstanding debt stock as a percentage of Gross

Domestic Product (GDP), declined to 81.1 percent in 2008 from 85 percent

in 2007. This was revealed at the launch of the publication on Public

Debt Management in Sri Lanka -2008 which was held yesterday at the

Central Bank.

Superintendent of Public Debt, Central Bank of Sri Lanka C.J.P

Siriwardene said most Debt Burden Indicators (DBI) have shown that Sri

Lanka is a low debt burden country.

DBI measures the level of the burden of external debt to the economy.

For this purpose two aggregate ratios are used comparing total

outstanding external debt (DOD) with GNP and XGS.

DOD/GNP has declined to 33.6 percent in 2008 compared to 37.5 percent

in 2007 reflecting an improvement in external debt sustainability of the

country. However, DOD/XGS has increased marginally to 102.4 percent

compared to 100.6 percent in 2007 comparing this ratio with its critical

values shows that Sri Lanka as a less indebted country in 2008.

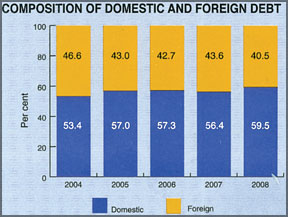

The actual gross borrowings of Rs. 689 billion in 2008 were within

the Parliament approved annual borrowing limit of Rs. 708 billion. The

total borrowing from domestic and external sources amounted to Rs. 559

billion and Rs. 130 billion respectively last year. The total

outstanding debt stock increased by Rs. 536 billion and stood at Rs.

3,578 billion as at end 2008, he said. The total interest cost on public

debt last year was Rs. 212 billion. The interest cost of domestic and

foreign debt amounted to Rs. 182 billion and Rs. 30 billion respectively

in 2008.

In terms of GDP, the interest cost of the government budget declined

to 4.8 percent in 2008, from 5.1 percent in 2007.

Depreciation of the Sri Lankan Rupee against major loan currencies

resulted in an increase of the debt stock last year by Rs. 131 billion

or 4.3 percent of the total debt stock he said.According to the Budget

2009, the total gross borrowing limit of the government for 2009, in

terms of book value, amounts to Rs. 840 billion.

Out of this Rs. 840 billion Rs. 25 billion been allocated to

unforeseen contingent expenses during the year. Out of the balance Rs.

815 billion, Rs. 241 billion is expected to be raised from foreign

sources and the remaining Rs. 574 billion is through domestic sources,

he said.

Central Bank Governor Ajith Nivard Cabraal said Sri Lanka has never

been in default and the country has maintained a good track record in

managing debt. Despite the challenging economic environment, the country

was able to maintain 81 percent debt to GDP ratio. |