Retailers take market to higher grounds

Market picked up during the week amid improved retail activity

resulting both the indices to gain ground. Start of the week saw

speculative trading on healthcare counters lead by Asha Central Hospital

and this momentum continued throughout the week with retailers showing

keen interest on selected low value counters. Market picked up during the week amid improved retail activity

resulting both the indices to gain ground. Start of the week saw

speculative trading on healthcare counters lead by Asha Central Hospital

and this momentum continued throughout the week with retailers showing

keen interest on selected low value counters.

On Friday, the ASPI (All Share Price Index) closed 2.13% or 51.6

points higher at 2475.7 points and the MPI (Milanka Price Index) rose

1.10% or 36.6 points to close at 3350.8 points.

Highest turnover

JKH, the blue chip conglomerate achieved the highest turnover for yet

another week with the aid of keen foreign interest on the counter.

The sales contribution from JKH amounted to Rs. 802.1 million or

40.4% of the total market activity with almost 6.2 million shares

changing hands. JKH counter was up at Rs. 129 per share with a price

increase of 2.38% during the week’s trading at the bourse.

The banking sector counter, DFCC managed to contribute Rs. 190.4

million to the weekly turnover becoming the second highest contributed

stock.

However bulk of the DFCC’s turnover came on Monday where the market

saw 1.5 million shares trading amounting to Rs. 178.2 million. Over the

week the 1.64 million DFCC stocks traded at a highest price of Rs. 129

and a lowest of Rs. 120 per share before counter closed the week at Rs.

125.50 on Friday.

Amid last week’s speculation on Asha Central, the counter further

witnessed a significant 21.2% appreciation in its share price this week,

closing at Rs. 90.25 per share on Friday.

Over the week 1.8 million Asha Central shares were traded,

contributing Rs. 157.3 million towards the weekly turnover. The counter

traded within a wide price range of Rs. 75.50 - 91.25 per share.

Strong results

The other banking sector counter, which managed to get among top

contributors, was the National Development Bank, with 0.57 million of

its shares being traded on Monday.

Meanwhile NDB released strong financial results for 1H of FY 2007,

however counter didn’t see a noteworthy increase in prices during the

week. The counter saw its share price increase by only 1.1% to stand at

Rs. 160.75 at week’s end.

The week’s equity turnover amounted to Rs. 1.98 billion with activity

levels improving marginally this week. Week on Week (WoW) activity

levels showed a 1.6% increase with a daily average turnover standing at

Rs. 397.1 million.

Foreign purchases stood at Rs. 973 million for the week while foreign

sales totaled to Rs. 182.3 million resulting in a net inflow of Rs.

790.7 million.

Comparing WoW, foreign purchases & sales were down by 33.3% & 61.5%

respectively thus leading to a 19.7% reduction in net inflows

comparatively to last week’s levels. Foreign participation this week

stood at 29.1% of total activity.

Improved retail activity

Heavily traded counters during the week were Lanka Cement, Asiri

Surgical, JKH, Tess Agro and Walk & Greig.

Market gained on healthy activity levels in the back of improved

retail participation.

Meanwhile the speculative trading that we saw during the latter part

of last week continued into this week giving a boost to the dull market

momentum that prevailed in the recent times. Overall market gained by

51.6 points during the week compared to last week’s closing levels.

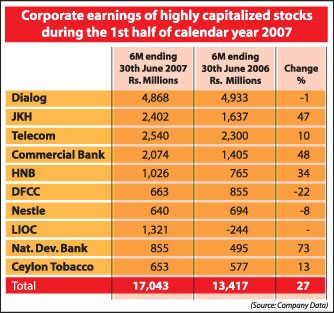

Healthy earnings

Although the environment for businesses was not that conducive with

high interest rates, inflation etc. the highly capitalized companies in

the market on average posted healthy earnings growth for the 1st six

months ended 2007.

The top ten companies (in terms of market capitalization) that

released results showed a 27% earnings growth during the period under

review. One of the main reasons for this growth is the turnaround of

Lanka IOC Company Limited (LIOC) that recorded losses during 2006.

In our opinion LIOC would continue to perform well during the

remaining part of 2007 giving a boost to the market earnings in 2007.

Broadly looking at the corporate earnings so far this year it is

evident that banks (due to interest rate volatility) and low-geared

companies with strong cash positions have performed exceedingly well

exploiting the high interest rate regime while the highly geared

entities have suffered due to high interest rates.

Considering the above we stick to our original market earnings growth

forecast of 22% for 2007, which we feel is achievable even with the

unfavourable macro economic factors.

Speculative trading likely to continue

We expect a similar sentiment to prevail in the market in the coming

week with retail investors likely to engage in speculative trading.

However we strongly advise investors not to commit too much into

rumour driven trading considering the high risk factor, thus we believe

investors should focus more on fundamentals during these uncertain

times.

“This information has been compiled from sources that we believe to

be reliable but we do not hold ourselves responsible for its

completeness or accuracy. All opinion views findings and conclusions

included in this report constitute our judgment of this date and are

subject to change without notice. |