Activity levels rise amid few large crossings

Market

closed higher this week with both the indices edging upward. However

during early part of the week the benchmark index was seen slipping 11.4

points. Reversing the direction, the Colombo bourse on Wednesday started

gaining to close higher during the latter part of the week. Market

closed higher this week with both the indices edging upward. However

during early part of the week the benchmark index was seen slipping 11.4

points. Reversing the direction, the Colombo bourse on Wednesday started

gaining to close higher during the latter part of the week.

ASPI (All Share Price Index) was up almost 24 points or 0.91% to

close at 2644.2 points while MPI (Milanka Price Index) ended 23.4 points

or 0.66% higher at 3558.7 points. During the week blue chip counters

such as JKH, Dialog and SLT managed to regain investor attention.

Premier blue chip counter JKH came out on top this week with a total

contribution of Rs.698.64 million, which is 26 per cent of total market

activity. Intense trading on the counter was seen throughout the week

with approximately 5.37 million shares traded within a narrow price

range of Rs.129 and Rs.130.50 per share.

Despite low 3rd quarter profits, Dialog managed to trade

approximately 2.17 billion shares adding Rs.510.17 million to market

turnover. million to market

turnover.

Sizeable amount of foreign interest was witnessed on the Counter

during this week’s trading. The counter closed flat at Rs.23.75 per

share while having traded between Rs.23 and Rs.24 per share.

Ranking at 3rd place in terms of market turnover was the banking

counter NDB representing almost 7.14 per cent of week’s total turnover

with a value of Rs.191.5 million.

However majority of the NDB turnover came on Friday amounting to

Rs.182.2 million backed by a large transaction of 1 million shares

changing hands at Rs.165. NDB share during the week reached a peak of

Rs.165 and a low of Rs.160 showing a price appreciation of 1.85 per cent

on a WoW basis.

The forestry counter, Touchwood which have been subjected for

continuous speculative trading over the past weeks ended up contributing

Rs.164 million to this week’s turnover becoming 4th largest contributor

for the week.

The Touchwood share traded within a wide price band of Rs.137 and 156

before closing 7.1 per cent down at Rs.140.5 per share. Heavy trading on

JKH, Dialog and SLT kept volumes up this week.

The two counters, JKH & Dialog together accounted for 45 per cent of

the weekly turnover. The total market activity amounted to Rs.2.7

billion up by a significant 85.2 per cent while the daily average

turnover surged 48.2% to stand at Rs.536.2 million during week’s

trading.

Market activity levels were moved up mostly on foreign buying thus

generating a comparatively higher net foreign inflow of Rs.761.8 as

against Rs.217.9 previous week.

Foreign purchases for the week amounted to Rs.1.45 billion and

foreign sales totalled Rs.691.9 million. Foreign purchases and sales

were substantially up by 326.4% and 462.5 per cent respectively.

Total foreign participation for the week was at 40 per cent of total

activity. Most traded stocks for the week were Dialog, Ceylinco Seylan,

JKH and Tess Agro. Market gained on healthy volumes during the week as

retail investors continued to rally around speculative stocks.

Overall the market gained marginally with All Share Price Index

(ASPI) notching up 23.9 points compared to last Friday’s closing levels.

We expect a little change in the market sentiment during the coming

week with retail investors likely to continue with speculative trading

in the market place. Furthermore we advise investors to carefully

monitor the corporate results that are being released and to accumulate

counters with fundamental value.

Annual average inflation that just hit a 17-year high last month

climbed further by 3.79 per cent in October in the back of higher food

prices.

The annual average inflation based on Colombo Consumers’ Price Index

(CCPI) hit 17.7 per cent in October compared to 17.5 per cent in

September. Meanwhile the Year on Year (YoY) inflation that stood at 17.3

per cent last month increased further to stand at 19.6 per cent.

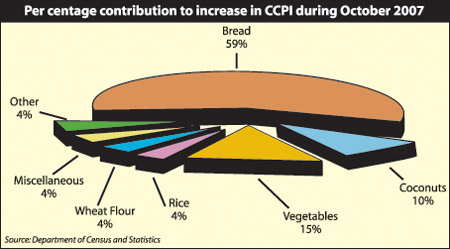

The rise in inflation in October compared to last month was largely

due to increases in food index which climbed by 3.62 per cent Month on

Month (MoM).

The increase of prices in bread backed by price hike in wheat flour

was the primary driver behind the increase in the food index.

Furthermore the higher prices of vegetables and coconuts also

contributed towards the surge in food index.

In our opinion the inflation is likely to remain high during the

remaining 2 months of 2007, as seasonal demand would keep pressure on

prices.

The recent increase in milk powder prices would also have an impact

on November inflation. Furthermore the fuel sub index remained unchanged

for the last 3 months in the absence of price revisions of domestic fuel

prices.

However in our opinion the domestic fuel prices could be revised

upwards further as crude oil prices have increased by almost $20 since

the last domestic fuel price revision.

Therefore we feel that a further domestic fuel price increase would

support the existing trend in inflation.

Thus according to our forecasts the CCPI is expected to increase by

further 4.4 per cent during November resulting the annual average

inflation to stand unchanged at 17.7 per cent.

“HNB Stockbrokers (Private) Limited has the sole copyright for this

report and the information and views contained cannot be reproduced or

quoted in part or whole in any form whatsoever without the written

permission from HNB Stockbrokers (Private) Limited. |