Miscellany

Investment in Ceylon Leather Products - A gold mine

V.I. Perera

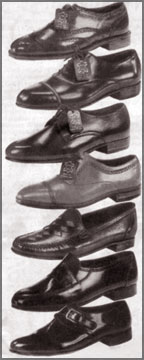

Ceylon Leather Products PLC, the former Government owned Ceylon

Leather Corporation is a leading company in the country manufacturing

real leather for the past 70 years.

A modern shoe factory was built at Mattakkuliya in 1962 and a fully

equipped tannery, the largest in Sri Lanka was built in 1970. The

company was privatised in 1991 and quoted in the Colombo Stock Exchange

in 2003.

The Company has been earning net profits for the past ten years

except in 2005 and 2007 and the company faced liquidity problems in the

recent past mainly due to the delay in receiving payment from major

government buyers.

Financial implication

The company which is rich in assets relocated the office and factory

to Ballummahara and the 3.7 acres land at Mattakkuliya was sold for Rs.

307 million. Consequently the debt position improved and recorded a net

profit of Rs. 93.2 million by way of capital gain. Similarly the net

assets value shot up to Rs. 59.45 from Rs. 27.11.

An abandoned factory at Ballummahara was refurbished and redesigned

as a modern factory by Footwear Design and Development Institute Nodia

and operations commenced June 2, 2008. The factory has been revalued at

Rs. 357 million and consequently the net assets value shot up to Rs. 81.

The company is in the process of relocating the tannery in a land

extent of 4.7 acres at Mattakkuliya preferably outside the Colombo

district and the financial implication from this exercise would make it

perhaps comparatively the strongest financially, among companies in the

Colombo Stock Market.

The land value in Mattakkuliya is expected to appreciate considerably

during the year due to the economic boom after the conflict ends

shortly, completion of the modern highway from Fort to Negombo via

Mattakkuliya and construction of the ultra modern fisheries harbour next

to the Pegasus Hotel within a radius of 2 km and the Orix Research

Report has estimated that the land would fetch Rs. 1 million per perch.

On this basis the company would receive Rs. 752 million and after

meeting the cost of relocation of approximately Rs. 130m and total debts

the company would have approximately Rs. 487 million excess cash. It is

estimated that this would generate a net interest income of Rs. 107

million.

The company would additionally save nearly Rs. 36 million as interest

cost from a debt free position. The company would also benefit from the

5 per cent subsidy on exports and removal of 15 per cent surcharge on

electricity under the recent stimulus package.

On this basis the company would be in a position to earn a net profit

of Rs. 70 million from normal operations for a 12 month period. After

the sale of property along with interest income it would record a total

profit of Rs. 177 million and net assets value per share of Rs. 102.28.

Mandatory offer

The resulting earnings per share of Rs. 14.16 on a conservative basis

of PE of 12 due to the bullish trends in the stock market during the

current year would justify a theoretical price of Rs. 169.2.

At present two major foreign funds Galleon and Lionheart Hedge Fund

have controlling interests and together S.A. Perera and Sons owned by

the Chairman (21.97 per cent) and other strategic investors account for

nearly 89 per cent. Considering the fact only 1,375,000 shares are held

by others it is likely for the share to be traded in a price range of Rs.

150-175 even after relocation of the tannery but prior to the sale of

land.

Consequent to the sale of land CLPL would rank as the company with

the highest ratio of cash to paid up capital of almost 4:1 with a major

portion of the net income derived as a matter of routine.

It is expected that the company would be available for sale within a

price range of Rs. 100-120 which would trigger a mandatory offer and

this may take place even prior to relocation of the tannery.

It is unfortunate that no comprehensive research paper has been

published so far on the real value of CLPL and the financial

implications arising from the relocation of the tannery.

The CLPL with the highest price of 94 during the 12 month period may

give even 200 per cent return at the present price of Rs. 54 for the

investors and easily the best investment in the Colombo Stock Market.

IMF sees world economy at near standstill in 2009

The global economy is slowing to a virtual standstill and it is

critical that policy-makers cleanse the banking system of toxic assets

to help restore growth, the IMF said on Wednesday.

In a grim assessment of the world economy, the IMF slashed its 2009

forecast to a slight 0.5 percent, the weakest year since World War Two,

from a November estimate of 2.2 percent.

IMF chief economist Olivier Blanchard said the world economy had

taken a turn for the worse over the past three months, with global

output and trade falling dramatically.

He urged countries to work more closely and to take decisive policy

actions to restore the collapse in confidence and revive the global

financial system.

"Despite wide-ranging policy actions, financial strains remain acute,

pulling down the real economy," the IMF said. "A sustained economic

recovery will not be possible until the financial sector's functionality

is restored and credit markets are unclogged."

While central banks have already aggressively cut interest rates,

Blanchard said there was still room for lower rates as inflation

pressures have subsided. On the other hand, deflation has become an

increasing risk, he added.

Meanwhile, countries implementing sizable stimulus packages should

aim for maximum impact on demand, which argues for measures to increase

spending, Blanchard added.

The IMF's outlook was especially bleak for advanced nations such as

the United States and in the euro area, whose economies are seen

contracting by 1.6 percent and 2 percent.

The sharpest decline will be in Britain, whose economy is likely to

contract by 2.8 percent this year, the IMF said. Japan's economy is

expected to shrink by 2.6 percent in 2009.

Jaime Caruana, the IMF's financial counselor, said it was critical to

clean bank balance sheets of damaged assets to revive lending activity,

but acknowledged it will be hard to put a value on the bad assets held

by global banks.

"It is easier said than done," Caruana told a news conference. "This

crisis is more complex, we recognize that ... but at the end, this

assessment needs to be done, the losses need to be recognized." Reuters

Investments in Dubai's real estate top Dh58b

Total investments in Dubai's real estate sector exceeded Dh58 billion

during the last quarter of 2008, representing a drop in comparison to

the previous quarter of 2008, according to REIDIN.com, an online

property tracker.

"The statistics reflect the current economic downturn, which has

affected the property and real estate market in the region," a statement

said.

"However, this has also created opportunities for regional and global

investors to benefit from."

Amidst the implications of the global financial meltdown, Dubai is

still regarded as one of the fastest-developing economies in the world

and as a gateway to other regional and international markets.

The emirate, in addition to the rest of the UAE, provides a

diversified business climate that offers vast opportunities for growth

of international investors, facilitating easy access to three billion

consumers situated in the greater Middle East, North Africa and

South-east Asia regions.

Dubai is expected to leverage the UAE's strategic geographic and

economic position to provide high net-worth individuals, global and

regional developers and other players within the global property market

an effective venue for high-impact networking and transactional

activities amidst the challenges posed by the present the economic

turmoil.

"The trust of the international real estate community in the Dubai

market is underlined by the exceptional interest of developers as well

as investors to venture into the emirate, despite the current challenges

brought about by the global credit crisis," said Dawood Al Shezawi, the

managing director of Strategic Marketing and Exhibitions - organisers of

the International Property Show slated for next month.

Gulfnews

|